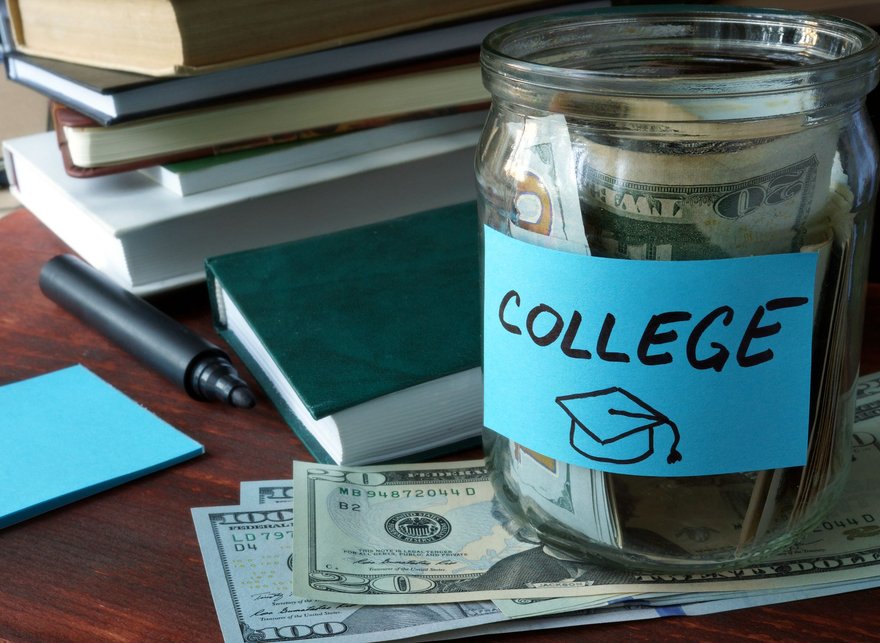

When it comes to saving for college, there are several different types of accounts you can use. The two account types that are specifically designed for college savings are the Coverdell ESA and the 529 savings plan. Of the two, the Coverdell ESA is less familiar to many Americans, so here's a rundown of what a Coverdell ESA is, the advantages and drawbacks, and how much you could potentially save in a Coverdell ESA.

What is a Coverdell ESA?

What is a Coverdell ESA?

A Coverdell Education Savings Account, also known as a Coverdell ESA, is a type of tax-advantaged investment account designed to help families save and invest money for college and other educational expenses. Formerly known as the Education IRA, the Coverdell offers the benefits of tax-free investment growth and tax-free withdrawals for qualified expenses.

Coverdell ESAs have the same general tax structure as Roth IRAs. If you're not familiar with them, here's how it works:

The money you contribute to a Coverdell ESA doesn't qualify for a current-year tax deduction of any kind. However, the money in the account will be invested and can grow and compound with no annual capital gains or dividend taxes. Plus, any money withdrawn for qualified education expenses will be 100% tax-free, regardless of how much it has grown.

For example, let's say that you put $2,000 into a Coverdell ESA every year for five years, for a total contribution of $10,000. If the account has grown to $25,000 by the time your child goes to college, you're able to withdraw the entire amount tax-free to use toward qualified expenses without paying a penny of tax on the $15,000 in profit.

Advantages

Advantages of a Coverdell ESA

The biggest advantage of using a Coverdell ESA to save for college is the investment flexibility. With most 529 savings plans -- the other college-specific investment account -- you'll have a choice between some ready-made portfolios or a menu of investment funds, just like you would have in a 401(k). On the other hand, money in a Coverdell ESA can be invested in virtually any stocks, bonds, ETFs, or mutual funds you want. For example, if you want to invest some of your kids' college savings in Microsoft (MSFT 1.82%) stock, a Coverdell ESA can allow you to do that.

There's also a bit more flexibility when it comes to using the money for non-college education expenses. Specifically, 529 plan withdrawals are limited to $10,000 for K-12 education, and tuition is the only allowable expense.

With a Coverdell ESA, you can use as much as you want toward K-12 education, and not just for tuition. You can use the money for books, supplies, tutoring services, and more.

Drawbacks

Drawbacks of a Coverdell ESA

The biggest disadvantage of a Coverdell ESA is its contribution limit. Coverdell contributions are limited to $2,000 per year. The amount is a per-person limit, not a per-account limit. In other words, if you open a Coverdell ESA for your child's benefit, and their grandparents do the same, the total contributions to both accounts cannot exceed $2,000 per year.

For comparison, most 529 savings plans don't have annual contribution limits and have lifetime contribution limits well into the six-figure range. As an example, South Carolina's 529 savings plan limits total contributions to 529 accounts to $540,000 per beneficiary -- far in excess of what you could put into a Coverdell.

Also, there are no state tax advantages for contributing to a Coverdell ESA. Because they are state-run, 529 plan contributions are often deductible in the year they’re made on your state tax return.

Related investing topics

Example

Example of how a Coverdell ESA could help you save for college

Although its contribution limit is relatively low when compared with a 529 plan, you might be surprised at how much a Coverdell ESA could help you pay for college, as long as you save consistently and invest well.

Consider this example. Let's say that you open a Coverdell ESA for your child when they're born and contribute $2,000 per year until they turn 18. If your investments achieve 7% average annual returns, which is quite realistic for a diverse portfolio of index funds or other investments, the account would be worth approximately $68,000 by the time your child reaches college age. And keep in mind, although your annual contributions would add up to just $36,000, the roughly $32,000 in profit could be withdrawn completely tax-free if used for qualifying expenses.