Between 2000 and 2020, the tuition and fees for four-year public colleges increased by an annual average of 5.1%, while tuition and fees for four-year private colleges rose by an average of 3.9% annually. If you're a parent worried about rising college costs, investing in a 529 plan is a smart move.

A 529 plan is a tax-advantaged education investment account you can use to pay for expenses like tuition, fees, and books. In this article, we'll explain the basics of 529 plans and how to invest in one.

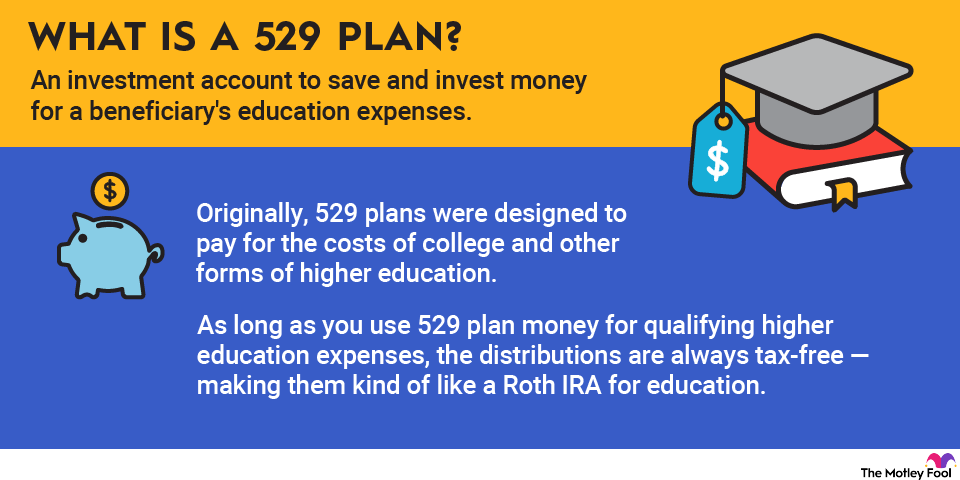

What is a 529 plan?

A 529 plan is an investment account to save and invest money for a beneficiary's education expenses. Originally, 529 plans were designed to pay for the costs of college and other forms of higher education.

However, the Tax Cuts and Jobs Act of 2017 changed the rules to allow up to $10,000 of 529 plan money to be used annually for kindergarten through 12th-grade private tuition (but not room and board).

The most common type of 529 plan is the college savings plan. Your contributions are always made post-tax at the federal level, although some states offer tax breaks on 529 plan contributions. But as long as you use 529 plan money for qualifying higher education expenses, the distributions are always tax-free -- making them kind of like a Roth IRA for education.

However, there are also prepaid tuition plans that let you lock in current in-state tuition rates at four-year public colleges. They usually have a conversion option in case the beneficiary (your child or whomever you set up the account for) chooses to attend a private or out-of-state college.

The 529 plans are state-sponsored, but you don't have to choose your home state's plan. You can choose any state's 529 plan, although some states offer tax breaks to residents who contribute to an in-state plan.

Do 529 plans affect financial aid?

529 plans have a relatively minor impact on financial aid. If the plan is owned by one of the student's parents and the student is a dependent, it's treated as a parental asset on the Free Application for Federal Student Aid (FAFSA).

The maximum amount that a parent asset can reduce a dependent student's financial aid award is 5.64%. In other words, if you had $10,000 in a 529 plan, it would reduce financial aid by no more than $564.

However, withdrawals won't count against you for financial aid purposes. That's a big advantage of saving for college with a 529 plan versus a Roth IRA. Assets in a Roth IRA don't count against you for FAFSA purposes, but withdrawals from a Roth IRA could reduce the aid award by up to 47%.

What can you invest 529 plan money in?

When you open a 529 plan, you can choose an investment portfolio that consists of mutual funds and exchange-traded funds (ETFs). Per IRS rules, however, you can't choose individual mutual funds, ETFs, stocks, and so forth for the plan.

You can choose a static portfolio, where the asset allocation doesn't change unless you adjust it, or an aged-based portfolio, where investments start out aggressively and shift to more conservative investments as college gets closer -- similar to a target-date fund.

Usually, an age-based portfolio is the better option. If the market tanks right as your child graduates or while they're in college, you probably don't want them delaying their education for several years to give their 529 plan investments time to recover.

Related investing topics

Example of a 529 plan: Utah's my529

Utah's my529 plan has been historically popular among college savers. It's available to residents of any state, although Utah residents receive a tax credit for contributing.

The plan consistently gets high marks for its low fees and investment options. Utah's plan offers 12 different target enrollment date portfolios that include a mix of Vanguard mutual funds, PIMCO interest income finds, and FDIC-insured accounts. Regardless of the beneficiary's planned college enrollment date, the account owner can choose more conservative or aggressive investment styles.

The my529 plan also has high contribution limits compared to other plans. As of 2023, you can fund a my529 plan until the account reaches a limit of $540,000.