2024 Financial Stress, Anxiety, and Mental Health Survey

KEY POINTS

- WIDESPREAD FINANCIAL ANXIETY: Over half of respondents feel stressed about their finances multiple times a week.

- GENERATIONAL STRESS DIFFERENCES: Gen Z experiences more intense financial stress compared to other age groups.

- BUDGETING TO COPE: The majority cope with financial stress by creating and adhering to a budget.

Financial stress and anxiety is prevalent: over 50% of respondents to The Motley Fool Ascent's 2024 Financial Stress, Anxiety, and Mental Health Survey reported being stressed or anxious three or more days a week. Overall, respondents reported a high level of intensity when experiencing financial stress, 3.2 out of 5.

Financial stress can impact mental health in a detrimental way, including by causing or worsening anxiety. Studies show this is the case when financial stress is objective, such as when finances are strained due to low income or high debt payments, or subjective, such as when someone perceives their financial situation to be precarious.

To better understand how common financial stress and anxiety is, its causes, and how Americans cope with financial anxiety, The Motley Fool Ascent surveyed 2,000 Americans. Read on for a deep dive.

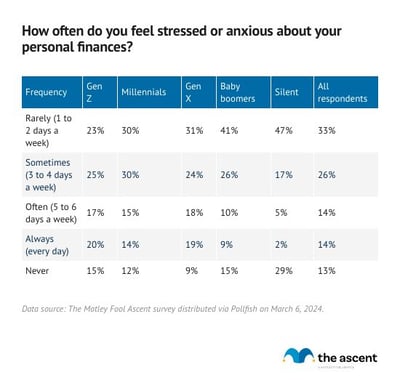

Over 50% of respondents have financial anxiety three or more days a week

Fifty-four percent of respondents feel stressed or anxious about their personal finances at least three days a week and 87% say they experience financial stress at least once a week.

That's a staggering rate and suggests that the overwhelming majority of Americans are anxious about their finances.

Gen Z are more likely than others to feel regularly stressed about money. Sixty-two percent say they're stressed more than three days a week and 20% say they feel financial anxiety every day.

Millennials and Gen X are also regularly stressed about their finances: 58% and 61% respectively experience anxiety about their finances at least three days a week. Nineteen percent of Gen X respondents and 14% of millennials reported feeling stressed about money every day.

Baby boomer respondents reported the least financial stress. Just 9% said they feel financial anxiety every day and only 44% feel anxious about money three or more times a week.

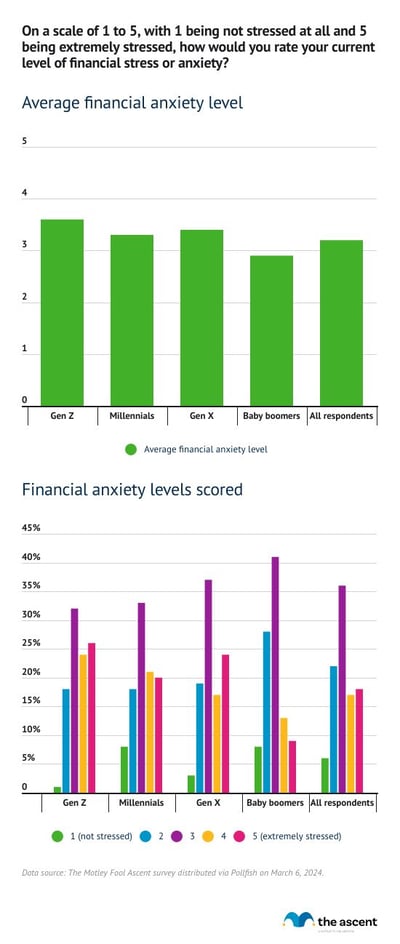

Gen Z feels more intense financial stress than any other generation

Gen Z respondents are not only stressed about money more often than other generations, their financial anxiety is also more intense.

Gen Z respondents reported an average financial anxiety level of 3.6 out of 5, with 5 being extremely stressed. That's slightly higher than millennials (3.3) and Gen X (3.4)

Baby boomers, who are financially anxious less often than younger generations, also feel less anxiety when they are stressed about money. They reported an average score of 2.9 out of 5 -- the only generation with an average score below 3.

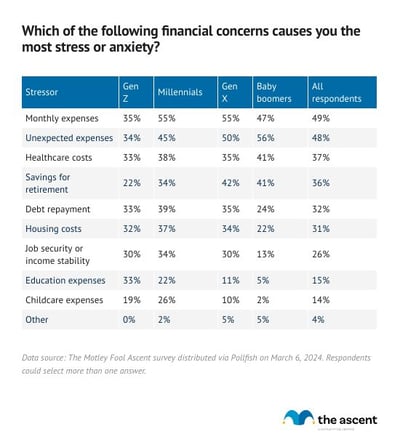

What causes the most financial anxiety: Regular expenses

The two most common causes for financial anxiety among respondents are standard monthly expenses (49%) and unexpected expenses (48%).

That's a worrisome combination. Both predictable and unpredictable expenses being nearly equally daunting highlights how prevalent financial anxiety is.

Each generation feels financial anxiety more acutely from particular expenses.

- Gen Z are more likely to become financially anxious due to educational expenses than other generations. Saving for retirement generates less stress for them than older generations.

- Millennials are more likely to become stressed when dealing with repaying debt, housing costs, job security, and child care expenses than other generations. Those causes of financial anxiety reflect the range of expenses millennials are balancing.

- Gen X are most likely to cite saving for retirement as causing financial anxiety -- a reflection of them approaching retirement age.

- Baby boomers feel financial anxiety from unexpected expenses more than any other generation, likely due to many members of that generation being on a fixed income. They're much less likely to become stressed due to thinking about job security, child care, housing costs, and debt repayment.

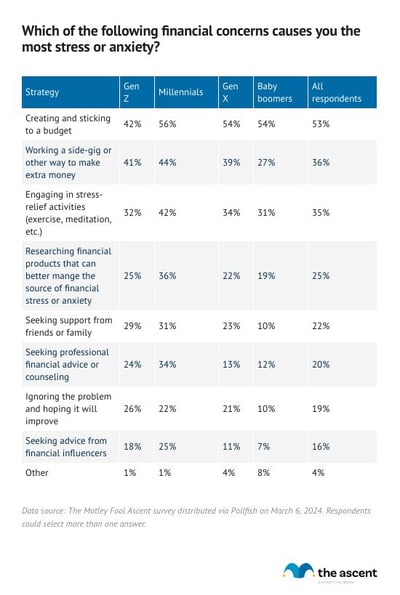

The most popular strategies to cope with financial stress and anxiety

Creating and sticking to a budget is the most common way respondents cope with financial stress and anxiety. That's the approach taken by 53% of respondents: over 50% of all generations except Gen Z, among whom 42% say they use budgeting to deal with financial stress.

Working a side gig or figuring out another way to generate extra income is the second most cited response to financial stress. Gen Z and millennial respondents are more likely to pick up extra work than older generations.

Those two responses directly impact wallets. Budgeting can provide a useful framework to find savings and reduce wasteful spending, while cultivating an additional income stream can create more financial flexibility.

The third most common response to financial anxiety is non-financial: engaging in an activity that relieves stress, like exercise or meditation. This approach is most popular among millennial respondents and least popular among baby boomers and Gen Z.

A quarter of respondents respond to financial stress by looking for financial products that can help them address the source of their financial stress.

This approach could be useful for those who have a clear understanding of what particular stressor is causing financial anxiety. For example, if credit card debt is the main source of financial anxiety, looking for a balance transfer card could offer some relief. If the concern is not generating enough savings, finding a high-yield savings account could help.

Around 20% of respondents turn to friends and family or a financial advisor when feeling financial stress. Gen Z and millennial respondents are more likely to use these approaches than older generations.

Nineteen percent opt to ignore the source of their financial anxiety and hope the stressor will resolve itself. Twenty-six percent of Gen Z take the avoidance approach to their financial stress, as do 22% of millennials and 20% of Gen X -- compared to just 10% of baby boomers.

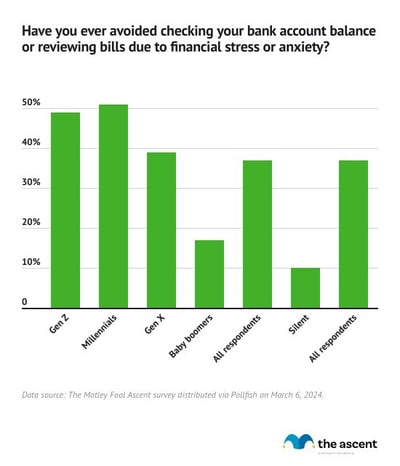

Roughly 50% of Gen Zers and millennials have avoided their bank account balance or bills due to financial stress

Thirty-seven percent of respondents have shielded their eyes from their bank account balance or bills as a result of financial anxiety. That percentage is much higher for Gen Z (49%) and millennials (51%).

Even if looking at a bill or account balance can be upsetting, being aware of the problem is the first step to relieving the stress it generates. Avoiding financial issues can prolong the anxiety they generate and limit time and options to address them.

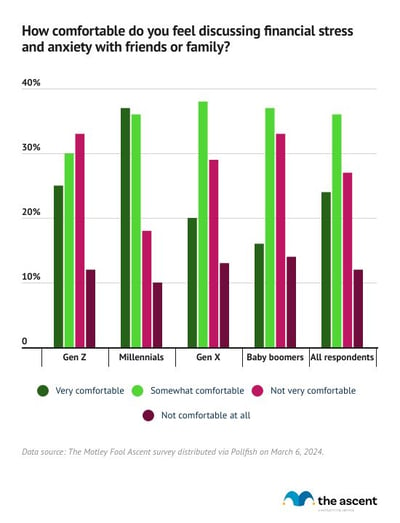

Millennials are most comfortable talking about financial anxiety

Speaking about financial stress can help dissipate it and may lead to solutions to resolve the core stressors. But only 40% of respondents are comfortable talking about their financial stress and anxiety with friends or family.

Millennial respondents by far are the most comfortable discussing financial anxiety. Seventy-three percent said they were either very comfortable or somewhat comfortable talking about financial stress with their friends and family.

Baby boomer respondents are least comfortable talking about financial anxiety with their friends and family. Just 16% said they are very comfortable doing so, and 37% said they are somewhat comfortable.

Gen Z and Gen X are more comfortable discussing financial anxiety than baby boomers, but not as comfortable as millennials.

How to cope with financial stress and anxiety

Financial anxiety can feel overwhelming, but strategies exist to help address it. Here are some approaches and resources to get started:

- Make a budget: A detailed budget to track income and expenses can reveal opportunities to save and be a tool to set financial goals. Knowing what you're spending on can be the first step to resolving a financial stressor.

- Speak to a professional: A financial advisor or counselor can provide actionable advice to address the root cause of financial anxieties. A resource to start with is the Financial Planning Association, which offers free financial planning.

- Stay present: Practicing mindfulness and focusing on what you can control can relieve anxiety and stress, and can help center attainable financial goals and the steps necessary to reach them.

Financial anxiety is more common than one might suspect. But most don't feel comfortable speaking about the financial stress they experience, even to close friends and family. Seeking support for financial anxiety is an important step that can reduce anxiety and lead to help addressing the underlying stressor.

Methodology

The Motley Fool Ascent distributed a survey via Pollfish on March 6, 2024. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling. The survey was composed of 2,000 American adults.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.