Image source: Nike.com.

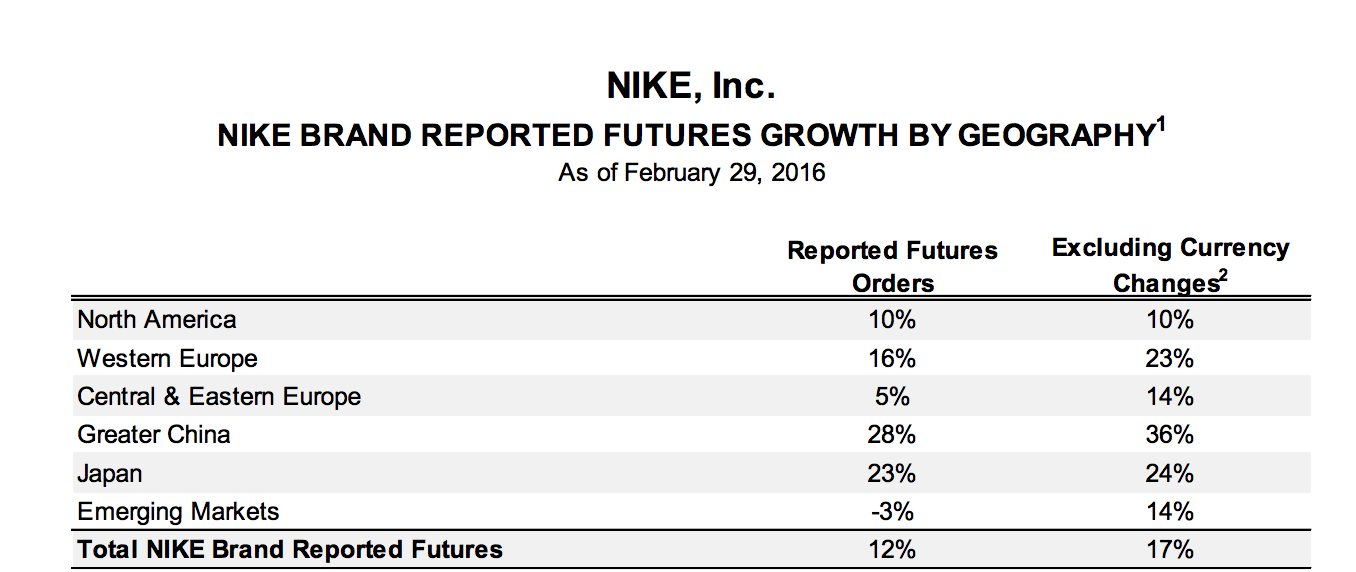

In its most recent earnings, Nike Inc (NYSE: NKE) management said that "futures orders" were up 12% worldwide year over year, or 17% accounting for currency fluctuations. But what are futures orders, and how can investors use this specific metric to update their outlook on Nike?

What it means

"Futures" or "futures contracts" is a term used when companies buy or sell commodities at a pre-determined price that comes due at a specific future date. Futures orders for commodities are usually a financial tool to hedge price volatility, and often the underlying commodity never actually changes hands.

However, this term as it applies to Nike means signed contracts for the sale of Nike goods that actually will be delivered and sold by the retailer. In Nike's 2015 annual report, it says, "We make substantial use of our futures ordering program, which allows retailers to order five to six months in advance of delivery with the commitment that their orders will be delivered within a set time period at a fixed price."

According to founder and former CEO Phil Knight in his recently released memoir Shoe Dog, Nike management essentially made up the concept of futures orders as it applies to its business as a cash-generating tool for when times were still lean during their early growth days. In the book, Knight writes, "Why not go to all of our biggest retailers and tell them that if they'd sign ironclad commitments, if they'd give us large and nonrefundable orders, six months in advance, we'd give them hefty discounts, up to 7 percent?" The system stuck and has been a key part of Nike's business model since.

How to read into it

Futures orders make up a sizable part of Nike's business. During 2015, 87% of Nike's wholesale footwear shipments (not including golf or other brands like Hurley) were made through futures orders, as was 67% of Nike's U.S. wholesale apparel.

Does that mean that we can look at futures orders and know exactly what Nike's next quarter sales will be? No, because reported futures orders don't take into account Nike's other brands such as Converse, nor direct-to-consumer sales which Nike is working to increase through investment in Nike.com. Also there could be order cancellations, shipping issues, and other reasons that final revenue is not in line with previously reported future orders.

Still, reported futures orders do provide clarity into demand for Nike products. Because Nike breaks futures orders down by region, it also gives insight into which regions are likely growing the fastest.

Nike's reported futures orders from the most recent quarterly earnings. Image source: Nike.

Why it matters

For investors and analysts, this level of detail provides great insight into Nike compared to its competitors, which usually do not provide this level of detail even if they do sell items in similar ways. This is not always good for Nike stock, which following the most recent quarterly earnings got a downgrade from Merrill Lynch. The firm wrote: "After posting double-digit futures growth in 22 of the past 23 quarters, we believe North America futures are poised to decelerate to a high-single-digit rate in 2016/2017."

Still, reporting this level of financial detail helps investors to really understand Nike's business and short-term prospects, likely helping also to smooth out expectations and decrease the chance of surprise changes, a good thing for both the company and investors.