Wills and trusts can work together or independently to communicate how you'd like your estate settled after you're gone. Whether you need a will, a trust, or both often depends on the complexity of your estate, whether you have minor children, and how quickly you'd like your heirs to receive their inheritance.

Read on for a closer look at wills and trusts, including the different types that are available.

Will vs. trust

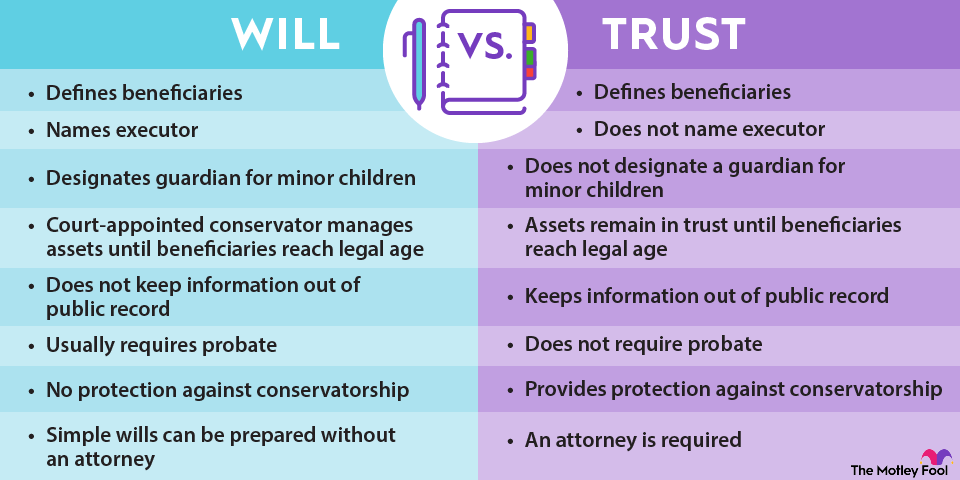

The table below outlines the key differences between a will and a trust.

Will | Trust | |

|---|---|---|

Defines beneficiaries? | Yes | Yes |

Names executor? | Yes | No |

Designates guardian for minor children? | Yes | No |

Handling of minor children as beneficiaries? | The court appoints a conservator to manage the assets until the beneficiaries reach legal age. | The assets remain in the trust until the beneficiaries reach legal age. |

Keeps your information out of public record? | No | Yes |

Requires probate? | Usually; small estates may use a streamlined probate process. | No |

Protection against conservatorship? | No | Yes |

Attorney needed? | Simple wills can be prepared without an attorney. | An attorney is required. |

Wills

A will is an estate planning document that serves three primary purposes:

- Documents how you'd like your property distributed. Your will covers property that doesn't already have a named beneficiary. Property held in trust, life insurance death benefits, 401(k)s, and bank accounts normally have named beneficiaries. They should receive the assets outside of the will process. For example, if you name someone as your 401(k) beneficiary, the account won't need to go through probate.

- Names a guardian for your minor children.

- Designates an executor, who manages the details of settling your estate.

The courts oversee your executor's implementation of the will's instructions in a process called probate. Probate is often criticized for being lengthy and expensive. Your estate may absorb court costs, attorney fees, appraisal fees, executor fees, and more. These costs reduce the inheritance that ultimately goes to your heirs.

Types of wills

Here are the most common types of wills.

Simple will

Simple wills are straightforward documents with no complex stipulations or clauses. A simple will can be created without an attorney and is suitable for single people or couples who don't have a lot of assets.

If you own a business, have a special needs child, or are interested in charitable giving, you will likely need a more detailed document, plus the guidance of an attorney.

Joint will

A joint will covers two people, usually a married couple. The document typically awards all property to the surviving spouse when one spouse dies. A joint will also name a beneficiary to receive the remaining assets after the second spouse's death.

Note that the surviving spouse cannot change the terms of a joint will. Also, not all states recognize and enforce joint wills.

Reciprocal will

A reciprocal will, also called a mirror will, is a more flexible alternative for couples than a joint will. There are two wills involved, but they are the same for each spouse -- except for the beneficiary. Each spouse names the other as a beneficiary.

Since the two wills are separate, each spouse has full control to update terms, change beneficiaries, or add stipulations -- before or after the other dies.

Pour-over will

A pour-over will directs your assets into an established trust when you die.

You might use a pour-over will to ensure that property not already in the trust gets distributed per the trust's instructions. A pour-over will can also streamline property transfer for couples. A surviving spouse who is also the trustee will still have control of the property -- for example, a home that was previously titled in the deceased spouse's name. Upon the death of the second spouse, that home would be distributed along with other trust assets.

Testamentary trust will

A testamentary trust will establish a trust after you die. You'd use this format if you didn't already have a trust but you want to control the timing of how your beneficiaries receive the assets -- something a will alone cannot do.

Trusts

A trust is a legal entity that holds assets and later distributes those assets to beneficiaries according to specific instructions. A trust has a grantor, a trustee, and one or more beneficiaries. The grantor is the person who creates the trust, and the trustee manages the trust assets. The beneficiaries are the heirs, meaning those who will ultimately receive the property in trust.

A trust has several advantages relative to a will:

- Property managed by a trust is not covered by a will and does not go through probate.

- A trust can specify when your beneficiaries receive their inheritance. This is useful if you have minor children; the trust can hold the assets until the children reach legal age.

- Trusts are not documented in public records. Probated wills are public documents and are viewable by anyone who requests them.

- Having a living trust in place may protect you from conservatorship if you are incapacitated and cannot manage your own finances. If your property is in the trust, it's already being managed by a trustee. There may be no benefit to the court appointing someone else to oversee your affairs.

- Irrevocable trusts can provide tax advantages during your lifetime.

Conservatorship

Types of trusts

Here are the most common trust structures.

Revocable living trust

You can change or update the terms of a revocable living trust at any time. You still control the assets in the trust, and so you are responsible for any income taxes incurred by those assets.

Irrevocable living trust

An irrevocable trust, once established, cannot be updated or changed without permission from the beneficiaries. This is because you relinquish your ownership rights to the property you place in an irrevocable trust. The trust controls the property and also pays any income taxes that the property incurs.

You might like the structure of an irrevocable trust if you want to lighten your income tax burden in retirement or shield the property from creditors.

Testamentary trust

A testamentary trust is established after you die through your testamentary will. Testamentary trusts do go through probate, which is a disadvantage relative to living trusts.

Will vs. trust: How to choose

Ultimately, deciding between a will and a trust depends on the size of your estate, the complexity of your estate planning, and whether you want your estate to bypass probate.

Wills tend to be the cheaper option, at least in terms of upfront costs. In most cases, even if you set up a trust, it's also advisable to have a will for any other assets that aren't covered. And if you already have beneficiaries for your assets, a trust may not be necessary.

A trust is a useful tool if you have a large estate or minor children. An irrevocable trust can also help lower your tax burden. If you're unsure which to choose, a will and a trust could be the best option.