Exchange-traded funds (ETFs) are investment vehicles that trade like a stock but give investors ownership of a broad range of stocks or other assets. ETFs offer investors an appealing alternative to owning individual stocks.

Exchange-Traded Fund (ETF)

There are all kinds of ETFs available. Some track major indexes, such as the S&P 500 or the Nasdaq Composite. Others give investors exposure to certain parts of the world, like China or emerging markets. And some ETFs concentrate on certain sectors, such as technology or banking, or specific types of stocks, like dividend or growth stocks.

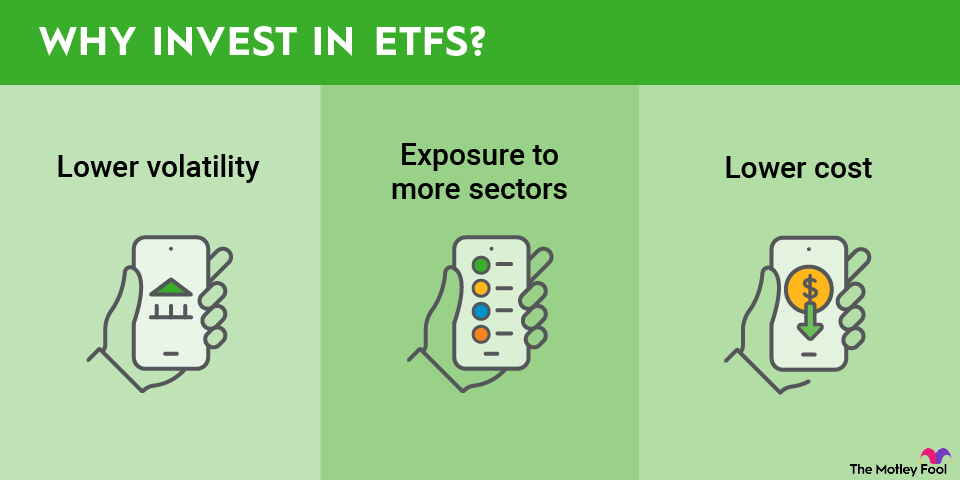

In a challenging market environment, ETFs can help reduce one considerable risk of owning an individual stock since they tend to be less volatile. Although they're similar in principle to mutual funds, they're easier to buy and trade than typical mutual funds and tend to have lower fees. If you're looking for ETFs to invest in, keep reading to see seven of the best.

Top seven ETFs to buy now

There are several types of ETFs that investors can buy, including:

- Broad index funds: Many of the largest ETFs focus on tracking a broad market index such as the S&P 500 or the Nasdaq-100. These funds enable investors to gain diversified market exposure through a single low-cost fund.

- Sector ETFs: These ETFs focus on stocks in a specific stock market sector, such as technology, energy, or healthcare.

- Asset-focused funds: Asset-focused funds invest in a specific asset class such as government bonds, dividend stocks, small-cap stocks, or commodities.

- Thematic ETFs: Thematic funds invest in an investment theme such as semiconductor stocks, artificial intelligence (AI), international stocks, or clean energy.

With those fund types in mind, here are some of the best ETFs to buy this month.

Exchange-Traded Fund (ETF) and Ticker | Assets Under Management (AUM) | Expense Ratio | Description |

|---|---|---|---|

Vanguard S&P 500 ETF (NYSEMKT:VOO) | $818.8 billion | 0.03% | Fund that tracks the S&P 500 |

Invesco QQQ Trust (NASDAQ:QQQ) | $399.9 billion | 0.2% | Fund that tracks the Nasdaq-100 |

Vanguard Growth ETF (NYSEMKT:VUG) | $201.8 billion | 0.04% | ETF that invests in large-cap U.S. growth stocks |

iShares Core S&P Small-Cap ETF (NYSEMKT:IJR) | $87.7 billion | 0.06% | Fund that tracks the S&P SmallCap 600 index |

Schwab U.S. Dividend Equity ETF (NYSEMKT:SCHD) | $70.7 billion | 0.06% | ETF that invests in 100 high-yielding U.S. stocks with histories of increasing their dividends |

Vanguard Total Stock Market ETF (NYSEMKT:VTI) | $564.2 billion | 0.03% | Fund that holds more than 3,500 U.S. stocks of all sizes |

iShares Core MSCI Total International Stock ETF (NASDAQ:IXUS) | $50.8 billion | 0.07% | ETF that holds around 4,250 international stocks of all sizes |

1. Vanguard S&P 500 ETF

Vanguard created the index fund. If you're looking for an S&P 500 index fund, the Vanguard S&P 500 ETF is hard to beat. It offers a dirt-cheap expense ratio of just 0.03%, compared to the 0.22% average for similar funds. This lower expense ratio means that for every $10,000 invested with the fund, investors will pay just $3 in annual fees versus $22 in a typical competing fund.

NYSEMKT: VOO

Key Data Points

The Vanguard S&P 500 ETF is one of the largest and most popular ETFs. It was the largest ETF by assets under management (AUM) in December 2025. The ETF's combination of low costs and large size makes it a great choice if you're looking to invest in the broader market. Because of its history, diversification, and exposure to blue chip stocks, many investors consider it one of the best ETFs to buy and hold.

The S&P 500 has an excellent track record of delivering returns for investors. Over the last 50 years, the average stock market return, as measured by the S&P 500, has been 8% with dividends reinvested. The Vanguard S&P 500 ETF is a low-cost way to capture the market's returns.

2. Invesco QQQ Trust

If you're looking to gain exposure to big tech stocks, Invesco QQQ Trust is an excellent choice. The ETF tracks the Nasdaq-100 index, which includes 100 of the Nasdaq's largest nonfinancial companies.

NASDAQ: QQQ

Key Data Points

The top stocks in the ETF are Nvidia (NVDA -2.05%), Apple (AAPL -1.25%), Microsoft (MSFT -2.46%), Broadcom (AVGO -4.33%), and Amazon (AMZN -2.00%). As one of the best-performing ETFs, it boasts an affordable expense ratio of 0.2%.

As of December 2025, the Invesco QQQ Trust had generated a total return of around 499% over the past decade. A $10,000 investment made in the Invesco QQQ Trust 10 years ago would be worth more than $59,911 today.

The Nasdaq-100's focus on innovative technology companies positions it to continue delivering strong total returns, especially as artificial intelligence (AI) accelerates growth in the tech sector in the coming years.

3. Vanguard Growth ETF

If you want to invest in growth stocks but don't want to be an active stock picker, the Vanguard Growth ETF makes that easy. The ETF holds large-cap growth stocks and tracks the CRSP US Large-Cap Growth index.

NYSEMKT: VUG

Key Data Points

Like Invesco QQQ Trust and Vanguard S&P 500, the Vanguard Growth ETF's biggest holdings are Nvidia, Apple, and Microsoft. The growth-focused ETF also held many other growth stocks among the roughly 160 companies in the fund as of December 2025. The Vanguard Growth ETF offers a rock-bottom expense ratio of just 0.04%. Its low cost makes it a good deal for anyone looking for a growth stock ETF.

4. iShares Core S&P Small-Cap ETF

The iShares Core S&P Small-Cap ETF provides broad exposure to small-cap stocks. Small caps tend to be more volatile than the broader market because they may not be profitable or as financially strong as their large-cap counterparts. As a result, small caps tend to be riskier during a downturn because they may not have the same access to capital.

NYSEMKT: IJR

Key Data Points

This ETF helps mute some of that risk by owning a large basket of small caps. As of December 2025, it held about 640 stocks and had a fairly low concentration of holdings. Its top 10 holdings made up less than 6.5% of the total. The ETF has a very low expense ratio of 0.06%, making it a low-cost way to add some small-cap exposure to your portfolio.

5. Schwab U.S. Dividend Equity ETF

Dividend stocks are great long-term investments. Over the last 50 years, dividend-paying companies outperformed those that don't pay dividends by more than 2-to-1 (9.2% average annual total return versus 4.3% for dividend nonpayers). The best performance came from dividend growers and initiators (10.2% versus 6.8% for companies with no change in their dividend policy).

NYSEMKT: SCHD

Key Data Points

6. Vanguard Total Stock Market ETF

Although the S&P 500 is considered a broad-market index, it gives you exposure to only 500 large-cap U.S. stocks. If you want to own all the stocks in the U.S. market, the best way to do it is through a total stock market fund such as the Vanguard Total Stock Market ETF.

NYSEMKT: VTI

Key Data Points

As of December 2025, the fund held more than 3,500 stocks, including large-cap, mid-cap, and small-cap stocks. Because its holdings encompass the S&P 500, its largest positions are the same as for the broad market index.

Vanguard Total Stock Market ETF aims to track the CRSP US Total Stock Market index. Like other Vanguard funds, its low expense ratio of 0.03% makes it an affordable way to invest in the entire U.S. stock market through one ETF.

7. iShares Core MSCI Total International Stock ETF

If it's international markets you want, the iShares Core MSCI Total International Stock ETF is a good way to go. The fund derives its holdings from an MSCI global index and subtracts the U.S. listings. It holds almost 4,200 stocks, including large caps, mid caps, and small caps from around the world.

The ETF offers diversified international exposure. Its top five geographies as of December 2025 were:

- Japan: 15.0% of the fund's holdings

- United Kingdom: 8.9%

- Canada: 8.2%

- China: 8.1%

- France: 6.0%

The iShares Core MSCI Total International Stock ETF allows you to invest globally at an affordable expense ratio of 0.07%. It also has an attractive dividend yield of 2.8% based on dividend payments over the last 12 months (as of late 2025).

Related investing topics

Should you invest in ETFs?

Exchange-traded funds can work for almost any kind of investor, regardless of your investing style or the type of stocks you're looking to invest in. Hundreds of ETFs offer exposure to a wide range of sectors and different investing goals, such as dividends or growth. These funds have several benefits, including:

- Potentially lower risk and volatility compared to investing in individual stocks

- A passive investment with a low management fee

- Ability to invest broadly in a sector or trend through a simple investment vehicle

However, there are also some drawbacks to investing in ETFs that investors need to consider, including:

- They have the potential to underperform a portfolio of individual stocks.

- The higher management fees of some funds can eat into their returns.

- Leverage and other factors can cause some funds to deliver poor long-term performance.

For most investors, holding at least one or two high-quality ETFs makes sense, especially if you want to eliminate some of the work of picking individual stocks. The list above offers a good start if you're looking for some of the best ETFs to buy.