Stock Advisor

Expert Analysis and Market-Beating Returns

Thousands of individual investors just like you save time and potentially make money with Motley Fool Stock Advisor.

Already a member? Sign in here ›

For over 20 years, Stock Advisor has delivered a proven track record of market-beating returns. Each month, investors receive two carefully selected stock recommendations to help potentially grow wealth faster—plus expert insights, financial planning articles, and top ETF picks to help investors build the financial future you’ve worked so hard for (and a little bit of Foolish fun along the way)!

Key Features

Stock Advisor Is a Comprehensive Investing Resource

MARKET BEATING RETURNS

Stock Advisor Has More Than Quadrupled the S&P 500 Over the Last 21 Years

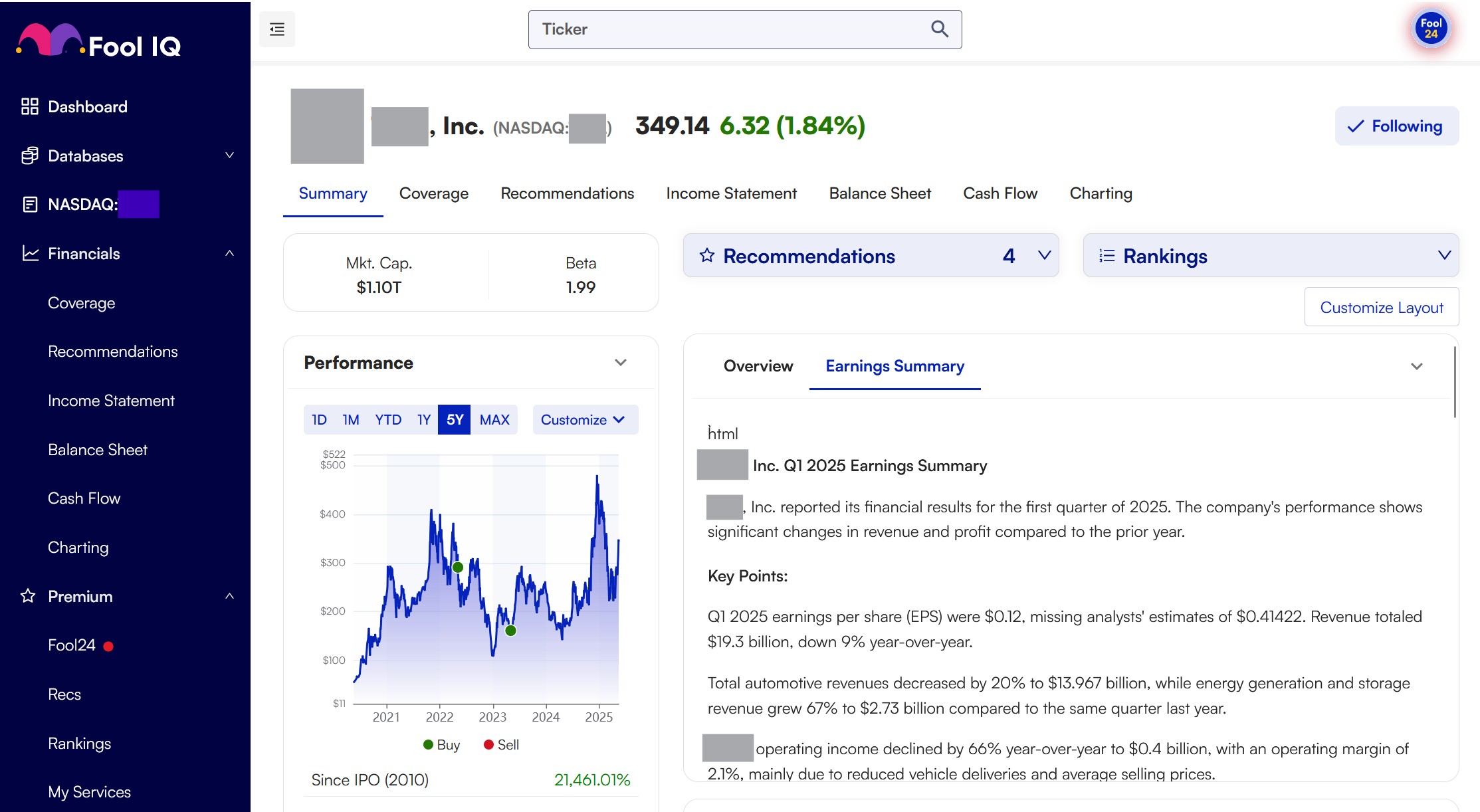

Stock Advisor has outperformed the market by more than four times through rigorously combing every corner of every industry for overlooked companies we believe could be posed to shatter the market – often when these businesses are flying under Wall Street’s radar.

Stock Advisor helps investors...

With 2 new recommendations every month and our top 10 stocks, you’ll always have fresh investment ideas.

With 2 new recommendations every month and our top 10 stocks, you’ll always have fresh investment ideas.

Average Stock Advisor Recommendations Have Returned of 950%

OUR INVESTING TEAM

Will Teach You the Principles of Investing

Additional Premium Investing Resources

For Investors Who'd Like More Stock Recommendations, Tools, and Features

Compare Motley Fool Services

2

5

8+

with daily Moneyball recs

$25K+

$50K+

$100K+

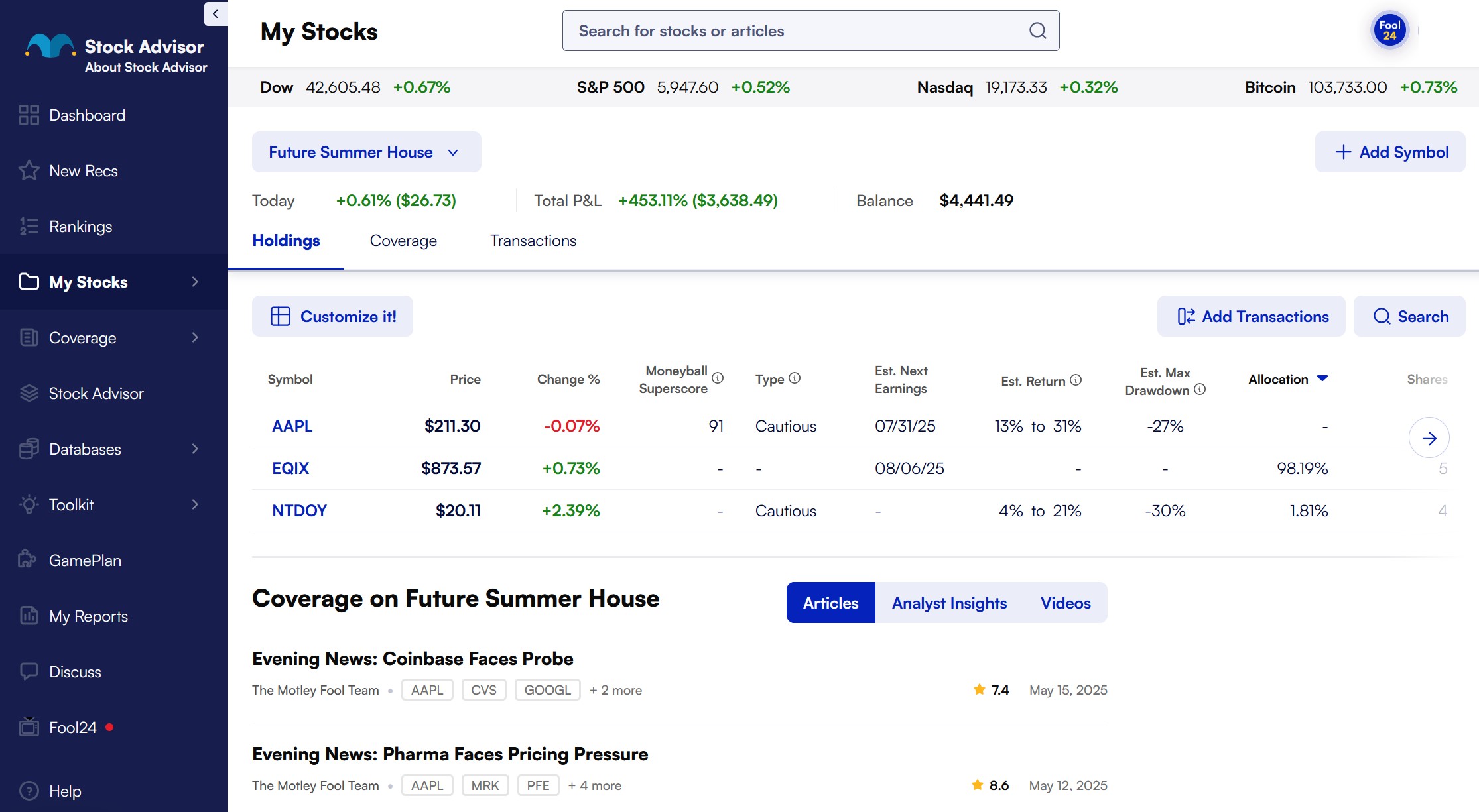

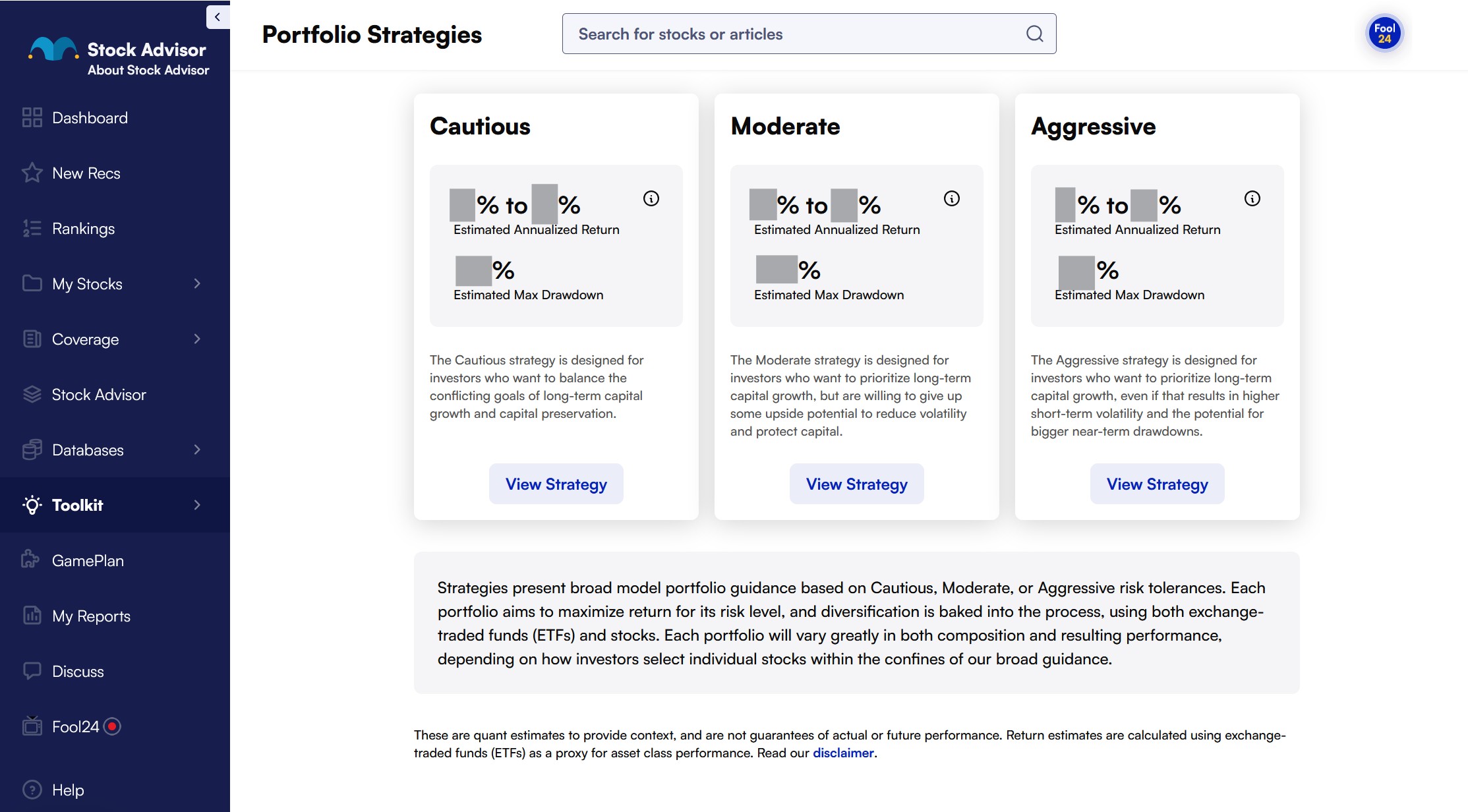

Cautious, Moderate, Aggressive

Cautious, Moderate, Aggressive with specific stock allocation

Cautious, Moderate, Aggressive with specific stock allocation

Partial

Full

Full

Partial

Full

Full

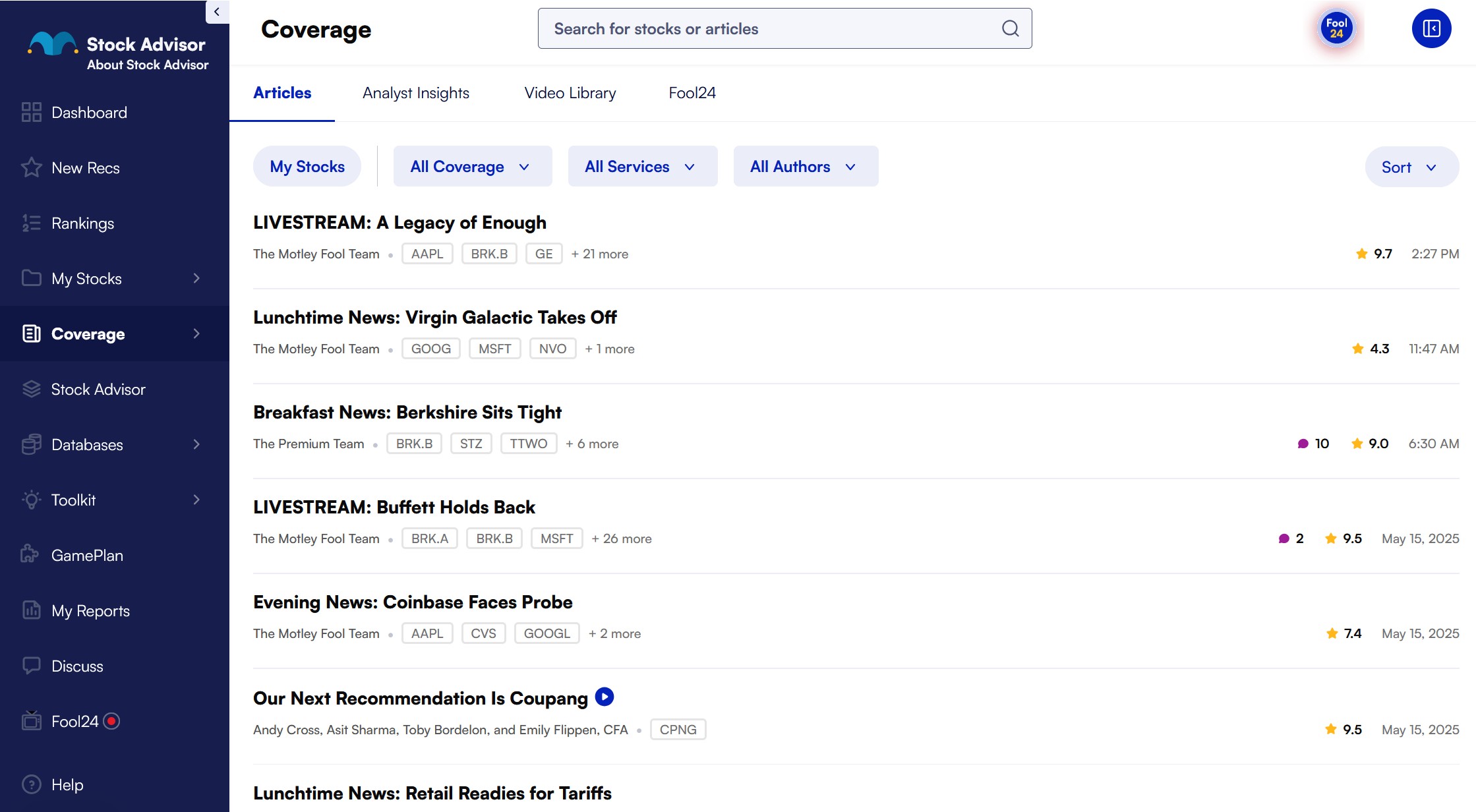

Covers 190+ companies

Covers 340+ companies

Covers 3,500+ companies

Covers 3,400+ companies

Everything in Stock Advisor plus:

Rule Breakers

Dividend Investor

Hidden Gems

Everything in Stock Advisor & Epic plus:

Trends

Value Hunters

Global Partners