Last month, Clorox (CLX +0.80%) paid shareholders a dividend of $0.71 per share, marking the 36th straight year in which the consumer-products company raised its payout to investors. That track record is rare even among the best dividend stocks, qualifying Clorox for membership among the Dividend Aristocrats. That elite group is composed of roughly 50 stocks that have delivered annual dividend increases for a quarter-century or longer.

Like many Aristocrats, Clorox keeps things simple, making its namesake laundry and cleaning products as well as a number of other well-known consumer lines. Between Glad trash bags, Kingsford charcoal, Hidden Valley salad dressing, and Brita water filters, Clorox has a stable of popular brands on which it has built a successful financial history, even in tough times. Let's take a closer look at Clorox to see whether it's likely to sustain or even improve on that dividend growth.

Dividend Stats on Clorox

|

Current Quarterly Dividend Per Share |

$0.71 |

|

Current Yield |

3.4% |

|

Number of Consecutive Years With Dividend Increases |

36 years |

|

Payout Ratio |

60% |

|

Last Increase |

July 2013 |

Source: Yahoo! Finance. Last increase refers to ex-dividend date.

Will Clorox help investors clean up in the long run?

For long-term investors, Clorox has been a great example of how a combination of growing dividends and rising share prices can add up to huge total returns. The stock set all-time highs earlier this year, and even with a modest pullback, a healthy yield continues to reward shareholders who've stayed the course.

Much of Clorox's success comes from its focus on brands in which it can dominate the competition. One frequently cited statistic is that the vast majority of Clorox's brands are among the top two positions of market share in their respective markets. The much larger Procter & Gamble (PG +0.92%) has had similarly broad success, with two dozen brands featuring billion-dollar sales, including its Tide line of laundry products. Unilever (UL +0.40%) also has a line of laundry brands, with Surf in the United States and different product names for various international markets that it serves. But unlike those larger companies, Clorox's focus helps it stay locked into its strongest niches without biting off more than it can chew.

Like P&G and other rivals, Clorox has had to deal with threats to its past performance. With some consumers still suffering from a sluggish economy, private-label brands represent a cheaper way for many customers to get adequate substitutes for Clorox products. But the bigger issue that Clorox and its peers have faced is the rise in input costs. Although Clorox customers are relatively loyal, that doesn't give the company unlimited power to pass through higher expenses to consumers via price increases.

For investors, though, Clorox's attention to cash flow is a big positive. The company has done a reasonably good job in recent years of meetings its goal of keeping free cash flow at 10%-12% of sales. By keeping capital expenditures in line with depreciation and amortization costs and by pushing margins higher, Clorox expects to achieve its cash flow goals.

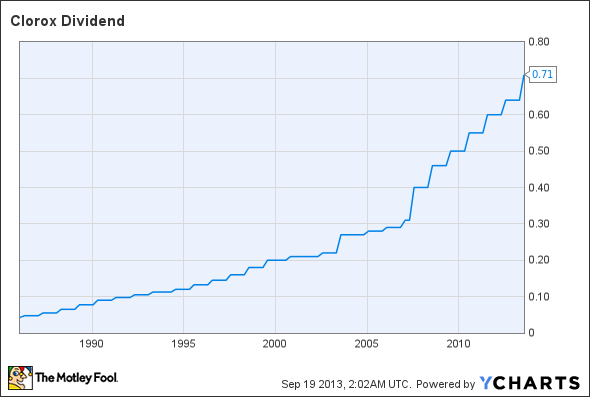

Clorox dividend data by YCharts.

As you can see, Clorox has accelerated its dividend growth in the past five years, with its latest boost of more than 10% being consistent with some of the other annual increases the company has made. Earnings growth has also been reasonably strong, but Clorox has demonstrated a willingness to give even more back to shareholders than its results might suggest was necessary.

When will Clorox boost its payout?

With the company just having made an increased payout, investors shouldn't expect another boost until late next year. The big question, though, is whether investors can expect a raise to about $0.80 per share quarterly, which would mark a nearly 13% jump. With Clorox's payout ratio starting to get fairly high at 60%, the company might prefer to make more modest increases in the future unless earnings growth accelerates enough to justify a healthier rate of payout growth.

As long as it can continue to compete against much larger peers and keep its brands popular, Clorox should remain a Dividend Aristocrat for a long time. Investors can only hope that its total returns match the amazing past performance that longtime shareholders have already enjoyed.

Click here to add Clorox to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.