Caterpillar Inc. (CAT +0.47%) and Deere & Company (DE 1.35%) both have a lot to offer income investors. Caterpillar currently has a dividend yield of 2.2% and Deere pays 2.4%. These are two world-class companies with products in demand across the globe, but which company is a better dividend machine for income investors today?

Dividend Coverage

Dividend safety matters. This is a cyclical industry, and there is no sense in banking on a dividend yield if the company could have a hard time paying it down the road. Dividend coverage is a useful measure to show the margin of safety between what a company earns and how much it pays out to investors.

Both Caterpillar and Deere have ample dividend coverage, and their dividend payout streams look safe. That said, Deere gets the advantage at this point with its earnings being able to cover dividends 4.5 times over.

Return on Equity

Turning to quality metrics to get an understanding of managerial effectiveness, the picture is more mixed. Both companies generate very high return on equity. But as you would expect due to the capital-intensive industry they operate in, both have higher debt levels.

Deere is able to generate almost twice as high of an ROE, but to do so it requires almost twice as much debt leverage. Since that debt can later on come back to bite companies in during downturns, this round goes to Caterpillar. By operating with less debt on its balance sheet, Caterpillar is in a better position to weather the market cyclicality that is inherent to this industry.

Repurchases and Dividend Growth

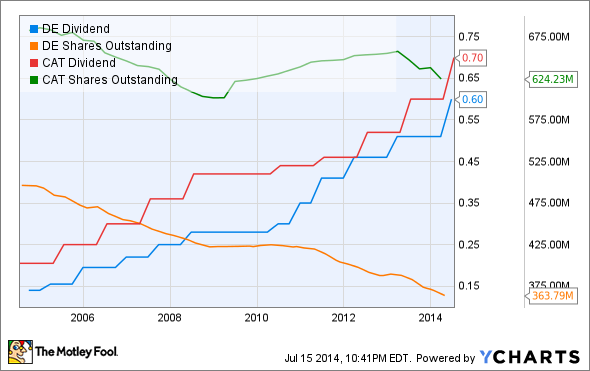

Both Caterpillar and Deere are shareholder friendly, the companies excel at R&D -- no not research and development -- repurchasing shares and raising dividends. Both actions directly benefit Caterpillar and Deere shareholders by boosting the stock price.

Both companies have excellent dividend growth track records. Caterpillar has raised its dividend twenty consecutive years. Deere's dividend has grown for ten straight years. The financial crisis could not stop these companies from rewarding their shareholders with dividend growth. Since 2004, Caterpillar has increased its dividend by 197% from $0.78 to $2.32, and Deere by 284% from $0.53 to $2.04. In the same time period, Caterpillar reduced its shares outstanding by 8%. Deere was even more aggressive by reducing its share count by 25%.

Value

At this point, both companies are somewhat interesting candidates especially given the overall dearth of bargain stocks. But as in everything else, price matters. Deere has the edge in dividend safety and share buybacks. Caterpillar has the advantage with its balance sheet. But which stock is cheaper?

At today's prices Deere clocks in at around half the price (on a P/E basis) of Caterpillar. Aside from that, while Caterpillar sells for a relatively rich valuation based on its history, Deere is selling for near its 10-year low range on valuation. With many of the metrics very close to each other, this one is a no brainer. The two companies have dividend yield, dividend growth, and dividend safety metrics that are each within shouting distance of each other, but Deere appears much cheaper at the moment, giving the stock more room to run.