The year 2015 has been a slow one on the stock market despite the continuation of low interest rates and a steadily improving economy. It's times like these when investors really appreciate stable, dividend-paying companies that, in markets both good and bad, consistently churn out cash for their shareholders. Not only can these companies provide steady income for shareholders, but they can also produce huge capital gains over the long term, as dividend stocks have historically outperformed the market by a wide margin.

With that in mind, here are four rock-solid dividend-paying stocks that look attractive today.

Verizon

Much has been made of increasing competition in the wireless business, but the fact remains that Verizon (VZ +0.07%) is the most profitable company in the space -- a position that doesn't appear to be in danger for the foreseeable future. Its whopping 4.8% dividend yield should even grow as more people spend more on wireless technology and Verizon moves into distributing video content of its own. The acquisition of AOL adds video advertising that reaches half of U.S. households, and an Internet TV service is reportedly in the works.

There's also an ingrained advantage in the core wireless business. It costs tens of billions of dollars to build out networks. Then it takes years to acquire the tens of millions of customers who will generate a return from that network. If a company attracts them with low prices, as T-Mobile and Sprint are trying to do, it will have a hard time making the profits necessary to invest in the next generation of wireless technology, creating a low-profit cycle that's difficult to escape.

Verizon Wireless commands a higher price for better service, making more money for investors and giving the company the cash it needs to invest in the next-generation network. The company's subscriber base may not grow as quickly as those of its competitors, but Verizon Wireless is willing to give up low-margin customers in order to maintain its profits and its payouts to shareholders. It's a business model that's built to last, because consumption of data from wireless companies is only increasing, and millions of people are willing to pay for it month after month.

Intel

Another forgotten business in today's market is chips, and that's Intel's (INTC 1.07%) specialty. Cloud and wireless devices get a lot of attention, but chips make this computing revolution possible, and Intel is still at the forefront of that business. With a P/E ratio of just 12.3 and a dividend yield of 3.4%, Intel is an attractive option for investors looking for yield.

Intel missed the boat on mobile products, but it's now leading the way in chips for cloud servers and Internet of Things-connected devices. Like Verizon, it's no longer a growth engine, but it continues to generate billions in cash and net income year after year. This market is not putting much value on the bottom-line fundamentals that make this a great value for investors.

Chevron

Low oil prices are bad news for the energy industry, but they're not debilitating for companies with diverse portfolios, like Chevron (CVX +0.07%). The company is still making massive profits on refining and distributing energy, even with oil prices now bouncing near $50 per barrel. Investors are getting a giant in the industry at 9.3 times earnings, and it pays a 4.7% dividend yield.

Even if energy earnings get worse overall, there could be an opportunity for Chevron. Major oil companies will likely become consolidators if shale and offshore drillers go bust in the next few years, and Chevron could be an opportunistic buyer.

Especially here in the U.S., energy consumption is starting to rise. Long term, that bodes well for a diversified company like Chevron. Getting in at today's price could prove to be a steal years down the road.

Apple

It seems like every few months, Apple (AAPL 0.45%) goes in and out of favor with the market. iPhone sales miss estimates, then they beat estimates. Then the stock falls into deep-value territory, the stock rises to a new all-time high, and the cycle repeats.

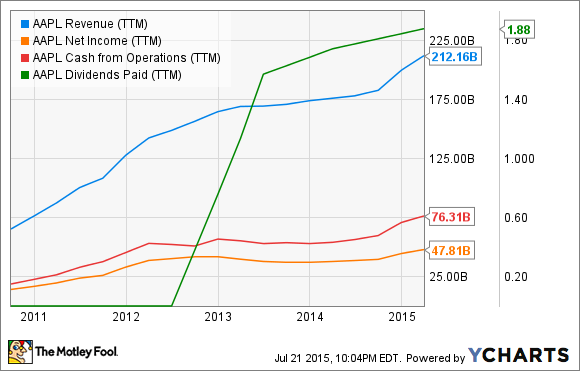

What can't be denied about Apple is that it's a cash-generating machine, and it's starting to reward shareholders in a big way through dividends and share buybacks.

Apple's dividend is already at a 1.7% yield, but its payout ratio of just 24% means it has lots of room to increase that dividend in the future. With a business few companies in the world could disrupt, Apple looks like one of the most stable dividend stocks on the market today.

Dividends can deliver market-crushing returns

Companies like Verizon, Intel, Chevron, and Apple may not be the growth machines that Wall Street loves today, but they have stable businesses that generate billions of dollars in cash for investors each year. And in the long term, these dividend stocks have a high chance of beating the market, and that's what every investor wants.

In my opinion, Wall Street has overlooked these stocks, and their incredible streaks of profitability and dividend payments shouldn't be overlooked by investors today.