Companies can choose to do several things with their profits. They can retain some or all of their earnings within the business to:

- Expand their operations organically or via acquisition

- Pay down debt

- Build up a stockpile of cash

They can also return a portion of it to shareholders by:

- Repurchasing stock to reduce the outstanding share count

- Paying it out via dividends, which can be in cash, shares, or a combination of the two

Here's a closer look at the latter option.

Example of dividend income

Dividend income is defined by the IRS as any distribution of an entity's property to its shareholders. While they are usually cash, dividends can also be in the form of stock or any other property.

Usually dividend income is the distribution of a company's taxable income to its investors. For example, say a company made $1 billion in net income last year. It chose to reinvest $750 million of that money to expand its business, buying a competitor for $500 million and investing $250 million in a new location. Since it already had a strong balance sheet with an adequate cash cushion, it opted to return its excess income to shareholders by paying out $250 million in dividends.

However, the IRS also considers the following situations as resulting in dividend income:

- The corporation pays the debt of its shareholder.

- The shareholder receives services from the corporation.

- The shareholder is allowed to use the corporation's property without adequate reimbursement to the company.

- A shareholder provides services to a corporation but gets paid more than what the company would have paid a third party for the same services.

Are dividends considered income?

The IRS considers most dividend payments to be taxable income. There are two types of taxable dividend income:

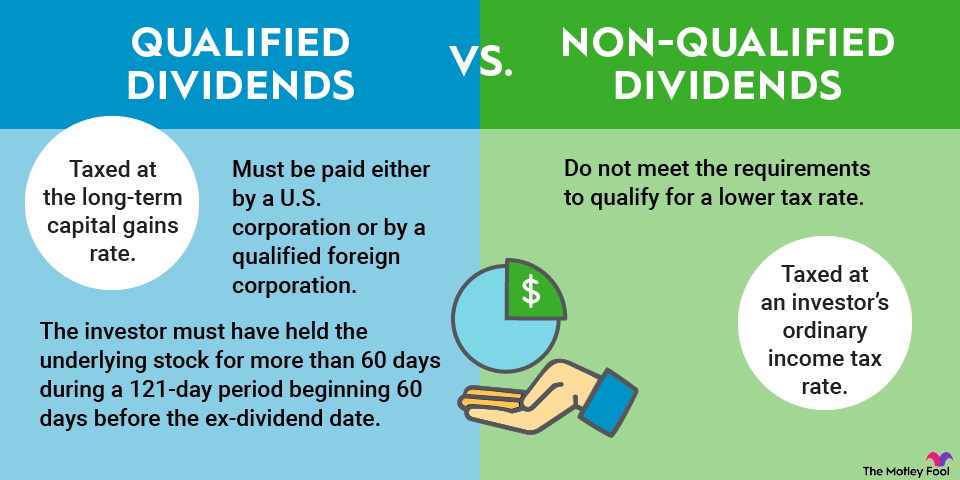

Qualified dividends

Qualified dividends must meet certain IRS requirements to qualify for a lower tax rate. The payee must be a U.S. corporation or a qualified foreign corporation (incorporated in a U.S. possession, located in a nation covered by an income tax treaty with the U.S., or with shares readily trading on a U.S. stock market exchange). Further, a recipient must hold the underlying stock for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date, which is the first day a stock trades without the dividend priced into its shares.

Nonqualified or ordinary dividends

Nonqualified or ordinary dividends do not meet those requirements to qualify for a lower tax rate. As a result, the IRS taxes them based on the recipient's ordinary income tax rate.

However, not all distributions from a company or investment are taxable dividend income. Special cases include:

- Return of capital: A repayment of some or all of an investor's investment in a company's stock. These payments reduce an investor's adjusted cost basis in the investment. A distribution usually qualifies as a return of capital if the company doesn't have any accumulated or current-year earnings.

- Capital gains distributions: Several entities, including regulated investment companies (e.g., mutual funds, exchange-traded funds, and money market funds) and real estate investment trusts, may pay a capital gains distribution. These payments get taxed as long-term capital gains.

- Spinoffs: Companies can spin off a portion or all of their ownership interest in a business unit through a stock dividend to existing shareholders, which can be tax-free or taxable depending on the structure.

- Stock dividends: When companies issue and distribute a new share class to shareholders, they'll often call it a stock dividend. However, unlike dividends paid with stock in lieu of cash, these are similar to those issued in a stock split, in which investors receive an equal amount of the new shares based on the proportion of existing stock they already own.

You may also be wondering: Are dividends earned income? According to the IRS, no. Earned income "includes all the taxable income and wages you get from working for someone else, yourself or from a business or farm you own."

Tax treatment of dividend income

As mentioned earlier, taxable dividend income comes in two forms: qualified and nonqualified. Investors will receive a Form 1099-DIV from each payer of distributions of at least $10, although most brokerage accounts provide a consolidated 1099-DIV that puts them all into one form. This form tells an investor how much qualified and nonqualified dividend income they earned the previous year. The IRS taxes ordinary (i.e., nonqualified) dividends at the recipient's ordinary income tax rate. For the 2021 tax year, the income tax brackets are as follows:

2021 Ordinary Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Households |

|---|---|---|---|

10% | Up to $9,950 | Up to $19,900 | Up to $14,200 |

12% | $9,951 to $40,525 | $19,901 to $81,050 | $14,201 to $54,200 |

22% | $40,526 to $86,375 | $81,051 to $172,750 | $54,201 to $86,350 |

24% | $86,376 to $164,925 | $172,751 to $329,850 | $86,351 to $164,900 |

32% | $164,926 to $209,425 | $329,851 to $418,850 | $164,901 to $209,400 |

35% | $209,426 to $523,600 | $418,851 to $628,300 | $209,401 to $523,600 |

37% | $523,601 or more | $628,301 or more | $523,601 or more |

Below are the income tax brackets for the 2022 tax year:

2022 Ordinary Dividend Income Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Households |

|---|---|---|---|

10% | Up to $10,275 | Up to $20,550 | Up to $14,650 |

12% | $10,276 to $41,775 | $20,551 to $83,550 | $14,651 to $55,900 |

22% | $41,776 to $89,075 | $83,551 to $178,150 | $55,901 to $89,050 |

24% | $89,076 to $170,050 | $178,151 to $340,100 | $89,051 to $170,050 |

32% | $170,051 to $215,950 | $340,101 to $431,900 | $170,051 to $215,950 |

35% | $215,951 to $539,900 | $431,901 to $647,850 | $215,951 to $539,900 |

37% | $539,901 or more | $647,851 or more | $539,901 or more |

Meanwhile, qualified dividends get taxed at the long-term capital gains tax rate. Here are the rates and income brackets for 2021:

2021 Qualified Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Households |

|---|---|---|---|

0% | Up to $40,400 | Up to $80,800 | Up to $54,100 |

15% | $40,401 to $445,850 | $80,801 to $501,600 | $54,101 to $473,750 |

20% | $445,851 or more | $501,601 or more | $473,751 or more |

Here are the rates and income brackets for 2022:

2022 Qualified Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Households |

|---|---|---|---|

0% | Up to $41,675 | Up to $83,350 | Up to $55,800 |

15% | $41,675 to $459,750 | $83,350 to $517,200 | $55,800 to $488,500 |

20% | $459,751 or more | $517,201 or more | $488,501 or more |

Because the IRS taxes nonqualified dividends at higher rates, investors should consider owning them in a tax-advantaged account like an individual retirement account (IRA). Although for higher-income individuals, there's certainly no harm in owning qualified dividend payers in tax-advantaged accounts to defer or avoid taxes on that income.

Dividend revenue in business

It's worth noting that there are different tax rules for dividends received by corporations. For example, the dividends received deduction (DRD) allows a company that receives a dividend from another company to deduct that payout from its income, which would reduce its income tax. However, several rules apply, and potential deductions range from 70% of the dividend to 100%.

Related investing topics

Interest and dividend income

The IRS deems dividend and interest payments received by investors as taxable income. However, there is a notable difference between the two. Dividends aren't an expense to a company but instead a distribution of its earnings to its investors. On the other hand, interest payments on a company's bonds or other debt are an expense; thus, these payments reduce its taxable income.

For individuals, the IRS treats interest income similar to nonqualified dividends, taxing both at the ordinary income tax rate. However, instead of a Form 1099-DIV, recipients will receive a 1099-INT to report this income on their taxes.

Dividend income doesn't have to be taxable

The IRS considers most distributions of cash, stock, or property from a company to its shareholders to be taxable income. The tax rate varies depending on the type of dividend and an investor's tax rate. However, investors can often defer or avoid taxes on this dividend income if they hold the investment in a retirement account, which is why it often makes sense to consider keeping dividend stocks in a tax-advantaged account.