Investing can be easy -- all you need is access to the Internet and a little cash. Investing well, on the other hand, is hard. And when our elected leaders routinely cause turmoil in the markets via "manufactured" crises like the recent two-week federal government shutdown and down-to-the-wire debt-ceiling negotiations, it can present an added layer of doubt and frustration for individual investors to face. And when it comes to making long-term investing choices in the hopes of earning money that you may need when you're unable to earn a wage, for many it seems almost pointless to try.

But with interest rates for savings accounts and CDs not even keeping up with inflation at this point, it's worth stepping back for a moment and remembering that investing in the stock market for long periods of time is still the best way to grow your wealth -- even when our friends on Capitol Hill fail to do their jobs. With that in mind, let's take a look at some historical data to help put things in perspective.

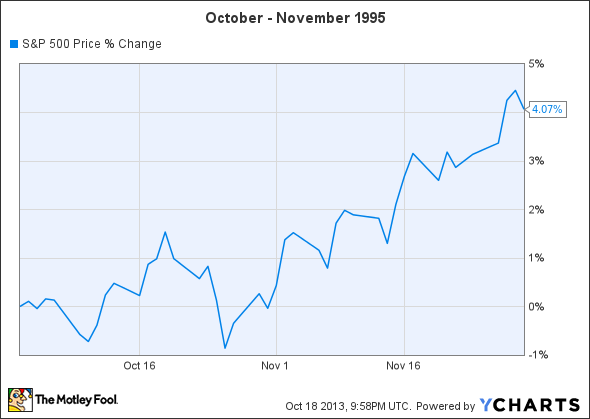

Can you spot the government shutdowns?

While the shutdown of an enterprise as large as the federal government does have a real impact on businesses that support government agencies directly, as well as businesses that rely on government employees for business, as you can see from the chart above, a government shutdown doesn't show up in a notable way when we look at the big picture. Let's take a look at the two shutdowns occurring under the Clinton presidency, in late 1995 and early 1996:

The first shutdown lasted from Nov. 14 to Nov. 19, and as you can see, the market actually rallied over this time.

The second shutdown, from Dec. 16 to Jan. 6, saw the market remain flat over the shutdown but climb sharply afterward, ending January up almost 4% in the two-month period. Let's take a look at the market's movement this time around:

As much as it might feel like the markets are simply ignoring what's happening in D.C., past history shows that the short-term impact doesn't warrant staying out of the market or trying to catch the market on a dip. Frankly, timing the market around any event like this doesn't offer any advantages. To the contrary, the market was actually up after all of these events. But that's no guarantee of what will happen next time.

Sound investing gets back to buying great companies

It's a lot less difficult to predict which companies will perform well over long periods of time. A great place to get started for a lot of investors -- especially young investors just putting money into their portfolios for the first time -- is with index-matching ETFs like the Guggenheim S&P Equal Weight ETF (RSP 0.26%). This exchange-traded fund tracks the performance of the S&P 500 Equal Weight Index, which grants an equal exposure to all 500 of its component stocks. Another option is the SPDR S&P 500 Trust ETF (SPY 0.52%). This fund tracks the S&P 500, which weights its holdings based on their market capitalization.

There are also solid ETFs that match the Russell 2000, which includes 2,000 small-cap companies and is reorganized annually as companies outgrow the index and new companies come in. A couple of good choices are the Vanguard Russell 2000 ETF (VTWO 0.09%) and the iShares Russell 2000 ETF (IWM 0.05%). Combining the S&P 500 and Russell 2000 indexes offers diversity for beginning investors and makes a strategy like dollar-cost-averaging really effective.

Here's a look at the ten-year performance of some of these indexes and the ETFs that track them:

RSP Total Return Price data by YCharts.

As you can see, the Guggenheim S&P 500 ETF and iShares Russell 2000 ETF have both outperformed the overall market over the past decade. The Vanguard Russell 2000 fund has only been around for a few years, but I would expect its performance to basically match the iShares fund, meaning a strong return for investors over time.

Final thoughts

Trying to speculate how our elected officials will behave, and what impact it will have on your investments, is a losing strategy. A simpler and more effective approach is to pick solid long-term investments and invest for the long-term. If you're just beginning, the ETFs above may be a great place to start.