Fast-food chain Burger King is prepping to be a public company again after less than three years on the private burner. But first, it's taking a page out of rival McDonald's (NYSE: MCD) recipe book and refranchising the business. Let's look at America's top fast-food joints by revenue to uncover which will outperform the market and which will flame out.

McDonald's is at the top of its game in the fast-food industry, and I don't see that status changing anytime soon. The chain spiced up its product roster last year by adding new items such as Angus Snack Wraps, Real Fruit Smoothies, and Frappes. The company's decision to expand its coffee business with the launch of the McCafe beverage line continues to boost revenue. The new drink segment should remain a strong point for the restaurant, since premium coffees pack higher profit margins than burgers and fries do.

Would you like a franchise with that?

The biggest advantage for the Golden Arches is its franchise business model. Today, franchisees own more than 80% of McDonald's restaurants worldwide. And that translates into a steady stream of free cash flow for the company, thanks to the royalties and service fees it collects from franchisees. The franchise model works so well, in fact, that competitors are following suit.

By 2013, Burger King plans to have franchised nearly all of its 7,200 chains in the United States and more than 12,500 of its stores internationally. Fast-food foe Yum! Brands (NYSE: YUM) joins the party with just 13% of its U.S. restaurants owned by corporate. The quick-serve brands under Yum!'s umbrella include Taco Bell, Pizza Hut, and KFC. Still, if I were to consider franchising one of these businesses, I'd go with McDonald's. That's because Mickey D's has the strongest brand of the companies, not to mention the soundest menu.

Running the numbers

And let's not forget about Wendy's (NYSE: WEN). The hamburger chain passed Burger King last year in domestic sales to claim the No. 2 spot behind McDonald's. In an effort to revamp its image, Wendy's tossed some new products on the menu, including Garden Sensation Salads and its so-called "Natural Cut Fries With Sea Salt."

The burger chain laid out a plan to reposition its brand as more of a premium fast-food restaurant. Part of this strategy includes a breakfast menu with bakery offerings and a gourmet-coffee segment similar to McCafe. But I think Wendy's needs much more than menu innovation if it wants to catch up to competitors.

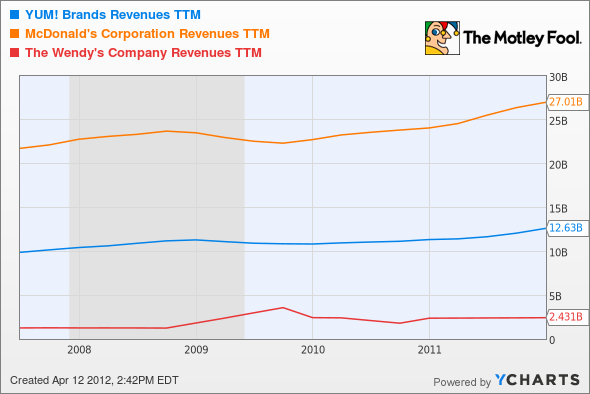

Last year, revenue from Wendy's and Burger King together totaled less than $5 billion. Meanwhile, McDonald's revenue climbed 12% to $27 billion for the same period. From an investment standpoint, we'll have to wait and see how Burger King's IPO pans out in the next few months before giving it fair consideration. Clearly, the battle of the fast-food chains boils down to a duel between McDonald's and Yum! Brands.

YUM Revenues TTM data by YCharts

I think McDonald's is the better investment of the two. Its stock comes to the table with a P/E ratio of 18 and a 2.8% dividend yield, compared with Yum!'s pricy P/E of more than 25 and a dividend yield of just 1.6%. While both brands are expanding overseas, McDonald's has the stronger brand to expand with, and more room to run in China.

Yum! opened 656 new stores in China alone last year, and in three years the company expects 75% of its profits to come from sales outside the United States -- but I believe McDonald's still has more global potential. To be clear, growth in emerging markets is critical in this industry. However, that growth shouldn't come at the expense of U.S operations -- a mistake that Yum! continues to make. McDonald's, on the other hand, is much better balanced in terms of global performance.

The meal deal

McDonald's core business is rock solid. Yum! Brands is still working out its franchise system, whereas McDonald's benefits from a more established strategy and flawless execution. I've given the Golden Arches an outperform rating in Motley Fool CAPS, and I expect the stock to reward investors for many years to come. And keep in mind that these fast-food giants aren't the only stocks gaining a competitive edge in emerging markets. Get the names of 3 American Companies Set to Dominate the World, in this free report from The Motley Fool.