Shares of Red Hat (NYSE: RHT) hit a 52-week high recently. Let's look at how it got here and whether clear skies are ahead.

How it got here

Red Hat is one of few companies that have found a way to successfully monetize open-source software. By helping support Linux and helping enterprise customers put it into data centers and providing support, Red Hat is proving that it can make money on something that's free.

Make money it does, as Red Hat has put up a string of strong quarters, including the second, third, and fourth fiscal quarters. The most recent earnings release saw revenue rise 21%, allowing the company to become the first open-source software player to cross the threshold of $1 billion in annual sales. Shares now stand at decade highs as the company keeps delivering growth.

As Red Hat continues to focus on virtualization in the future, it will also see itself bumping into VMware (NYSE: VMW), which is setting all-time highs itself.

How it stacks up

Let's see how Red Hat stacks up with some of its software peers, although you won't find any of them touting open-source computing anytime soon.

Let's toss in some additional metrics to see where they stand.

|

Company |

P/E (TTM) |

Revenue Growth (5-year rate) |

Net margin (TTM) |

ROE (TTM) |

|---|---|---|---|---|

| Red Hat | 80.6 | 23.1% | 12.9% | 10.9% |

| Microsoft | 11.3 | 9.6% | 32.6% | 41.7% |

| Oracle | 15.3 | 19.9% | 26.3% | 24.5% |

| IBM | 14.9 | 3.2% | 15.0% | 74.0% |

| VMWare | 60.9 | 39.9% | 19.9% | 17.2% |

Source: Reuters. TTM = trailing 12 months.

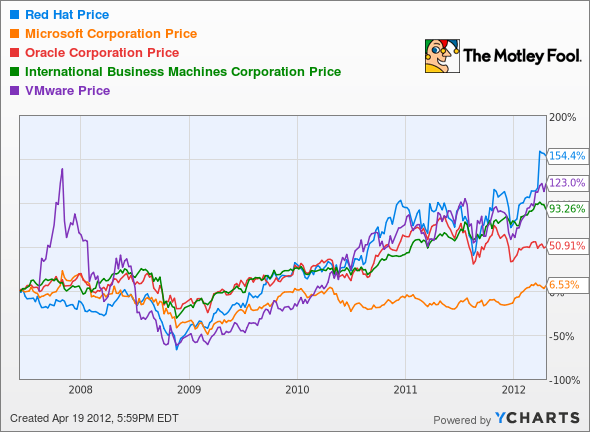

These charts paint a mixed picture. Red Hat's stock has outperformed its rivals over the past five years, which is one reason it carries such a loftier valuation. It has the lowest return on equity and net margin among the group -- does it deserve such a premium valuation?

Red Hat is disrupting the traditional model of selling software, and disruptors can sometimes prove to be worth high multiples.

What's next

Looking to our CAPS community, Red Hat carries just a two-star ranking (out of 5) -- hardly worth calling home about. While I think the company is on a good run with an innovative business model, shares seem priced for perfection right now and any missteps could lead to some serious downside.

If open-source computing proves to be the next generation of computing, then Red Hat is poised to be a major winner, but that's a big if.

Interested in more info on Red Hat? Add it to your watchlist by clicking here.