Take a peek outside, investor, and what trends do you see?

- Aging populations needing more health care.

- Modernizing countries requiring more energy.

- Greater use of information technology to drive all aspects of business.

Now come back to your computer, and let's dive into a recent IPO that offers investors a piece of one of these trends.

Transforming data

Data roams free and wild around corporations. Data borne from different applications, servers, network doohickeys, security devices, websites, operating systems, call records, and other digital widgets. Now, companies are realizing the value of using this data to improve their businesses. Splunk (Nasdaq: SPLK) corrals the data from the multitude of sources, turns the data into digestible information, and offers businesses a way to search, capture, slice, dice, fillet, present, and act on all the wild data running around a company.

Who wants to cut up data? Companies with big pockets like Autodesk, Bank of America, Comcast, Viacom, and Zynga, which represent just a few of Splunk's 3,700 customers. What do companies achieve by analyzing this data? Splunk offers a few examples in its registration statement.

-

Expedia (Nasdaq: EXPE) used Splunk to consolidate all of its error-reporting platforms that had trouble communicating with one another to solve problems. This resulted in both reduced outages and "allowed it to decommission nearly 200 servers and 22 database licenses, reducing license and hardware costs."

- salesforce.com (NYSE: CRM) used Splunk to observe the performance of its services and the way customers interacted with new products. This helped salesforce.com reduce time spent troubleshooting, and now Splunk is used to "monitor application performance, enhance their [users'] experience, and improve capacity planning."

The competition

Of course, Splunk isn't alone in this business, where it's achieved gross margins of 90% over the past three years. Splunk's competitors consist of heavyweights like EMC, IBM, Oracle (Nasdaq: ORCL), SAP, and open-source software Hadoop. Companies like Oracle, which released its Oracle Big Data Appliance in January, are selling support services based around Hadoop.

What edge does Splunk have? It holds only two patents, one for "organizing and understanding machine data through the use of a 'machine data web,'" and the second for organizing, indexing, searching, and presenting time-series data. But unlike most large business-intelligence software, Splunk champions ease of use with dashboards that business and executives can edit, as opposed to just the IT employees.

The case can also be made that there is plenty of business to share, with the size of the "big data" market estimated to be between $17 billion and $30 billion in 2015, based on reports from Wikibon and IDC. This is up from the current year's market-size estimates of $5 billion.

Leadership

Splunk CEO Godfrey Sullivan has an impressive record, most significantly leading enterprise-software company Hyperion. There, he doubled revenue to almost $1 billion before the company was acquired by Oracle for more than $3 billion. And if you like insider ownership, after the IPO Sullivan owns 7.1% of Splunk, and co-founders Erik Swan and Robin Das own more than 8% combined.

Value

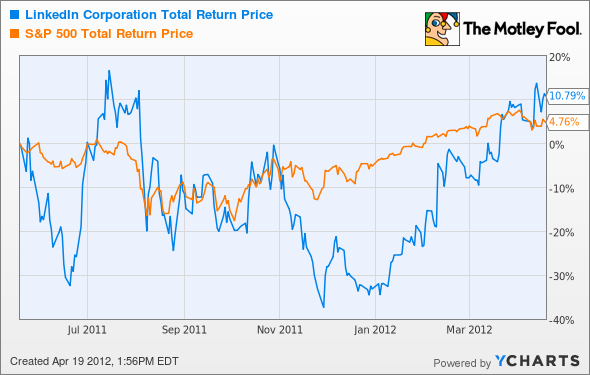

The IPO saw Splunk shares initially priced at $17 jumping to $32 before closing the week over $36. IPOs, especially of young companies that have yet to post profits, typically underperform the market for up to three years. Splunk's shareholders have a 180-day lock-up period where shareholders of more than two-thirds of the company's stock are not allowed to sell. Once that lock-up period ends, those shareholders may want to reduce their holdings, and the stock price could fall. For example, LinkedIn's (NYSE: LNKD) lock-up period ended last November, after its May IPO. Its lowest close occurred Nov. 29, at $59.07 per share. Still, LinkedIn has beaten the return of the S&P 500 by more than 8% since the close of its first trading day, when the company more than doubled over its IPO pricing.

LNKD Total Return Price data by YCharts

Put it on your Watchlist

Splunk could be a solid buy, backed by the trend of data, an easy-to-use product, and great leadership that's heavily invested in the company. For now, I'd wait until the IPO excitement dies down and keep an eye out for when its lock-up period plans to expire around October.

Splunk isn't alone in cashing in on the evident growth trends around health care, energy, and IT. In fact, one health-care stock has its focus on our aging joints and provides a system for knee and hip replacements. Find out which stock, along with our Rule Breakers investing philosophy, by reading our free report: "Discover the Next Rule-Breaking Multibagger."