Shares of MasterCard (NYSE: MA) hit a 52-week high on Thursday. Let's take a look at how it got there and see whether clear skies are still in the forecast.

How it got here

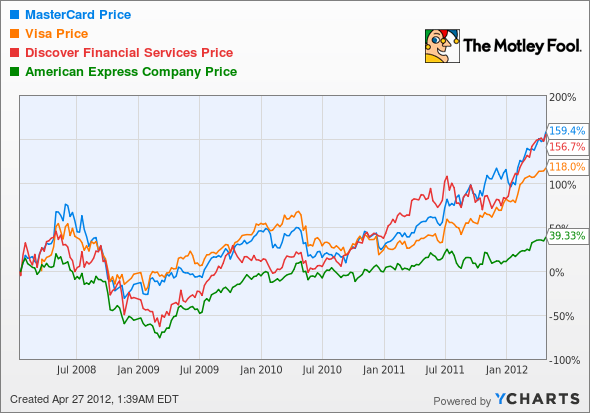

The entire credit services sector, from processors to lenders, has been on fire for years thanks to emerging-market expansion and consumers opting more and more to use plastic as opposed to cash. With 85% of all transactions worldwide still done in cash, the possibilities for credit service stocks seems huge.

Credit card processors MasterCard and Visa (NYSE: V) have benefited from higher international gross dollar volume and strong cash flow, all while being at no risk of lending defaults since they are simply a transaction facilitator. American Express (NYSE: AXP) and Discover Financial Services (NYSE: DFS) which act as both processor and lender, have both easily surpassed Wall Street's expectations in recent quarters. But one aspect all of these companies share is a significant dividend increase within the past year. All four look well on their way to being the dividend juggernauts of the future.

How it stacks up

Let's see how MasterCard stacks up next to its peers.

The trend is your friend, and not even problems in Europe are slowing down credit service stocks at the moment.

|

Company |

Price/Book |

Price/Cash Flow |

Forward P/E |

Dividend Yield |

|---|---|---|---|---|

| MasterCard | 10.0 | 22.1 | 17.9 | 0.3% |

| Visa | 3.7 | 30.1 | 17.8 | 0.7% |

| Discover Financial Services | 2.1 | 5.5 | 8.9 | 1.2% |

| American Express | 3.7 | 6.8 | 12.7 | 1.3% |

Source: Morningstar. Note: yields are projected.

One of the biggest differences you'll see in the table above is the gap between credit processors and credit lenders with regards to cash flow. With no default risk, investors are willing to pay a heftier premium for Visa and MasterCard than Discover and AMEX, which pose potential default risks related to their lending. However, it should be noted that Discover's recent quarter highlighted record-low delinquency rates, so those fears could easily be overinflated.

All in all, this sector may not have the flashiest dividends at the moment, but many of these companies are loaded with cash. MasterCard and Visa are sitting on debt-free balance sheets and nearly $5 billion and $2.7 billion in cash, respectively, and it's likely these companies will begin to dole out more cash to shareholders over the coming years as their cash flows increase further.

What's next

Now for the real question: What's next for MasterCard? That question really depends on whether it can continue to keep pace with Visa in international expansion and grow momentum in stealing debit-card market share from Visa in the near term.

Our very own CAPS community gives the company a four-star rating (out of five), with a whopping 91.5% of members expecting it to outperform. Count me among those who have made a CAPScall of outperform on MasterCard. My scorecard puts me up 14 points since my initial call of outperform.

There's just way too much to like about MasterCard not to be bullish. Aside from its lack of default risk, the international growth opportunities are monstrous for the company. MasterCard is benefiting from increased debit usage, gross dollar volume, and an overall trend toward consumers using more plastic. My take is that if a financial services company can grow in an economically depressed Europe right now, it has to be something special. There's a reason I selected MasterCard CEO Ajay Banga as my top CEO for 2011, and the above strengths illustrate why I feel MasterCard is headed significantly higher.

Craving more input on MasterCard? Start by adding it to your free and personalized Watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.