Homebuilder sentiment soared to a five-year high this month, but the good news didn't stop shares of the world's two largest home-improvement companies from trading lower today. Let's take a closer look at what caused shares of both Home Depot (NYSE: HD) and smaller rival Lowe's (NYSE: LOW) to nosedive.

Shares of Home Depot fell 3% to $48.38 in early trading, after the specialty retailer reported weaker-than-expected quarterly sales. Revenue for the company's first-quarter clocked in at $17.81 billion, marking a 6% gain from the same period a year ago but falling short of the Street's estimates for revenue of $17.89 billion.

But it wasn't all bad news for the leading home-improvement company. Profit jumped more than 27% in the quarter and earnings climbed to $0.68 a share, up from just $0.50 a share in the year-ago period. Wall Street may have been disappointed, but Home Depot expressed confidence in the results by raising its guidance for fiscal 2012 earnings.

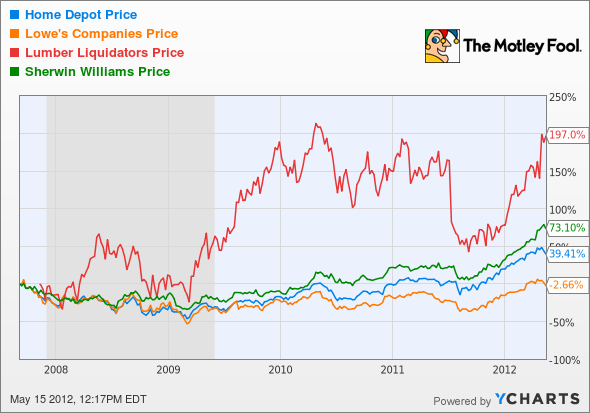

Home Depot's miss caused shares of Lowe's, which doesn't report its earnings until next Monday, to also dip lower -- dropping 3.2% before the market open on Tuesday. Let's see how other competitors in the home renovation space compare in terms of stock performance.

The largest specialty hardwood flooring retailer in the U.S., Lumber Liquidators (NYSE: LL), has enjoyed a nice run lately, with shares up about 60% year to date. We're starting to see upbeat data in the housing market again, which should power the stock going forward. However, the company currently trades at a price-to-earnings ratio of 28 and doesn't pay a dividend, whereas shares of Home Depot pay a solid dividend of 2.33% and trade at a P/E of 20.

Home fix-it chain Lowe's also comes to the party with a P/E around 20 and pays a smaller yield of 1.89%. Meanwhile, shares of Sherwin-Williams (NYSE: SHW) are up more than 35% year to date, with a P/E ratio of 27 and a dividend yield of 1.29%.

The paint stock is a shareholders best friend. In February, Sherwin-Williams boosted its dividend 7% -- marking the 33rd straight year of increases to its annual payout. The company reported first-quarter earnings last month that showed revenue growth of 15% from the prior year. According to Bloomberg, spending on new housing construction and home improvements is at a three-year high -- news that bodes well for all of these stocks going forward.

Game plan

To rehash an old adage: Home Depot is where the heart is -- at least where investors are concerned. I think the DIY retail giant is the best play in the home-improvement space, despite today's decline. With its beta below 1, strong free cash flow generation and a healthy dividend, I like my odds. For these reasons I'm giving shares of Home Depot an outperform rating on my profile in Motley Fool CAPS. I encourage you to use The Motley Fool's free tool called My Watchlist to effortlessly track and monitor your favorite companies. Get started by adding these stocks to your personal Watchlist now.

- Add Sherwin-Williams to My Watchlist.

- Add Lowe's to My Watchlist.

- Add Lumber Liquidators Holdings to My Watchlist.

- Add Home Depot to My Watchlist.