Shares of World Wrestling Entertainment (NYSE: WWE) hit a 52-week low last week. Let's take a look at how the company got there to find out if it's about to get pinned to the mat.

How it got here

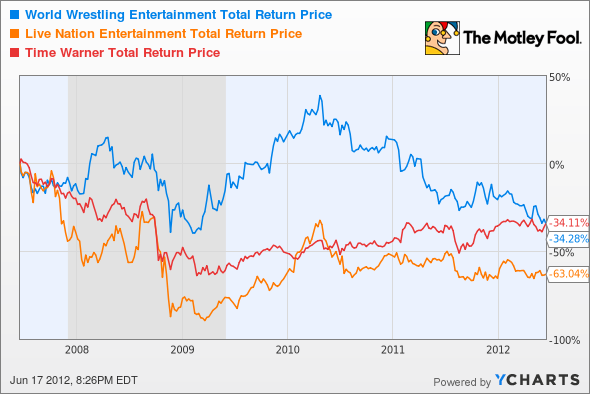

It hasn't been a good time for entertainment stocks over the last few years, and WWE's just one of the specialist stocks that's gotten body-slammed by changing consumer interests. Fellow live-entertainment purveyor Live Nation (NYSE: LYV) is doing worse, and even diversified brands like Time Warner (NYSE: TWX) have fallen on hard times:

WWE Total Return Price data by YCharts.

WWE's bread and butter is its annual Wrestlemania pay-per-view match, but that event alone can't drive its growth. Neither, it seems, can its international events, which took in less revenue in 2011 than they did the year before. It wasn't just WWE facing headwinds with its live shows. Live event promoters of all kinds saw trouble -- Madison Square Garden (NYSE: MSG), despite strong share-price growth over the last two years, was hurt by the basketball strike that cut last season short.

Some companies associated with the WWE brand have been similarly smacked down. THQ (Nasdaq: THQI) is one of the worst-performing stocks of the last five years (at least among those that haven't gone bankrupt), and a glance at past sales of its licensed WWE console titles offers one clue as to why. The series peaked years ago, and despite solid sales for the latest iteration, it hasn't come close to matching the high points in sales reached during the middle of the last decade.

What you need to know

WWE's well-known for paying out as much as it can in dividends, but is that strategy sustainable? Let's take a look.

|

Company |

P/E Ratio |

3-Year Annualized Earnings Growth |

TTM Free Cash Flow Payout Ratio |

|---|---|---|---|

| WWE | 17.7 | (13.8%) | 120% |

| Live Nation | NM | NM | NM |

| Time Warner | 13.4 | 4.5% | 43.7% |

| Madison Square Garden | 32.4 | 44.8% | N/A |

Source: Morningstar. NM = not material due to negative earnings. N/A = not applicable; MSG doesn't pay a dividend.

What's WWE's problem? Let's start with one obvious issue: lousy cash flow management! Over the last five years, Vince McMahon's steered his company in some interesting directions, but none have had much impact on WWE's top line. Its bottom line's done worse, and free cash flow's been unable to recover for long.

The company's free cash flow has telegraphed its stock direction rather accurately, as you can see:

WWE Revenues TTM data by YCharts.

Despite continued cash flow weakness, WWE continues to pay out more in dividends than it can support. My fellow Fool Brian Stoffel pointed out that WWE's payouts were unsustainable nearly a year ago, and there's little sign that this has changed. Since McMahon and top lieutenants collectively own well over half the company, their actions may signal that they don't believe WWE can grow enough in the future to justify plowing more earnings back into its development. Sucking so much cash out of the company signals to me that leadership doesn't believe that funding growth will work. That's a big red flag.

If not for that high payout ratio (to say nothing of shrinking earnings), WWE would look like an appealing buy, especially compared to cash-bleeding Live Nation or highly valued but dividend-free Madison Square Garden. Despite its yield hovering near five-year lows, WWE doesn't look like it's got a lot of growth ahead. The company's TV ratings have been stuck in a rut for years, which is never a good sign for a company that relies on its weekly programs to keep fans interested.

What's next?

Where does WWE go from here? That will depend on its ability to recapture fans turned off by weak plotting, poor execution, economic weakness, or some other combination of factors that have kept them away. Serious investors should demand better expense management as well. WWE's double-digit operating margin fell last year to lows not seen since 2003.

The Motley Fool's CAPS community has given WWE a two-star rating, with 20% expecting the stock to continue its 52-week trek lower. At this level, I'd be wary of shorting it, but I wouldn't want to add the stock to my portfolio, either. There are safer dividends out there if you know where to look.

Interested in tracking this stock as it continues on its path? Add WWE to your Watchlist now for all the news we Fools can find, delivered to your inbox as it happens. If you crave that stable payout, you need to take a look at The Motley Fool's guide to "the three Dow stocks dividend investors need." Find out more about these three companies for free -- click here for more information.