Almost 18 months ago, I told investors that they should stay away from for-profit education. Enrollment was dropping at the schools, they got too much money from the government, and students were defaulting on their loans at alarming rates.

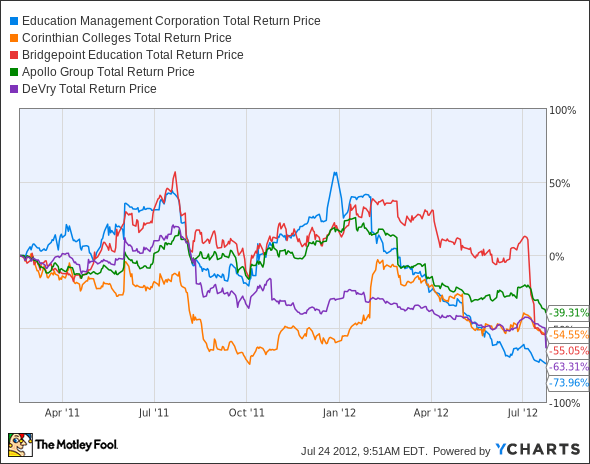

And none of this actually included the question: Is a degree from an online, for-profit school worth it anyway? Judging by the numbers, you would've been well served by taking my advice. Here's how five of the industry's biggest players have fared since I wrote that article. Keep in mind that over this time frame, the S&P 500 has returned 3.5% -- including dividends -- since then.

EDMC Total Return Price data by YCharts

As you can see, Apollo (Nasdaq: APOL) -- parent company of the University of Phoenix -- is the only company that hasn't been halved in this time frame. And Corinthian Colleges (Nasdaq: COCO), which I identified as the worst for-profit school on the market, didn't actually perform the worst. That being said, I don't think you'll find either company bragging about those accolades.

There are three heavy forces that have combined to push shares of all of these companies down, and I don't see them abating any time soon.

Improving employment

Perhaps it makes sense to some, but don't count me among them: When the economy goes south, enrollment in higher education programs skyrockets. Though it has been a painfully slow recovery thus far, our unemployment rate has been steadily improving for over two years now. As you can see, the movement of a stock like Apollo has a strong correlation to the unemployment rate.

US Unemployment Rate data by YCharts

Even a slight uptick in unemployment would send shares up, while a steady improvement in employment could mean students leaving the virtual classroom in search of a job. With the unemployment picture improving ever so slightly, this means fewer students interested in getting their degrees.

Government regulations

Though I'd like to believe the government has actually gone pretty soft on the sector, the Obama administration has started to clamp down on for-profit institutions.

It all started over two years ago, when undercover federal employees filmed recruiters aggressively recruiting students with questionable tactics. Since then, there have been congressional hearings on the matter. There are now rules in place to control how much money a school can get from the government, what the default rate can be for a school's students, and how to measure whether or not schooling leads to gainful employment. Overall, I have no doubt that the industry would be rooting for a Romney win this November, as Republicans seem to have a more hands-off approach to the industry.

Where's the quality?

But possibly the biggest problem with for-profit schools is that many of them simply aren't up to snuff. As potential students get more and more educated about the costs and (lack of) benefits from a degree at some for-profit schools, numbers have sagged.

Shares of DeVry (NYSE: DV) are down close to 30% this morning on news that the company's profit is falling, it is laying off 570 employees, and enrollment is expected to be down 15% to 17% in the coming year.

Rival Education Management (Nasdaq: EDMC) fell over 20% in February -- and has continued falling since -- when it released earnings. The company announced a 9% drop in overall courses, and an 18.5% drop in fully online courses.

Rounding out the bad-news companies is Bridgepoint Education (NYSE: BPI). The company was actually one of the few to maintain healthy levels of student enrollment over the last few years. But just this month, it was hit with a double whammy of two accreditation services calling into question whether the school's degrees were worthy of acknowledgement at other institutes of higher learning.

Obviously, I think there are better places to put your money. To get you started, check out our new special free report: The 3 Dow Stocks Dividend Investors Need. Inside, you'll get the names and tickers of three companies that are poised to wallop the market over the next five years. Get your copy of the report today, absolutely free!