At the halfway point of the trading day, the Dow Jones Industrial Average (INDEX: ^DJI) was basically unchanged, up just three points (0.02%) to 13,127. That's down just 211 points from the one-year high of 13,338, which was set last Tuesday.

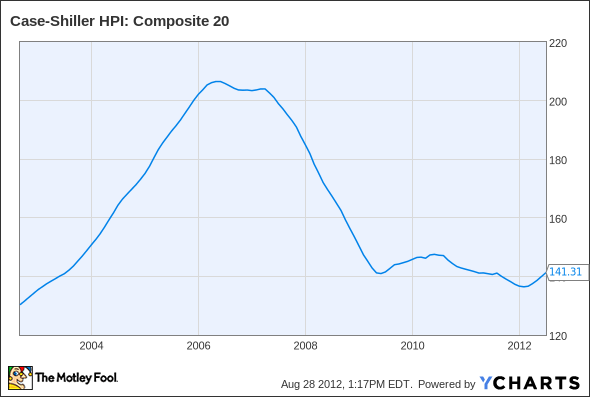

There were two economic data releases today that garnered mixed reactions from stocks. The first was the Case-Shiller 20-city composite home price index, which rose 2.3% in June. The Case-Shiller index is now up 0.5% year over year, the first year-over-year increase in two years. The index sits near the 2003 level.

Case-Shiller Home Price Index: Composite 20 data by YCharts.

The second economic data release was the Conference Board's consumer confidence index, which came in way below analyst expectations. In August, consumer confidence hit a nine-month low, with future expectations down while present conditions remained unchanged. Consumers have had a rough go of it, and with uncertainty over the looming election, consumer confidence is likely to remain low.

The market is also anticipating Federal Reserve Chairman Ben Bernanke's Friday speech in Jackson Hole, Wyo. Investors hope his remarks will give insight into any possible moves from the Fed. However, some investors think Bernanke probably won't announce anything until the German constitutional court decides if the EU bailout fund is legal.

In any event, stocks today are up very slightly.

Today's top three

- Today's Dow leader is Home Depot (NYSE: HD) up 0.79% (or $0.44) to $56.83. The company is up on the positive home-price index data. Home Depot reported strong earnings two weeks ago and hit a 52-week high last Friday of $57.18. Home Depot has been benefiting from strength in homebuilders.

- Kraft (NYSE: KFT) comes in behind Home Depot, up 0.53% (or $0.22) to $41.95. Kraft announced last week it is selling a stake in its Back to Nature brand to private equity firm Brynwood partners, which has a history of buying small brands from large consumer goods companies. Kraft's stake will be included in the company's spinoff later this year of its snack brands, which will be called Mondelez International. Investors have debated which company will be better for investors post-spin, as well as what's up with the company's strange name.

- Alcoa (NYSE: AA) is third for the day behind Kraft, up 0.49% (or $0.04) to $8.52. Yesterday RUSAL, the world's largest aluminum producer, announced it would cut its own capacity by 3% by the end of the year. This is part of a plan announced in May to cut its capacity by 6% over the next 18 months. This is good news for aluminum prices, which have fallen 30% since April 2011. Alcoa shares have been in a slump thanks to the weak aluminum market. If China's economy continues to slow, things could get worse for Alcoa. With all the negatives surrounding Alcoa, Fool analyst Sean Williams still believes the aluminum giant will outperform the market. Click here to read his analysis.

The best approach

Watching the broad market each day is exciting, but investing doesn't have to be gut-wrenching and stressful. If you're in the mood to pick up some solid buys for the long term, The Motley Fool has created a brand-new free report that focuses on three Dow stocks with both promising growth prospects and strong dividends. It can be yours, absolutely free -- just click here.