Investors have to ask one question before they add a stock to their portfolio: "Is this a good buy right now?" Today we’ll take a closer look at one company that’s got many would-be investors wondering just that. Is Atmel (Nasdaq: ATML) a good buy? There’s a ton of information we can dig into for an answer, so let’s see what we can discover.

Tracking the trends

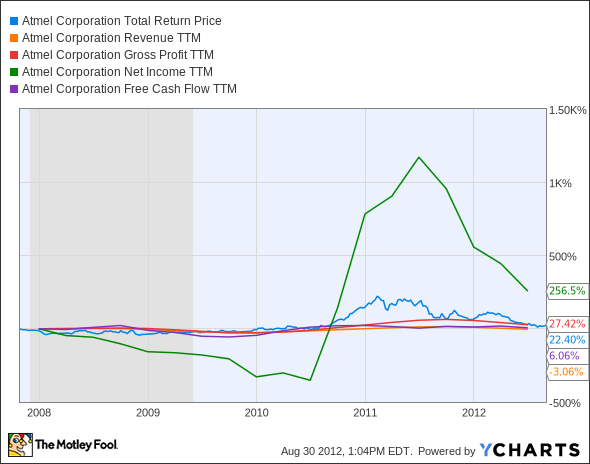

One way to find out how the market views Atmel is to look at its stock performance as compared to its key metrics, like revenue, net income, and free cash flow. Is Atmel’s price responding to its earnings, or is there a discrepancy that we might be able to take advantage of?

ATML Total Return Price data by YCharts

Atmel had a huge run in 2010, buoyed by the growth of touchscreens in every post-iPhone smartphone. But Atmel’s lack of key placement in Apple (Nasdaq: AAPL) devices let the air out of its bubble, and the stock’s been sliding since. One possible cause for optimism is a new Kindle Fire from Amazon.com (Nasdaq: AMZN), which is rumored to use Atmel’s controllers. Amazon reported that its Fire inventories have sold out this week, which is sure to churn up excitement over a successor tablet.

Atmel’s huge pop, and subsequent drop, has brought its stock price in line with anemic growth rates during the last few years. After the excitement of bottom-line gains wore off, and net income started to trend downward, stockholders were forced to face the reality that Atmel hasn’t been much of a winner in the smartphone wars:

|

Metric |

Current Result |

5-Year Annualized Change* |

|---|---|---|

| Stock Total Return | 17.2% | 3.4% |

| TTM Revenue | $1.59 billion | (0.6%) |

| TTM Net Income | $171 million | 28.9% |

| TTM Free Cash Flow | $123 million | (0.3%) |

| Total Debt | N/A | N/A |

Source: Morningstar and YCharts. TTM = trailing 12 months.

* Annualized from 2007 annual results to TTM results, except stock price.

Net income’s the only number that’s seen real growth, but part of that can be attributed to recession weakness in earlier numbers. Prior to the huge bump in net income that came from post-crash tax write-offs, Atmel’s net income had been in slow decline for years. Its free cash flow levels have barely changed since 2004!

ATML Total Return Price data by YCharts

Now that we’ve thoroughly dissected Atmel’s historical mediocrity, let’s take a look at the future.

Looking ahead

Wall Street has plenty of opinions to offer on Atmel, but it’s also worth looking at The Motley Fool’s CAPS rating, and Atmel’s own anticipated guidance.

|

Forward Period |

Expected Result |

|---|---|

| Upcoming Quarter Earnings Growth | 0.0% |

| Full Year (2012) Earnings Growth | (73.5%) |

| Next Year (2013) Earnings Growth | 111.1% |

| Full-Year (2012) Sales Growth | (23.0%) |

| Five-Year Annualized Forward Growth | 20.0% |

| Latest Corporate Guidance (Q3 2012) | $357 million to $379 million revenue |

| Motley Fool CAPS Rating and % Outperform | **** ( 91.7% ) |

Source: Yahoo! Finance, company conference call, and Motley Fool CAPS.

Analysts were expecting a pretty steep drop in earnings this year, and they’ve been proven right, so far -- but look at that forward growth! If 2013’s results come anywhere near those optimistic projections, Atmel’s stock could be in line for a major recovery. The company’s P/E hasn’t always been positive, but it’s currently dawdling near five-year lows -- and its 15.4 price-to-free-cash-flow ratio is also similarly cheap on a historical basis.

To justify an investment, Atmel’s got to find strength in areas dominated by Apple. Not only do its tablet partners face an uphill battle against iPads, they’ve also got fierce competition in the fragmented Google (Nasdaq: GOOG) Android arena. Placement in Samsung and Motorola tablets is valuable, especially now that Moto’s been subsumed into the Google empire. However, nothing’s come close to dethroning Apple, though Amazon’s taken the lead in the anti-iPad brigade. The upcoming Microsoft (Nasdaq: MSFT) Surface tablet remains a question mark in many ways. It could be boon or bane to Atmel, depending on whether or not it claims significant market share, and whether or not Microsoft uses Atmel’s touchscreen controllers.

Buying Atmel today would be to buy into the hope that the Google-Samsung-Amazon trio can unseat Apple in tablets, since there’s little else to latch onto in terms of future initiatives. As the largest non-Apple player, Amazon’s success in tablets could determine Atmel’s success in the market. One way to stay ahead of the game is with the Fool’s new premium research service that's dedicated to Amazon. Your subscription gains access to a full year of regular Amazon updates, so what are you waiting for? Start digging deeper with our research analysts today.