Shares of Monsanto (NYSE: MON) hit a 52-week high last week. Let's look at what's driving these gains to understand what lies over the horizon. Are there clear skies ahead? We'll have a better forecast once we examine the details.

How it got here

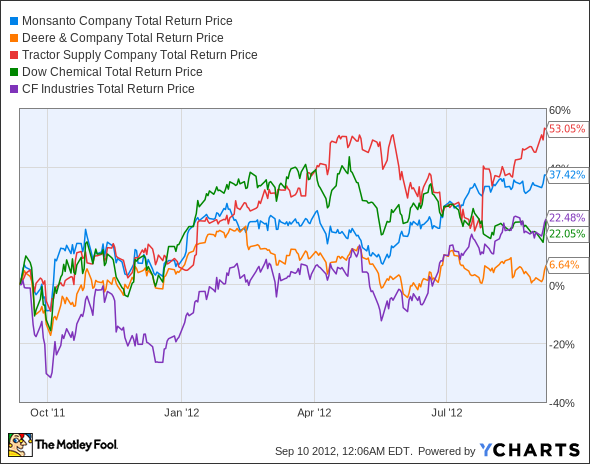

Monsanto's one of many agriculturally focused stocks pushing their way through new highs this year. Whether they're fertilizers such as diversified segment leader CF Industries (NYSE: CF), agricultural-equipment makers like Deere (NYSE: DE), farm suppliers such as Tractor Supply Company (Nasdaq: TSCO), or Monsanto's seeds-and-weeds competitor Dow Chemical (NYSE: DOW), it has paid to go down on the farm for your stocks over the past year:

MON Total Return Price data by YCharts.

Of this group, only Deere is a relative underperformer. An underwhelming third quarter seems to be the most recent culprit, but Fool contributor David Lee Smith feels that investors may be underestimating its resilience. Monsanto has already ridden three strong earnings reports to new highs this year, and the drumbeat of drought profiteering has echoed its name all summer. Here are a few examples of the Fool's faith in Monsanto's value in these dry times:

- Andrew Marder's "The Coming Corn Crisis"

- Jacob Roche's "How to Survive a Drought"

- Dan Carroll's "The Global Drought's Big Winners"

Monsanto should do well in a world craving more food from fewer resources. Does that mean its price accurately reflects its potential? Let's dig deeper to find out.

What you need to know

You'll notice some fairly big discrepancies across these various stocks' key metrics, but those differences will be helpful in figuring out whether or not the stocks deserve their multiples:

|

Company |

P/E Ratio |

Price to Levered Free Cash Flow |

Net Margin (TTM) |

Projected Growth Rate (2013) |

|---|---|---|---|---|

| Monsanto | 22.3 | 24.8 | 15.8% | 17% |

| CF Industries | 9.1 | 7.9 | 25.2% | (9.3%) |

| Deere | 10.4 | NM | 8.7% | 6.8% |

| Tractor Supply | 28.4 | 55.6 | 5.7% | 16.7% |

| Dow Chemical | 19.2 | 12.4 | 3.8% | 37.4% |

Source: Yahoo! Finance. TTM = trailing 12 months. NM = not material due to negative results.

The only company with higher multiples than Monsanto is Tractor Supply, but it recently turned around a midyear slide with better-than-expected earnings, and its stock has boomed ever since. With a lower expected forward growth rate and a smaller net margin than Monsanto, Tractor Supply may be just a bit overvalued. CF remains cheap after solid 52-week gains, but poor expectations (and weak dividend payouts relative to other fertilizer companies) are holding its valuations down. Dow might be a better value than Monsanto, but its smaller net margin is less appealing than Monsanto's double-digit profitability.

While Monsanto's P/E may seem high, it's actually near five-year lows:

MON P/E Ratio data by YCharts.

Dow's unprofitable recessionary period would have skewed this graph somewhat, which is why it's not included -- but its P/E has trended higher for nearly a year. Monsanto's P/E has trended lower for the past decade, so I wouldn't expect substantial stock-price gains from here on out unless they're matched by substantial earnings growth. Based on the company's history, that's not an unreasonable expectation:

MON P/E Ratio data by YCharts.

What's next?

Where does Monsanto go from here? The company's strong today, and its commitment to innovation -- including an 11% research and development ratio -- should help it stay on top of crop-busting climate shifts. That's not only good for Monsanto; it's good for the world. Crops that use less water would be really revolutionary.

The Motley Fool's CAPS community has given Monsanto a four-star rating, with only 24 of 578 CAPS All-Stars betting against the company's continued outperformance.

Interested in tracking this stock as it continues on its path? Add Monsanto to your Watchlist now for all the news we Fools can find, delivered to your inbox as it happens. Monsanto was one of the market's best-kept secrets until unwelcome publicity hit over the past few years. It's too bad we can't go back to the early days of Monsanto's growth -- or can we? The Fool's always looking for the next big thing, and we've found three hidden middle-class millionaire-making stocks flying under Wall Street's radar. Like Monsanto, you probably use their products all the time without knowing it. Want to find out more? Click here for your 100% free report on the three stocks Wall Street's too rich to notice.