Shares of NetSuite

How it got here

There are a number of cloud-software companies looking for their piece of the Web, but NetSuite's been among the absolute best stocks in the sector over the past year:

N Total Return Price data by YCharts

Only SAP

SAP has been nudging higher ever since acquiring SuccessFactors to effectively buy its way into cloud computing. It joins Oracle

Now that we have a little background, let's dig into some key numbers for these companies to figure out if NetSuite's growth is warranted, or if it's flying too high.

What you need to know

NetSuite isn't currently profitable, but we can compare it on a price-to-free-cash-flow basis. In this regard, it's still costlier than its peers -- but it does sport a superior forward growth rate to back up that premium valuation:

|

Company |

P/E Ratio |

Price to Levered Free Cash Flow |

Net Margin (TTM) |

Projected Growth Rate (2013) |

|---|---|---|---|---|

| NetSuite | NM | 45.8 | (12%) | 59.1% |

| SAP | 18.3 | 17.7 | 23.4% | 14.3% |

| Oracle | 16.5 | 13.6 | 26.9% | 9.8% |

| Salesforce | NM | 30.5 | (1.4%) | 32.7% |

Source: Yahoo! Finance. TTM = trailing 12 months. NM = not material due to negative results.

In the last few years, all but SAP have improved their free cash flow levels, but none have done so well as NetSuite:

N Free Cash Flow TTM data by YCharts

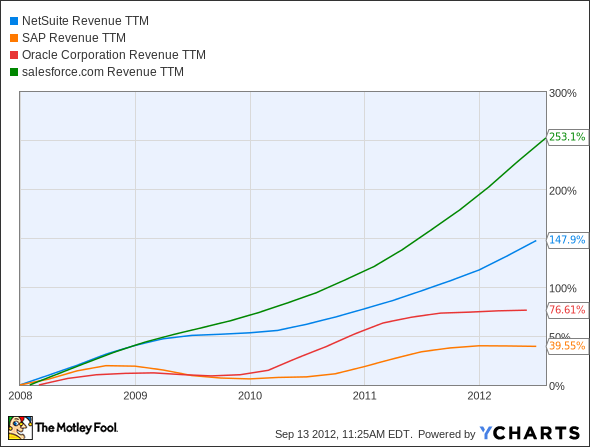

Keep in mind that NetSuite is the smallest of the bunch by a long shot, and has a longer growth runway than its more established peers. However, it does have the least evidence of profitability of any these companies, and its gross margins have consistently been a fair bit lower than either Oracle's or Salesforce's. Improving margins will be one of the keys to NetSuite's long-term success, as its revenue growth rate has been solid, but not as impressive as Salesforce's:

N Revenue TTM data by YCharts

What's next?

Where does NetSuite go from here? Analysts expect a big improvement in the company's bottom line next year, but that's in terms of adjusted earnings. It would be nice to see some good old GAAP profit to go along with that free cash flow growth, but for the time being, the market seems to trust NetSuite's ability to grow through the next year without tapping its cash reserves.

If you're looking for other ways to play the cloud, you can't go wrong with big data. One company's right in the thick of the data boom created by billions of connected devices, and it might have even more growth in store than NetSuite's enjoyed lately. Find out more about this hidden opportunity in the Fool's free report on the data analytics revolution -- click here for the information you need.