Shares of Panera Bread (Nasdaq: PNRA) hit a 52-week high this past week. Let's look at what's driving these gains to understand what lies over the horizon. Are there clear skies ahead? We'll have a better forecast once we examine the details.

How it got here

It hasn't been a great summer for growth-stage restaurant stocks. Shares of Fool favorite Chipotle Mexican Grill (NYSE: CMG) got thrashed after its same-store sales came in at "really good" levels, rather than the "absolutely fantastic" growth rates investors have been accustomed to. Buffalo Wild Wings (Nasdaq: BWLD) became too hot to handle after second-quarter results missed estimates -- though its shares have since regained much of those losses. And how is Panera doing? Very well, thank you:

PNRA Total Return Price data by YCharts

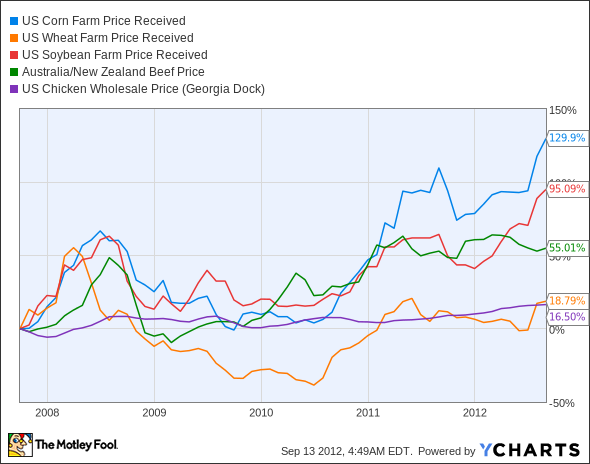

Panera's second-quarter earnings were a rare bright spot in a gloomy sector. Booming commodities prices have been particularly bad for restaurateurs, as nearly every major food input has risen to multiyear highs this summer:

US Corn Farm Price Received data by YCharts

Panera's bakery focus has enabled it to take greater advantage of wheat prices that have remained largely stable for years. A focus on natural ingredients also helps it avoid overexposure to booming corn prices, as that commodity features heavily in the processed fare served by McDonald's (NYSE: MCD) and Mickey D's megafranchisee Arcos Dorados (Nasdaq: ARCO). However, Arcos and Chipotle still boast higher same-store-sales growth than Panera, owing in part to smaller footprints. Does that make Panera a worse investment choice at its current highs? Let's dig into some key statistics to find an answer.

What you need to know

Panera isn't cheap by any means, but neither is its valuation particularly outlandish when compared with its peers:

|

Company |

P/E Ratio |

Price to Levered Free Cash Flow |

Net Margin (TTM) |

Projected Growth Rate (2013) |

|---|---|---|---|---|

| Panera Bread | 32.2 | 28.5 | 7.7% | 18.7% |

| Chipotle | 41.1 | 48.3 | 10.4% | 21% |

| Buffalo Wild Wings | 28.7 | 552.8 | 6% | 17.6% |

| McDonald's | 17.1 | 25.9 | 20% | 10% |

| Arcos Dorados | 27.9 | NM | 2.7% | 32.2% |

Sources: Yahoo! Finance and Morningstar.

NM = not material because of lack of results.

It's important to be aware of not only current valuation ratios, but also how those ratios stack up to historical norms. In that regard, Panera shareholders may have reason to be a little nervous:

PNRA P/E Ratio data by YCharts

Now that Chipotle's shares have fallen, Panera sports the largest cumulative P/E increase of its peers over the past few years. Arcos, which has less financial data, has seen its P/E drop consistently since attaining profitability, so it's an odd restaurant stock out in this batch. Panera's shares are trading at the high end of their valuation range, which leaves them very susceptible to a potential Chipotle-style pullback if the market detects even a whiff of weakness.

Panera's annualized growth rates have been strong for years, but not as strong as Chipotle's. Will the market continue to push Panera's P/E toward Chipotle's without truly Chipotle-like growth to back it up?

What's next?

Panera isn't yet at the stratospheric valuations that undid Chipotle this summer, but it's worth keeping an eye on the company's bottom-line growth relative to its stock price gains. Panera's fundamentals are very strong, so the greatest risk seems likely to come from irrational investor exuberance. The Motley Fool's CAPS community has given Panera Bread a four-star rating, with 90% of our CAPS players expecting the company to beat the Street going forward. The CAPS community clearly believes that Panera deserves its premium valuation.

Interested in tracking this stock in the months and years ahead? Add Panera to your Watchlist now, for all the news we Fools can find, delivered to your inbox as it happens. If you're looking for other top brands earning consumer loyalty and excellent returns, look no further than the Fool's free report on "3 Companies Ready to Rule Retail." It's available for a limited time, so find out more at no cost.