Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's look at what StoneMor Partners' (STON +0.00%) recent results tell us about its potential for future gains.

What the numbers tell you

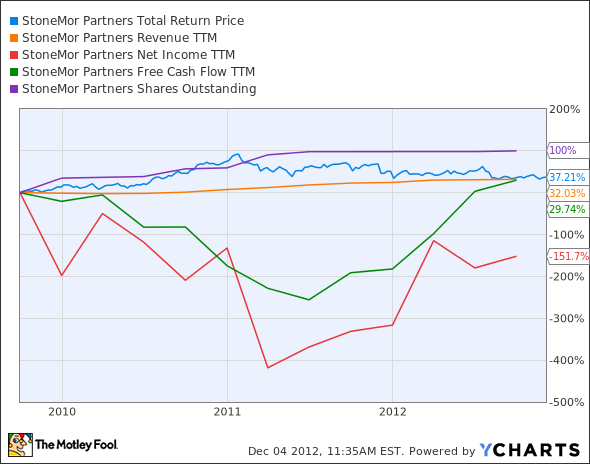

The graphs you're about to see tell StoneMor's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much StoneMor's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If StoneMor's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

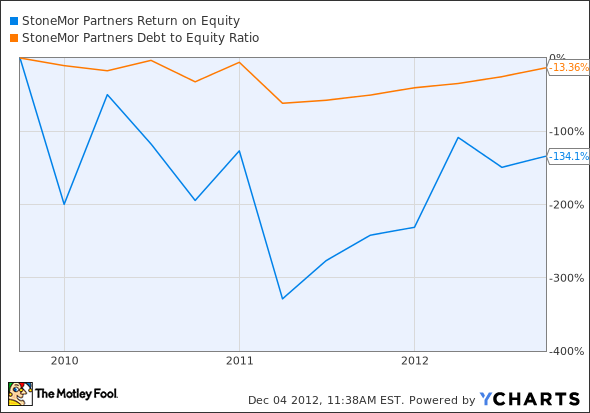

Is StoneMor managing its resources well? A company's return on equity should be improving, and its debt-to-equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that StoneMor's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at StoneMor's key statistics:

STON Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

32% |

Pass |

|

Improving profit margin |

(64.3%) |

Fail |

|

Free cash flow growth > Net income growth |

29.7% vs. (151.7%) |

Pass |

|

Improving EPS |

(123.7%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

37.2% vs. (123.7%) |

Fail |

Source: YCharts.

* Period begins at end of Q3 2009.

STON Return on Equity data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(134.1%) |

Fail |

|

Declining debt to equity |

(13.4%) |

Pass |

|

Dividend growth > 25% |

5.4% |

Fail |

|

Free cash flow payout ratio < 50% |

391.7% |

Fail |

Sources: YCharts, Dividata, and Morningstar.

*Period begins at end of Q3 2009.

How we got here and where we're going

Despite being in one of the most stable businesses around, StoneMor earns only three of a possible nine passing grades. As a master limited partnership, or MLP, the company's dividend payouts will always be high, but for several years now, payouts have far exceeded free cash flow. StoneMor appears to be financing some of that yield through debt issuance -- although its total debt is lower now than it was in 2010. Can StoneMor reverse its declining profitability numbers without sacrificing long-term growth?

One thing in its favor, of course, is the eternal need for cemetery services. Although life expectancy has risen over the years (as it should), the past 50 years have "only" tacked on eight years of life expectancy to the average American's time on Earth. An estimated 41 million Americans were over 65 in the last Census estimate, and the baby boomer retirement wave will add many millions more in years to come. StoneMor won't have any problem finding use for its services. I know that sounds horribly morbid, but that's the cemetery business for you.

StoneMor is also more resistant to stock market swings than many other large companies. MLPs such as StoneMor, Enterprise Products Partners (EPD +0.86%) and Terra Nitrogen (NYSE: TNH) have a lower correlation to the moves of major indexes. Both companies, however, are also paying out more in dividends than they retain in free cash flow, but at least Terra has been very close to the optimal MLP payout level and has not needed to issue any debt.

Alternatives to StoneMor's double-digit yield come with risks of their own. Beleaguered France Telecom (FTE +0.86%) has a higher yield, but it's likewise paying out more in dividends than it retains in free cash flow at the moment. France Telecom does have an easier business model to understand than StoneMor's, which has been the subject of bearish attacks. A Seeking Alpha post that questioned the company's cash-flow management earlier this year tanked StoneMor's shares, and the stock has yet to recover.

StoneMor may be stable, but investors must also ask themselves if the added complexity of MLP taxation, on top of a business structure that can be confusing to non-professionals, justifies the extra yield.

Putting the pieces together

Today, StoneMor has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.