Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Heckmann's (HEK +0.00%) recent results tell us about its potential for future gains.

What the numbers tell you

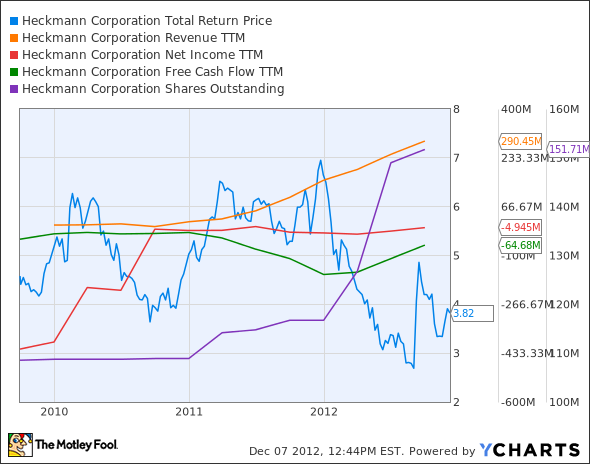

The graphs you're about to see tell Heckmann's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much Heckmann's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Heckmann's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

Is Heckmann managing its resources well? A company's return on equity should be improving, and its debt to equity ratio declining, if it's to earn our approval.

By the numbers

Now, let's take a look at Heckmann's key statistics:

HEK Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

7,500% |

Pass |

|

Improving profit margin |

N/A |

N/A |

|

Free cash flow growth > Net income growth |

(45.9%) vs. 98.8% |

Fail |

|

Improving EPS |

99.2% |

Pass |

|

Stock growth + 15% < EPS growth |

(11.6%) vs. 99.2% |

Pass |

Source: YCharts. 2009 profit margin not available. * Period begins at end of Q3 2009.

HEK Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

98.7% |

Pass |

|

Declining debt to equity |

23,580% |

Fail |

Source: YCharts. * Period begins at end of Q3 2009.

How we got here and where we're going

Although Heckmann remains unprofitable, the company has been moving in the right direction by bringing EPS much closer to breakeven point. Four of seven (really six) possible passing grades isn't bad, but it's nothing to get excited about as long as Heckmann stays in the red. What will it take to pull Heckmann into the black, and to improve the company's other metrics for a stronger score?

One major development that hasn't yet been reflected in the financials is Heckmann's recent merger with Power Fuels, which brings it much needed diversity in unconventional oil plays. As a player in nat-gas fracking water provisions, Heckmann's fortunes have been heavily tied to the industry's demand for more drilling. That demand has withered since its peak several years ago -- even nat-gas leader Chesapeake Energy (CHK +0.00%) has been trying to divest itself of some unwanted acreage, just to get back to a stronger financial state. If Heckmann has to take on additional debt, as it did earlier this fall, doing so to diversify into higher-demand shale oil services is one of the few smart reasons.

The market's reaction to Heckmann's merger should speak volumes about the popular perception of nat-gas focused stocks. There was some hope earlier this year that the price of natural gas, as expressed by the United States Natural Gas Fund (UNG 1.63%), would finally be on the rebound. Unfortunately, price growth seems to have stalled for months after a shallow bounce in the spring.

Heckmann's well-positioned to transition toward a more oil-intensive future, thanks to an agreement already in place with Halliburton (HAL +2.94%) to provide environmental services. Halliburton's already a major provider of unconventional drilling services for both oil and gas exploration, so transitioning from one segment to the other will be made easier with the right connections -- something Heckmann's been building for years. Perhaps by the next time we put the company through its paces in this series, it'll have picked up another passing grade or two.

Putting the pieces together

Today, Heckmann has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.