Mosaic (MOS 1.93%) reported positive earnings results on Friday, beating expectations despite a 16% decline in sales which came in at $2.54 billion, below the expected $2.51 billion. The results were sufficient to help extend a general rally in fertilizer stocks that began with the announcement earlier in the week that Mosaic, PotashCorp (POT +0.00%), and Agrium (NYSE: AGU) had entered an arrangement to provide China's Sinofert Holdings with potash fertilizer. The combination of the two pieces of positive news, coupled with favorable comments from Mosaic's CEO James T. Prokopanko suggest that fertilizer is well-positioned heading into 2013 and deserves a spot in your portfolio.

The earnings results

For the most recent quarter, net income rose from $1.47 per share from $1.40 per share on a year-over-year basis; this translated to $1.02 per share excluding a tax benefit and foreign exchange adjustment. Consensus estimates had been for $0.88 per share according to 11 analysts surveyed by Bloomberg. These results were achieved despite a fall in potash sales from 1.8 million tons to 1.5 million tons; the decline was attributed to delayed purchases out of both China and India. This delay caused other buyers to slow purchases in order to potentially capitalize on price negotiations in those two countries.

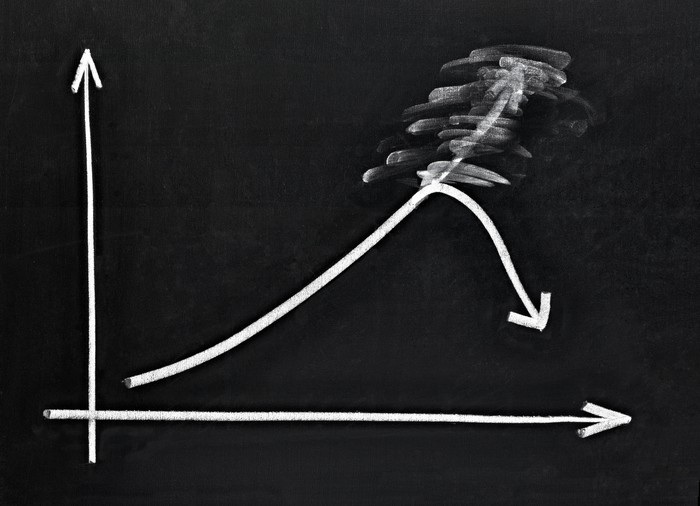

In the company's earnings call, Prokopanko said that "agricultural fundamentals are exceptionally strong around the globe, and that bodes well for Mosaic over the long term. Despite the severe drought in the U.S. and weather problems in other parts of the world, this year's global harvest was the second-largest ever." Looking forward, the industry as a whole seems to be at the beginning of what could prove to be a sustained uptrend.

China rising

On Dec. 31, Mosaic, PotashCorp, and Agrium announced a deal to sell potash to China at a deeply discounted price of about $400 a ton. The last contract the Hong Kong-based Sinofert negotiated was for $470 per ton, making the discount attractive. This compares with the average selling price achieved by Mosaic in the most recent quarter of $445 per ton. While the discount is not without significance, it has the potential to unclog the potash glut that has built up over the past several quarters. More deals out of China, as well as several from India, are expected by this summer, each of which is expected to help prop up prices.

The Internal Fertilizer Industry Association (IFA) expects that global trade in potash will expand by 15%-20% between 2011 and 2016. Prokopanko also noted: "Food supply is precarious, and farmers are well aware of this fact. So it should come as no surprise that futures markets are signaling farmers to expand planted area and increase fertilizer applications to boost yield in 2013." This is part of a growing trend that should drive growth in the fertilizer space for years to come.

A recent report from the United Nations projects that the global population will grow by 47% from 2000 to 2050, which will result in close to 9 billion people on the planet. The bulk of high-quality land is already in use, meaning that yields must grow and low-quality land must be improved if the world is going to be able to feed itself in the future. The implication of this reality is that the fertilizer industry will not only experience significant growth, it will grow at a sustained and highly attractive rate from an investment perspective. Regardless of the stock you may put in these projections, significant population growth is inevitable. There are not many industries that have a realistic expectation of significant growth for decades to come.

The industry

Based on the announced deal, Mosaic advanced 4.2% between Dec. 31 and Jan. 2; PotashCorp was up 3.9%, and Agrium was up 5.2%. When you add the solid earnings results to the mix, Mosaic is up 6.2%, Potash is up 4.5%, and Agrium is up 6%. During the same period, CF Industries (CF 0.85%) was up 5.6% and Monsanto (MON +0.00%) was up 3.3%. Monsanto is set to release earning of January 8 and CF is scheduled for February 11.

The Monsanto report is expected to shed some light on how biotech seed is doing on a global level. While these are complementary products, rather than competitive ones, this upcoming report should give an even deeper picture of the global agriculture business. The recent news from the fertilizer industry has been favorable and shows solid positioning heading into the new year.

Mosaic's beat should act as an initial catalyst for the industry and is a solid reason to add fertilizer names to your portfolio. Upcoming earnings releases by Mosaic's competitors, and the announcement of additional deals out of China and India, should all serve as further price supports for the companies and catalysts for their stocks. Mosaic is well-positioned and is a buy at current levels.