Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Ebix's (EBIX +0.00%) recent results tell us about its potential for future gains.

What the numbers tell you

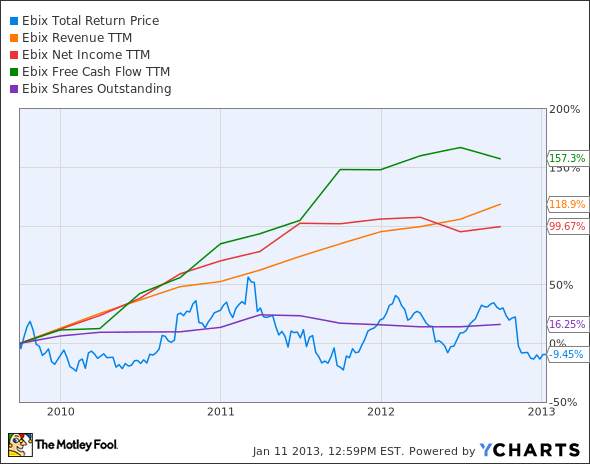

The graphs you're about to see tell Ebix's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much Ebix's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Ebix's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

Is Ebix managing its resources well? A company's return on equity should be improving and its debt-to-equity ratio declining if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Ebix's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Ebix's key statistics:

EBIX Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

118.9% |

Pass |

|

Improving profit margin |

(17.1%) |

Fail |

|

Free cash flow growth > Net income growth |

157.3% vs. 99.7% |

Pass |

|

Improving EPS |

89% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

(9.5%) vs. 89% |

Pass |

Source: YCharts. * Period begins at end of Q3 2009.

EBIX Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(47.1%) |

Fail |

|

Declining debt to equity |

(55.5%) |

Pass |

|

Dividend growth > 25% |

Begun in 2011 |

Pass |

|

Free cash flow payout ratio < 50% |

9.3% |

Pass |

Source: YCharts. * Period begins at end of Q3 2009.

How we got here and where we're going

Ebix turns in a strong performance with seven out of nine possible passing grades. However, a declining profit margin and a withering return on equity ratio may be cause for concern. Will Ebix be able to turn this weakness into a strength in 2013?

That will depend heavily on how well Ebix manages the several new subsidiaries it acquired last year. Large acquisitions are often problematic, and it remains to be seen if Ebix can bolt these companies onto its existing business model or otherwise use them to expand its range. However, as long as those acquisitions don't turn out to be total disasters, Ebix can still continue to make progress just by doing what it's been doing, which has resulted in some of the best growth rates on the market. The implementation of Obamacare is a huge opportunity to expand into a mandated health-insurance market, which could sustain Ebix's industry-leading growth rates for years to come.

Ebix doesn't boast a large enough size to defend its moat on scale alone, and it could be gobbled up by a larger competitor, which my fellow Fool Keith Speights has suggested might be Computer Sciences. Recent IPO Guidewire is also a competitor, and at nearly three times Ebix's valuation, it could be either a potential buyer or a merger candidate.

Until recently, Ebix was one of the decade's best stocks, turning in a 55-bagger performance from 2002 to 2012. Virtually all of that growth occurred before the financial crisis, as you can see that the stock has been flat for three years. Ebix's most recent fall coincides with a Bloomberg report that called the company's accounting practices into question. The stock has not yet recovered despite Ebix's firm denial of these accusations, which has prompted several analysts to call its stock oversold. It's hard to argue with those claims while Ebix sports a single-digit P/E and an easily sustainable dividend, and the company has been the target of very aggressive short-sellers in the past. If Ebix's numbers are accurate -- and there appears to be no reason to doubt them -- then this might be an attractive time to jump in, perfect score or not.

Putting the pieces together

Today, Ebix has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Keep track of Ebix by adding it to your free stock Watchlist.