Based on the aggregated intelligence of 180,000-plus investors participating in Motley Fool CAPS, the Fool's free investing community, semiconductor company Analog Devices (ADI 0.52%) has earned a respected four-star ranking.

With that in mind, let's take a closer look at Analog Devices and see what CAPS investors are saying about the stock right now.

Analog Devices facts

|

Headquarters (founded) |

Norwood, Mass. (1965) |

|

Market Cap |

$12.7 billion |

|

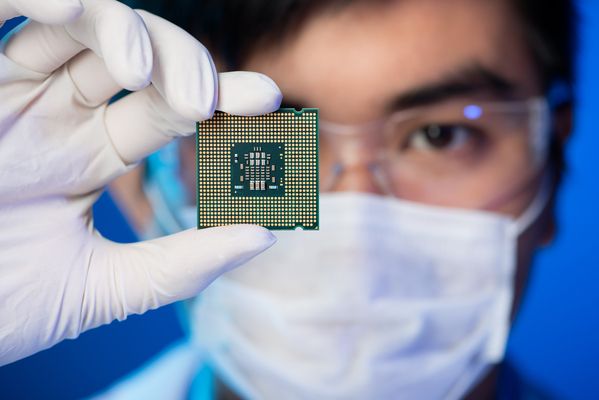

Industry |

Semiconductors |

|

Trailing-12-Month Revenue |

$2.7 billion |

|

Management |

CEO Jerald Fishman (since 1996) |

|

Return on Equity (average, past 3 years) |

21.9% |

|

Cash/Debt |

$3.9 billion / $821.6 million |

|

Dividend Yield |

2.8% |

|

Competitors |

NXP Semiconductors |

Sources: S&P Capital IQ and Motley Fool CAPS.

On CAPS, 92% of the 405 members who have rated Analog Devices believe the stock will outperform the S&P 500 going forward.

Earlier this month, one of those Fools, Acolin, helped bring the opportunity to our community's attention:

Thirteen billion dollar Analog Devices designs, manufactures and markets analog, mixed-signal and digital signal processing integrated circuits used in virtually all types of electronic equipment. This stock will pay Fools to hold it as they gain higher prices! [Analog Devices] pays almost 3% in a dividend. ... P/E is average 19. P/S and P/B ratios are 4.4 and 3.

Want to see how well (or not so well) the stocks in this series are performing? Follow the TrackPoisedTo CAPS account.