I was looking for some specific information as Intel (INTC 5.86%) prepared for Thursday night's fourth-quarter report. I walked away from the presentation a little bit disappointed.

Sales should land close to the official guidance, regardless how loudly skeptics proclaimed the imminent death of the PC. $13.5 billion is very close to the $13.6 billion guidance midpoint, and well within the range. Score one for Intel.

The company should have dropped some clues on how the hunt for a new CEO is working out. Outgoing chief Paul Otellini leaves some mighty large shoes to fill, and investors deserve at least some discussion of what the company is looking for next. After combing through the official releases and the accompanying analyst call, mum's the word.

Otellini's actual retirement is only four months away. Need. More. Info.

Is the board of directors planning to elevate an insider to the top job, or will they break this grand old Intel tradition by snagging a rock-star outsider? Otellini was the first Intel CEO to bring more business sense than technical know-how to the job. Again, no idea which way the company will lean next.

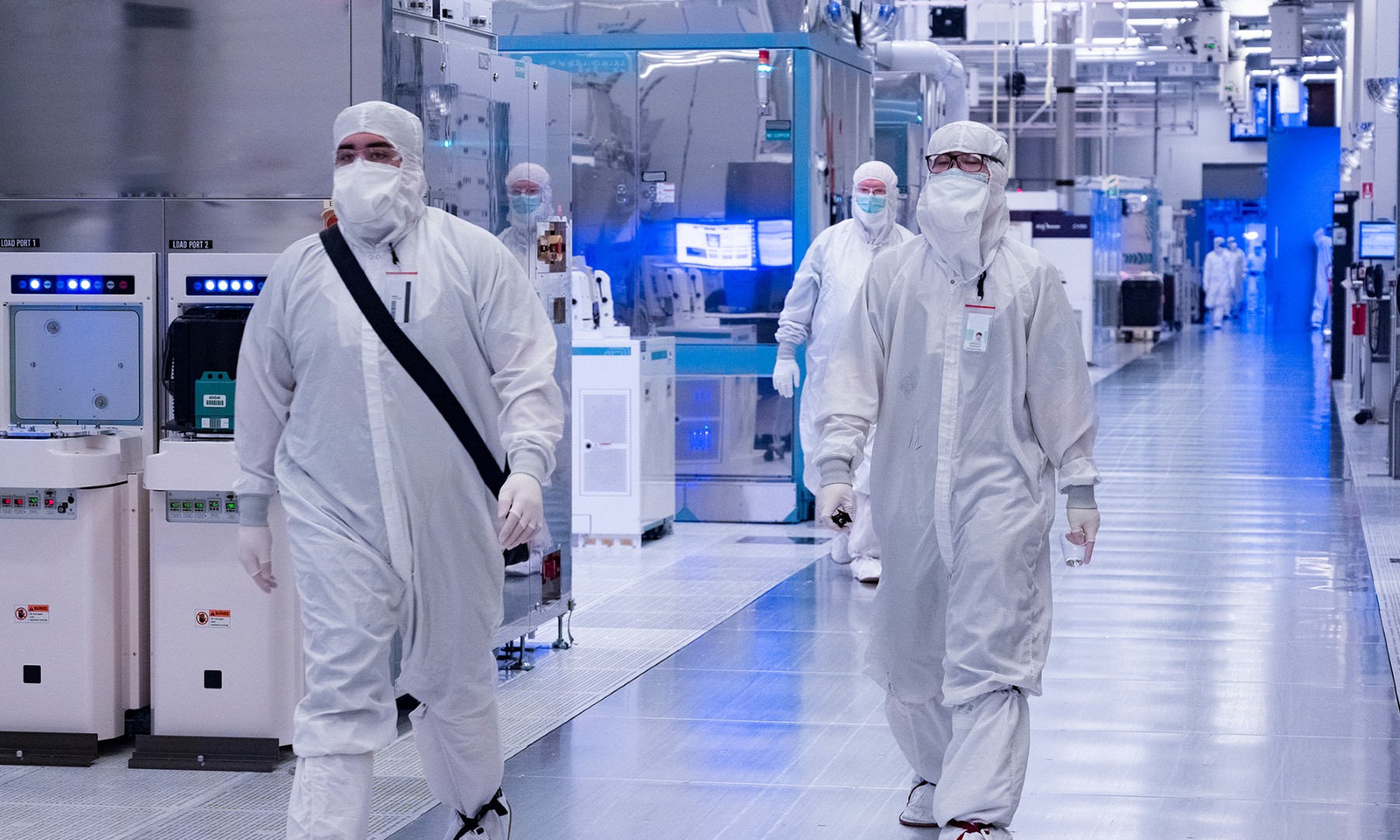

Intel shares plunged 7% on the report. Not because of weak results, because they weren't -- earnings and sales both topped the Street view. But the bar was set low for the first quarter. Sales should drop to about $12.7 billion, gross margins stay slim at 58% or so, and Intel will invest heavily in its manufacturing infrastructure.

Never mind that CFO Stacy Smith sees stronger business in the back half of 2013. Microsoft's (MSFT +0.91%) Windows 8 platform should start gaining traction as consumers overcome their resistance to design changes and corporate buyers qualify the software for business use. A slew of brand new mobile processors will find their way into tablets and smartphones, running both Microsoft's Windows 8 and Google's Android software. (Note to self: Don't bet on Microsoft reporting a huge quarter next week, but do listen to Mr. Softy's full-year guidance.)

And in the background to all of this, the global economy seems due for some good news. Smith said that "the consensus day is that there's a pretty significant strengthening in the worldwide economy over the course of the back half of this year."

So all things considered, this drastic sell-off looks like a knee-jerk reaction to a soft short-term outlook. The stock should rise later on, as Intel's road map for the second half plays out. Meanwhile, enjoy a temporary period of low buy-in prices and fantastic dividend yields.