Shares of insurance giant AIG (AIG 0.48%) reached a 52-week high on Tuesday. Let's take a look at how it got here to find out if the company's stock price can move even higher.

How it got here

Never underestimate the power of a glowing research note. Bernstein Research issued an update on AIG, in which it termed the chance to buy the insurer's stock a "once-in-a-generation opportunity."

This is because of one particular valuation that stood out strongly for the firm -- price to book. At the time the report was written, AIG was trading at around half of its book value. That was a far distance from the typical insurance stock, which these days trades closer to 1.

The situation hasn't changed much since the Bernstein report; as of this writing, price/book was still low, at 0.54. That compares favorably to the other big names in the sector. Prudential (PRU 2.30%) currently hovers around 0.7, MetLife (MET 3.40%) is at just over 0.6, and Travelers (TRV +1.72%) is at more than twice AIG's level, approaching 1.2.

Payback's a...

What helps is that AIG shares are continuing their recovery from a very low level. This is understandable, since the company was one of the most high-profile victims of the financial crisis of not so many years ago. It probably would have died an unlamented death had it not been for the federal government, which gave it a lifeline.

This would ultimately end up costing the public a horrifying $182 billion. Not even the top two banks getting TARP bailout funds -- Citigroup and Bank of America -- would come anywhere near that level.

AIG was one of the few insurance slingers that felt it needed the money. Exactly half of the six big insurers offered dollars from the government's TARP bailout program turned down the help. Meanwhile, the two other firms that said yes -- The Hartford (HIG +0.99%) and Lincoln National -- together necessitated roughly one-fortieth of the amount swallowed by their hungry rival.

Following that, no one expected much of a success story from AIG. But that's exactly what happened in the wake of the bailout. The company eventually whittled its operations down to two core business units, improved the balance sheet, and got out of the shaky financial derivatives that had put it in hot water to begin with. And within only a few years, every single penny of government money was returned from whence it came.

That, and more -- when the reprivatization was over, the Feds had actually made a profit from the bailout, taking in nearly $23 billion more than they had put into the company. That was par for the course in the sector (The Hartfordand Lincoln National had both retired their debt the year after they received it), but $182 billion is a huge amount of money, and the speed and intensity with which it was repaid is impressive.

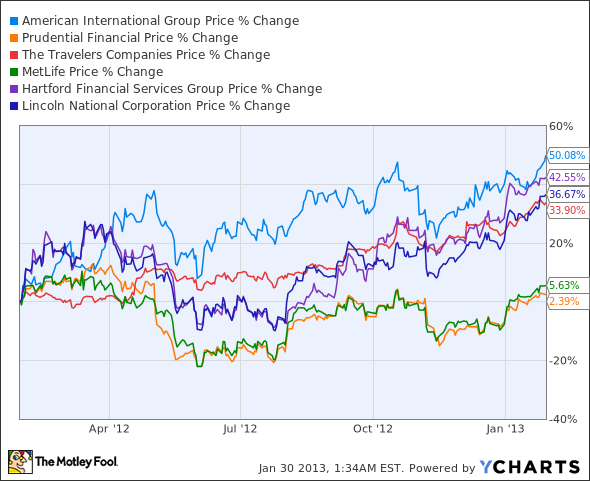

The market seemed to agree. Now that the Fed has gotten its money back (and then some), a nice degree of stability and bullishness has returned to the sector. In fact, over the last year, the three bailed-out firms have shown the most impressive share price growth among a select group of their peers.

And leading that pack is the biggest turnaround story of the three. Guess who?

What's next

AIG's been making good moves in the last few months. Its consolidation process is now largely complete, following the $4 billion-plus divestment of most of its former aircraft leasing unit, ILFC, to a consortium of Chinese investors.

So now, in the succinct words of its Chairman Robert "Steve" Miller, the company is "done playing defense," and ready to make some moves aimed at growing the business.

And the bank has put money where its mouth is: AIG has been actively pushing its wares, most recently inking a 10-year, $55 million contract with HSBC to essentially function as the bank's agent for non-life products in various European markets. The deal also comes packaged with an acquisition -- by paying $14.5 million, the American company will be the new owner of HSBC Assurances IARD, the bank's insurance unit in France.

On the down side, AIG was affected badly by Hurricane Sandy late last year. It anticipated taking a $1.3 billion hit from its exposure to assets damaged by the freak weather pattern. Although the company has the resources to tackle this, it's a big pile of money, and it'll help plunge 4Q results well into the red.

That aside, AIG continues to be a remarkable come-from-behind success story, and it's doing very well in terms of operations and, of course, share price. What's more, looking at that P/B ratio Bernstein likes so much, it's cheap. All that considered, the stock has more than enough potential to hit another high.