The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small differences in the short term add up to massive divergence over decades. In the end, the biggest winners don't always deliver the fattest share-price returns.

Today, we're looking at the newest member of the Dow Jones Industrials (^DJI 0.38%) index. UnitedHealth Group (UNH 0.01%) became a significant dividend-payer only recently, but it's never too late to start an all-night party.

Setting the stage

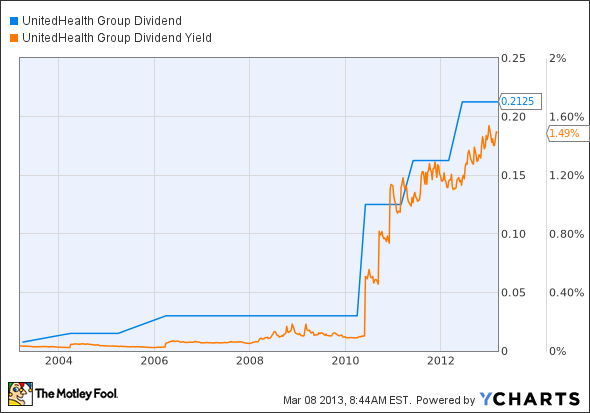

UnitedHealth paid a pittance of a dividend for many years. The policy was started at $0.01 per share, once yearly, way back in 1999. A full decade later, the yearly payout remained a minuscule $0.03 per share.

UnitedHealth absolutely crushed the Dow during those 10 years -- no thanks to dividend boosts.

However, that all changed in 2010.

UnitedHealth had been using its spare cash on big, splashy acquisitions, but the well of available targets was drying up due to changing congressional policies. So the board of directors decided to divert some of the buyout reserves into a much more substantial dividend policy.

Suddenly, UnitedHealth paid out $0.50 in annual dividends per share -- and started raising the payouts every year.

UNH Dividend data by YCharts.

The result? The formerly forgettable dividend yield is growing by leaps and bounds, and it now sits at a respectable 1.6%.

How far did UnitedHealth climb?

It's still one of the weakest payouts in the Dow, with only five of the 30 blue chips offering a thinner yield. But UnitedHealth's policy has more room to grow than any of its fellow bottom-dwellers.

The company covers its dividend costs with just 15% of its annual income today. The three lowest-paying stocks consume far larger slices of their income pies at the dividend table.

| Company |

Dividend Yield |

Payout Ratio |

10-Year Annual Dividend Growth |

|---|---|---|---|

|

Home Depot (HD 1.33%) |

0.02% |

15% |

19% |

|

Bank of America (BAC 0.71%) |

0.3% |

38% |

(29%) |

|

American Express (AXP +0.45%) |

1.2% |

46% |

10% |

|

UnitedHealth |

1.6% |

69% |

60% |

Data from S&P Capital IQ.

What's going on?

All of these companies have their reasons for not paying larger dividends, of course.

Home Depot is more concerned with cost savings and revenue growth than straight-up shareholder service at the moment. The home improvement retailer has been through a few tough years, but it has surged back to growing both sales and earnings. For Home Depot, this is not the time to make a dramatic dividend move, but rather to reap the rewards of efficiency lessons learned in the last five years.

Bank of America slashed its dividend by 98% during the subprime crisis of 2008. Even if the bank wanted to increase its payouts today, it would have to gain regulatory approval first. A recent payout boost at fellow crash-hampered megabank Wells Fargo has raised hopes that B of A might get that crucial nod of approval soon, but you never really know what the Fed is going to do.

American Express has nearly as much headroom for dividend increases as UnitedHealth does, but it prefers to return cash to shareholders in the form of share buybacks. There's nothing terribly wrong with that approach, but companies are rarely great at investing in their own stock, and buybacks do nothing for investors who prefer regular income over higher stock prices.

I see UnitedHealth climbing out of the bottom rungs of Dow dividends soon enough, with the caveat that Bank of America might follow suit as soon as regulators allow it.