Pairs trading is a strategy investors can employ to maintain a relatively market neutral position while attempting to exploit mispriced stocks. The idea is to go long an undervalued stock and short an overvalued stock, with the theoretical expectation that the two will converge and mispricing will be eliminated. It's a rather risky strategy in general, because pairs trading is inherently leveraged, the prices can diverge further, and the paper losses can add up quickly with two positions going the wrong way.

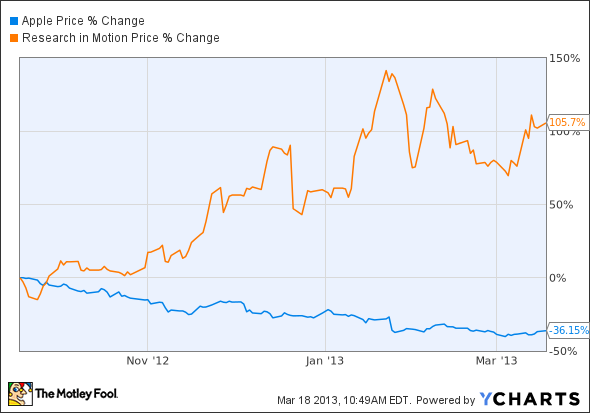

Over the past six months, a pairs trade on Apple (AAPL 0.38%) and BlackBerry (BBRY 0.13%), formerly known as Research In Motion, would have paid off immensely for investors who saw it coming. The Mac maker has seen shares lose 36% while BlackBerry shares have more than doubled. At one point, BlackBerry was flirting with gains of nearly 150% during the past few months.

Apple topped out at over $705 on the same day it launched the iPhone 5, but has pulled back because of negative investor sentiment surrounding its competitive prospects and investor frustration over its oversized cash position. Investor pessimism over BlackBerry reached a fever pitch at nearly the exact same time, which is about when shares bottomed out near $6.

In January, the company proceeded to -- at long last -- launch its BlackBerry 10 operating system platform after years of development and delays. The success or failure of BlackBerry 10 in the coming quarters will very much make or break the company, and investors are expressing their optimism by sending shares higher.

As profitable as a short Apple and long BlackBerry pairs trade would have been over the past six months, is it time to switch those positions, and go long Apple and short BlackBerry?

One analyst thinks so

Growth Avenue Asset Advisors thinks that now is precisely the time to make the swap. Analyst C.K. Narayan is out with a research note recommending that investors buy Apple and sell BlackBerry.

BlackBerry needs a "blockbuster of a product" to change its direction for the long term, and overall tech reviews of the new Z10 don't consider the Z10 a blockbuster. The new device is certainly competitive in many ways, but isn't leapfrogging the competition, which is effectively what investors are pricing in right now.

Narayan believes BlackBerry's recent rally is "more or less over," and if the Z10's actual results are below investor expectations, shares could promptly return from whence they came and "test" all-time lows again.

BlackBerry has been coy about early launch figures, providing vaguely impressive comparisons to previous launches. On the other hand, the company did take the opportunity to boast an order for 1 million BlackBerry 10 devices last week, the largest single purchase order in BlackBerry's history. Those smartphones are going to an unnamed "established partner."

The devil is in the details though, and the identity of this mystery partner remains to be seen. If BlackBerry is referring to a large carrier partner or other distributor, then the order isn't as impressive as if the company was selling those devices to a large enterprise or government buyer. Selling into the channel and selling to end users have very different implications. Low sell-through simply leads to inventory writedowns, after all.

Much like how negativity around BlackBerry peaked six months ago, the same appears to be happening with Apple right now. The current dirt-cheap valuation simply makes no sense, and the pullback may be close to its end. Narayan believes that since Apple has come back to where it was before its meteoric rise, shares can resume a steadier climb. The mean reversion has ended, according to the analyst, and both Apple and BlackBerry are about to resume their previous trends.

Over the next six months, will a long Apple and short BlackBerry pairs trade prove as profitable as the opposite position was over the last six months?