There will always be comparisons made between Yahoo! (NASDAQ: YHOO) and Google (GOOG 1.03%) because of their history as Internet pioneers and innovators in search. But while Google has branched into email, cloud services, video, mobile operating systems, and other products, it has stayed a search company at heart, something Yahoo! hasn't done -- for better or worse.

Yahoo! has become a true Internet portal -- a source for news, financial analysis, and an assortment of other services. Everything the company does is intended to get eyeballs to the site.

The problem for Yahoo! is that a search for users has caused the search business to suffer in the mean time. Paid clicks generated from search dropped throughout 2011 and have only began to rebound from lows seen in late 2012. While clicks have picked up, price per click dropped 7% in the first quarter, a sign the company isn't monetizing search as well as Google. Yahoo!'s partnership with Microsoft, which was supposed to help both companies battle Google, hasn't resulted in significant financial progress for either company.

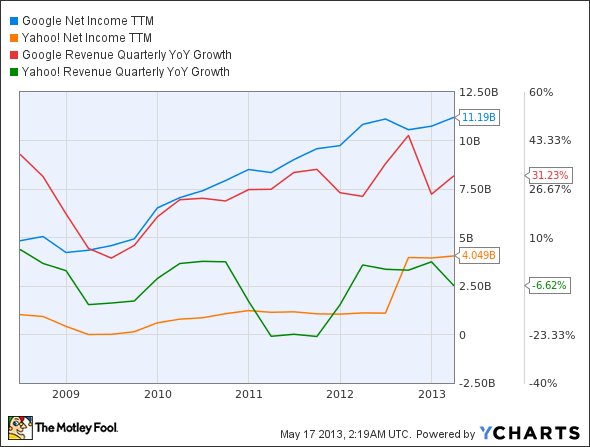

On the display ad side of the business, ads sold have fallen every quarter since Q2 2011 and price per ad also dropped in Q1 of this year. It's really display ads that have been a drag on revenue. When you add display and search together, you get the chart below, with revenue growth lagging well behind Google. The bump in earnings you see is only because of a one-time $2.8 billion gain from the sale of Alibaba shares.

GOOG Net Income TTM data by YCharts.

Desperate times call for desperate measures

Yahoo! can't seem to get traction in its core businesses, so now it's spending $1.1 billion in precious cash to buy blog site Tumblr. But that may backfire: Tumblr's users have already started a petition protesting the sale and some say they'll leave rather than become part of Yahoo!. To make matters worse, TechCrunch reports that visits to the site have been falling over the past year, as much as 21% in the U.S., a trend that makes Yahoo!'s purchase look unwise.

Can Marissa Mayer save Yahoo! stock?

What Yahoo! stock has going for it over Google is a low baseline and the potential for magic from Marissa Mayer. She was one of Google's first employees and knows how to build an Internet business.

If Mayer is successful, Yahoo! stock has plenty of potential. Both Yahoo! and Google trade at 17 times forward earnings, so with a little growth the stock could continue to charge higher. The big difference is we know Google is a steady growth company and Yahoo! has had problems monetizing traffic to its sites. I've made an outperform CAPScall on Google because of its consistency and innovation, but Yahoo! doesn't have the same qualities... yet.

Foolish bottom line

I don't like Yahoo!'s trends in search or display ads but what it does have is millions of eyeballs visiting its sites every day. If Mayer is able to somehow able to make Yahoo! cool again, there's a lot of upside, keeps me for making an underperform call on the stock. The problem is, I don't see a lot of improvement operationally, which will keep me from making an outperform call as well. Like Yahoo!'s operations, its stock is stuck in no-man's land.

To be honest, the best outcome for Yahoo! stock may be an acquisition by Microsoft, which looked likely just a few years ago. Without that, Yahoo! is stuck in neutral with a ton of traffic but no identity as a search, news, or tech company.