Berkshire Hathaway (NYSE: BRK-B) is back in buy mode. The company snatched up NV Energy (NYSE: NVE), calling into question the recent utilities pullback we've seen over the past month. And while "monkey see, monkey do" is the fastest way to financial ruin, the Oracle of Omaha may know something we don't. Let's look at why Warren Buffett loves this dividend stock and whether any other utility dividend stocks offer similar deals.

The details

Berkshire Hathaway's MidAmerican Energy subsidiary announced Wednesday that it has agreed to acquire NV Energy for $5.59 billion. That equates to $23.75 per share, a 23% premium over its pre-announcement closing price. Once NV's debt is added into the deal, MidAmerican will have coughed up $10 billion for this dividend stock.

In a press release, Buffett noted: "This is a great fit for Berkshire Hathaway, and we are pleased to make a long-term investment in Nevada's economy. Through MidAmerican, we have found in NV Energy a great company with similar values, outstanding assets, and a superb management team."

According to MidAmerican President and CEO Greg Abel, the mastermind behind the deal, the acquisition has been a long time coming. Abel had been in talks with NV for several years and sees significant upside to the deal. In an Omaha World-Herald interview, Abel reflected: "[T]hey've got a very good management team. They have excellent regulated assets, and we view Nevada as an excellent place for investment long-term."

What makes NV a Buffett buy?

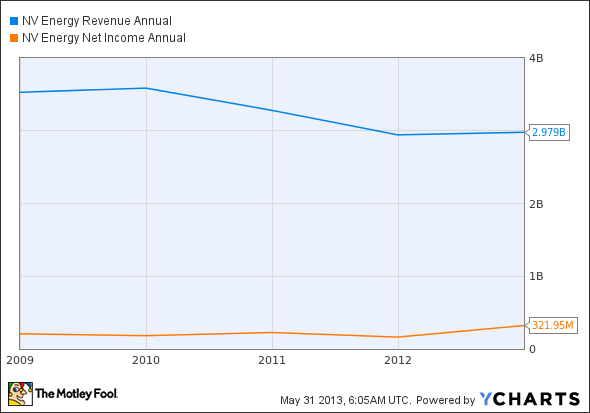

Dividend stocks, and utilities specifically, are a natural fit for Berkshire Hathaway. Regulation allows electricity companies to maintain steady earnings through good times and bad. Even though NV is based in recession-ravaged Nevada, the corporation's sales have dropped just 15% since 2009. Even better, its bottom line has recently headed higher for an overall 54% net profit gain in the last five years.

NVE Revenue Annual data by YCharts.

Buffett is famous for his quote "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price," and NV seems to be the former. Even after shares skyrocketed this week, the dividend stock trades at just 17 times last year's earnings. And while Berkshire Hathaway doesn't distribute dividends itself because it's smarter than you, NV's 3.8% yield serves as another solid signal that this company's earnings aren't going anywhere.

More Buffett bites

All dividend stocks are not created equal, but recent overvaluation worries have dropped prices back down for some potential value grabs. Investors should look for utilities with stable earnings, diverse generation portfolios, and an eye toward future fundamentals.

Stable earnings are a result of a plethora of factors, but friendly regulation is the best starting point. Ameren (AEE +1.65%) is making major strides in Illinois legislature, with recent wins for both smart grid modernization projects and $330 million more in natural gas investments.

Dividend stocks such as Exelon (EXC +0.69%) and Southern (SO +1.85%) offer stable income sources with major investments up their sleeves. The utilities rely on steady nuclear generation for 55% and 16% of their capacity, respectively, but are also expanding into other energy opportunities. Exelon operates 44 wind projects with nearly 1,300 MW of capacity and plans to invest $80 million in smart grid upgrades over the next two years. Southern has recently been on a renewables rampage, adding on 139 MW of solar, 250 MW of wind, and 53 MW of biomass in the past few months.

Dividend stocks for the win

Berkshire Hathaway's announcement might push Wall Street back toward utilities, but smart investors didn't need the nudge. Reasonably priced dividend stocks have historically outperformed other investments -- and without the price swings that keep shareholders up at night. Don't bite into utilities just because of Buffett -- do it because dividend stocks are downright delicious.