Among stock markets around the world, the S&P 500 (^GSPC 0.44%) has given investors great performance, with double-digit percentage gains even as many international markets have struggled to avoid losses. But even within the S&P, you'll find some danger spots that could wreak havoc on your overall portfolio.

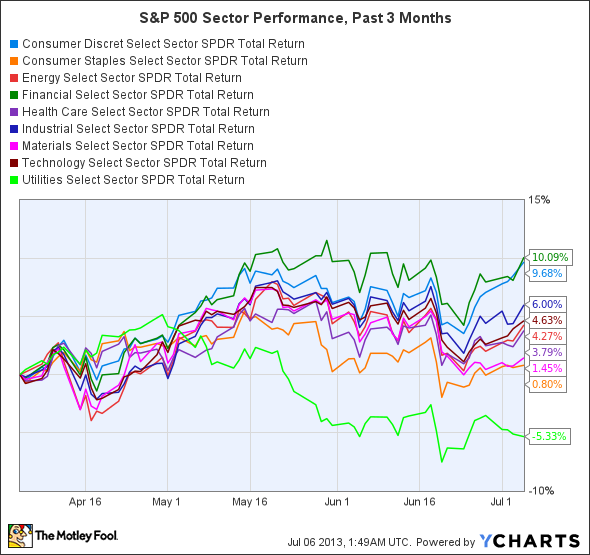

Plenty of sectors within the S&P haven't produced the best returns lately, with materials in particular having suffered from an overall plunge in commodities. But when you look at the performance of all of the S&P's sectors over the past three months, utilities stand out as having badly lagged the gains that other sectors have produced, with the Utilities Select SPDR (XLU 0.97%) being the only sector ETF to lose ground in the past three months. Let's try to figure out why.

S&P Sector Total Return Price data by YCharts.

Why utilities aren't performing well

To understand the performance of utilities, you have to look at the business models that most utilities have. For regulated utilities -- those that offer electricity and natural gas service directly to customers -- growth prospects are generally quite limited, as they already have the mandate to provide services to all potential customers in a given geographical area. Organic growth generally takes a back seat to mergers and acquisitions for those utilities seeking to go beyond their traditional geographical areas. For instance, Duke Energy (DUK 0.41%) bought Progress Energy in order to take a more commanding position in the Southeast.

At the other end of the spectrum, many companies focus less on traditional regulated-utility business and have emphasized power generation and wholesale distribution instead. For instance, Exelon (EXC) is a major producer of energy that gets used throughout the country, and its purchase of Constellation helped bolster its presence in the deregulated energy market. For power wholesalers, growth prospects are somewhat greater, but immense competition has nevertheless kept the reins on most of the major producers in the industry.

Even though utilities don't have much growth in their future, they're good at producing dependable cash flow. For the regulated side of the utility business, rates generally ensure a modest but reliable profit, with the ability to apply for rate increases if those profits prove to be inadequate because of changing conditions. Competitive power wholesalers are more exposed to changing conditions, but by using long-term contracts, utilities can hedge against some of the volatility in power prices.

A bond by any other name

Because of their slow growth and strong cash flow, utilities end up resembling bonds to a large extent. Therein lies the problem, as stocks have held their own quite well lately, but bonds have posted declines of a magnitude not seen in years. Investors treat utilities much like bonds, and so they've sent companies down by similar percentages. Industry giants Duke and Southern Company (SO 0.58%) have seen losses of between 5% and 10%, while Exelon has plunged 14% in the past three months.

Worst of all, utilities face the uncertain environment of volatile energy-input costs and potential regulation. With Southern and Duke having made a big shift toward gas-fired power plants, rising natural gas prices could leave them with weak earnings. Meanwhile, anti-pollution regulations could force new capital costs on the industry, further hurting short-term prospects.

Longer to wait

As long as bonds suffer, utilities are likely to lag behind the overall market. At least for now, conservative investors shouldn't count on utilities to provide their usual defense against falling stock markets.