The first six months of 2013 have been good to Yahoo! (NASDAQ: YHOO) and those who hold Yahoo! stock. Though we Fools know that six months doesn't make or break an investing thesis, it's always good to periodically check in on your holdings.

And if you hold Yahoo! stock, you've got to be pretty happy with what you've seen thus far.

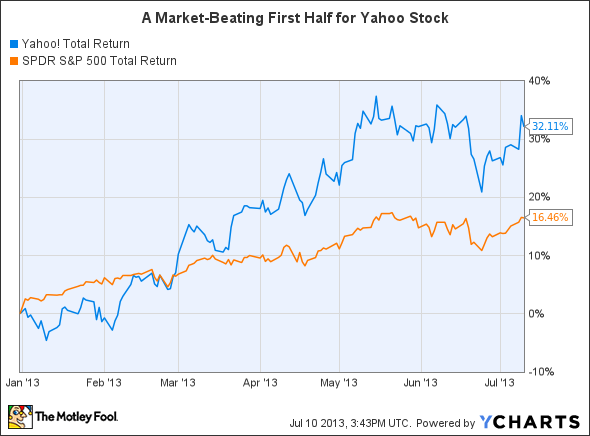

YHOO Total Return Price data by YCharts.

Though Yahoo! stock started out below the S&P 500's return, it has outperformed the market ever since late February, outpacing the index by over 15 percentage points on the year. If we take a closer look at the half-year's events, three themes in particular stand out.

Solid earnings reports

Source: YCharts.

Of course, the most intensely watched events in a company's year are usually quarterly earnings reports. Yahoo! is no different in that respect. The company announced earnings on Jan. 28 and April 16, and in both cases, Wall Street was generally pleased.

At the end of the fourth quarter of 2012, Yahoo! CEO Marissa Mayer was able to gleefully proclaim: "Yahoo! exhibited revenue growth for the first time in 4 years." After four years of futility, investors were happy to see this move. They were also pleased with the fact that during the fourth quarter revenue increased 2% from the previous year, and non-GAAP earnings per share jumped 28%.

That positive momentum continued when the company announced results for the first quarter of 2013. Though revenue was basically flat (excluding traffic acquisition costs) during the quarter, non-GAAP earnings per share grew an impressive 41%.

A clear mission

Source: YCharts.

For most of its life as a public company, Yahoo! was known first and foremost for its role as a search engine. As it stands now, Yahoo! is still beating out Microsoft's Bing globally, but it is a game that's already largely over, with Google maintaining a dominant 80% share.

Sources: Netmarketshare, Market Watch, webpronews, clickz, OneStat, and Websidestory.

As that part of Yahoo!'s business has faded, and the company has had trouble keeping the same team in the executive suite for more than a couple of years, it's been difficult for Yahoo! to have a cohesive, unifying purpose.

For those paying close attention, Mayer addressed this concern head-on in the company's annual report on March 1, stating Yahoo! is "a global technology company focused on making the world's daily habits inspiring and entertaining."

As John Fort of CNBC wrote: "Mayer is intent on remaking the company as a technology company that specializes in media, not a media company that gets efficiency through technology." Mayer followed up on that promise in late May, when she announced that Yahoo! would be acquiring photo-sharing site Tumblr.

Stake in Alibaba

Source: YCharts.

For those who might be unfamiliar, Alibaba is a major force in the Chinese Internet space. The company had over $4 billion in revenue in 2012, and has its hands in e-commerce, digital payments, and cloud computing.

Yahoo! actually has a 24% stake in Alibaba. While it's impossible to know just how much that stake is worth, Alibaba has been growing by leaps and bounds. And Reuters reported that Alibaba has been taking out jumbo loans to finance the repurchase of some or all of Yahoo!'s stake in Alibaba. When this happens, it could contribute billions to Yahoo!'s bottom line, and help push Yahoo! stock even higher.

And in May, Yahoo! CFO Ken Goldman mused that he may find a way to work a deal to reduce Yahoo!'s tax burden when Alibaba eventually buys back the rest of Yahoo!'s holdings. Whether or not a change in the tax Yahoo! must pay goes through remains to be seen. What's certain is that the company has had a stellar first half of the year.