The streak ends here. The S&P 500 (^GSPC 0.06%) lost 0.4% today, failing to extend its eight-day winning streak (which was nevertheless very unusual -- read yesterday's column to find out why). The narrower, price-weighted Dow Jones Industrial Average (^DJI 0.17%), meanwhile, fell 0.2%.

With the S&P 500 down on the day, it's not surprising to see the CBOE Volatility Index (VIX) (^VIX +0.13%), Wall Street's "fear index", rise nearly 5% to close at 14.42. (The VIX is calculated from S&P 500 option prices and reflects investor expectations for stock market volatility over the coming 30 days.)

Stocks' performance and that of the VIX may reflect professional investors' (i.e., traders') uncertainty with regard to Federal Reserve Chairman Ben Bernanke's two-day Congressional testimony, which begins tomorrow. Traders are so desperate to cling to the "liquidity rally" that they're hungry for any clue to help them divine the future path of Fed policy. But don't expect any surprises from Bernanke, who will be satisfied to keep hammering his audience with the stance articulated at the last Federal Open Market Committee meeting.

Furthermore, the Fed's policy path will ultimately depend on economic data that isn't available yet -- it's more than likely the central bank does not itself know at this time precisely when or how it will begin tapering its monthly bond purchases (i.e., "quantitative easing"). For long-term fundamental investors, Bernanke's trip to Capitol Hill is a non-event; for traders, on the other hand, it's vital stuff.

No sugar high for Coke

Shares of Dow component Coca-Cola (KO 0.09%) closed down nearly 2% today, even as the company reported second-quarter earnings per share of $0.63, in line with Wall Street expectations. The problem was not so much with earnings, but rather with volume/revenue growth. Revenue of $12.7 billion was a bit shy of the $12.9 billion consensus estimate. Worse, perhaps, was anemic growth -- 1% -- in worldwide volume. Even that figure masked a 4% volume decline in U.S. volume.

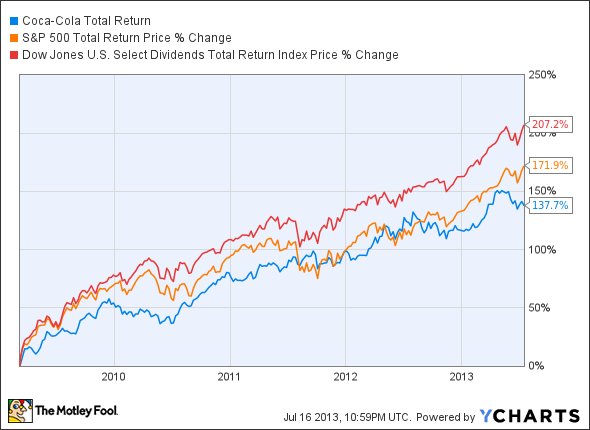

Coca-Cola is a high-quality franchise, a Berkshire Hathaway favorite holding that pays an above-market dividend of 2.7%. While the safety and stability of the franchise is attractive in the post-crisis environment, it comes at a hefty price -- 19 times next 12 months' earnings-per-share estimate. Even despite investors' interest in high-quality stocks in the past couple of years, Coca-Cola has failed to keep pace with the market or with dividend shares, beginning from the market bottom of March 2009:

KO Total Return Price data by YCharts

Finally, even the exposure to higher-growth economies didn't pay off for Coca-Cola in the second quarter. Take three of the four BRICs: Sales stagnated in Brazil and China and rose just 1% in India.

Coca-Cola is no more than a reasonable investment at current levels, and shareholders may have to be patient to see a decent return, as the market digests a slow return to growth.