U.S. stocks are somewhat flat this morning, with the S&P 500 (^GSPC 0.70%) down a mere point and the narrower, price-weighted Dow Jones Industrial Average (^DJI 0.92%) up a modest 32 points as of 10:10 a.m. EDT.

Time to exit Yahoo?

Yahoo! (NASDAQ: YHOO) announced yesterday that it had agreed to repurchase 40 million of its own shares from activist hedge fund manager Third Point, led by Dan Loeb. Yahoo! will pay $29.11 per share (last Friday's closing price), and the transaction reduces Third Point's position by approximately two-thirds to roughly 20 million shares (less than 2% of the common shares outstanding). The three Yahoo! directors nominated by Third Point, including Loeb himself, will step down from the board at the end of the month.

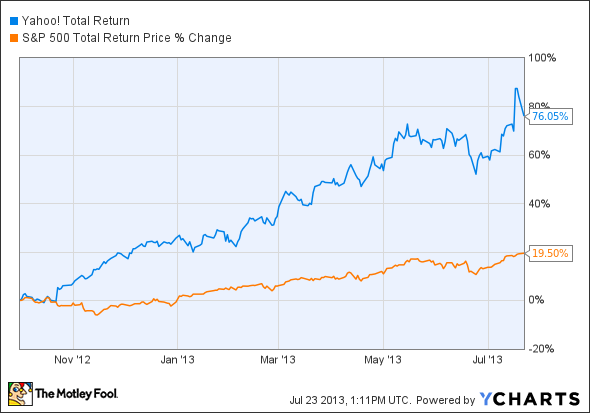

Third Point was Yahoo!'s largest outside shareholder and was instrumental in the hire of Marissa Mayer after it precipitated the resignation of her predecessor, Scott Thompson. The fund manager acquired the bulk of its position in the fourth quarter of 2012. The following graph, which shows Yahoo!'s performance since then, hints at the tidy profit Third Point has booked on its position:

YHOO Total Return Price data by YCharts.

As Dan Loeb steps away from Yahoo!, should investors do the same? The hire of Marissa Mayer was a brilliant coup, as she has reinvigorated the company from the standpoint of strategic direction and investor perception. But while Mayer looks like she is on the right track, there remains significant uncertainty regarding the ultimate success of the company's turnaround. Last week's second-quarter results showed that while a series of high-profile acquisitions, including that of Tumblr for $1.1 billion, have halted the decline in traffic, revenue including the costs of acquiring Web traffic fell 1%.

In terms of value, the low-hanging fruit has been picked -- or harvested on an industrial scale, in Third Point's case. Investors who rode Third Point's coattails over the past 12 months can pat themselves on the back, but continuing to hold shares now valued at 18.2 times the next 12 months' estimated earnings per share requires a real degree of confidence in a successful turnaround. That, in turn, requires a judicious appraisal -- and constant monitoring -- of the company's progress in a highly competitive, ever-changing environment. In my view, there are easier ways to make money.