When it comes to investing in some of the energy sector's best master limited partnerships, investors often find themselves with a decision to make. Should they buy shares with the general partner, or should they buy shares of the MLP? Today I'll look at one factor that may influence this important decision: insider ownership.

Management's slice of the pie

Insider ownership is pretty important here at the Fool. Management's stake in a company or partnership is often equated with their faith in the future success of the business, as well as a commitment to shareholders. When management holds a big stake in a company it's as if they're saying, "I'm in this with you."

Aligning yourself with management is even more important with MLP investing, because limited partner units do not come with voting rights, giving unit holders very little say with what goes on. The thinking goes that if management has a high stake in a company, then they will do what it takes to protect not only their investments but also any investor who has come along for the ride.

With that in mind, let's take a look at three families of investments, considering management's share of the float in the general partner compared to the MLP.

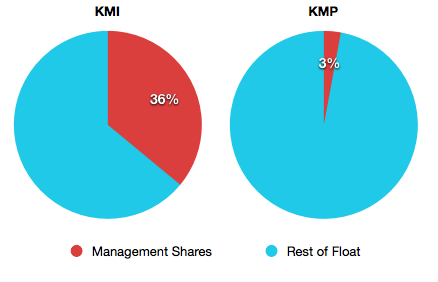

First up, we have Kinder Morgan (KMI 0.74%) and Kinder Morgan Energy Partners (NYSE: KMP):

Source: SEC filing

Followed by Energy Transfer Equity (ETE +1.03%) and Energy Transfer Partners (ETP +0.00%)

Source: SEC filing

Finally, we have NuStar GP Holdings and NuStar Energy (NS +0.00%)

Source: SEC filing

It is pretty clear that management holds a much larger stake in the general partner than the underlying MLP. It should also be noted that Kinder Morgan is structured as a C-corp, Energy Transfer Equity is itself an MLP, and NuStar GP Holdings is an LLC. Structure is a non-issue as far as respective management's holdings go (though that too can be a factor in an individual investor's decision).

Clearly, because the MLP drives the success of the general partner, the fact that management does not hold a huge percentage of the float does not mean that they don't have faith in the business, it just means that the general partner is the preferred investment vehicle. In fact, the generally accepted reasoning behind this ownership pattern is that the general partner's benefit from incentive distribution rights comes from the underlying MLP, which quite often leads to a faster-growing distribution rate at the general partner.

The other benefit to following management's lead and buying shares of a general partner is that general partners typically hold many common units of their underlying MLPs. That remains true with the three general partners listed above. Kinder Morgan holds 43 million common units of KMP, Energy Transfer Equity holds more than 50 million common units of ETP, and NuStar GP Holdings holds more than 10 million common units of NS. This gives investors who hold the general partner the best of both worlds: alignment with management and indirect exposure to the MLP.

Bottom line

Obviously, there are many things to consider when deciding between owning a general partner or owning an MLP, and ultimately the decision shouldn't be based on one sole factor. That being said, insider ownership is important and should absolutely be considered when making an investment decision.