OPEC's profits have yet to dry up. Photo credit: Flickr/Mark Rain

Export earnings among OPEC members rose to $1.26 trillion last year. That's up from the $1.15 trillion it earned in 2011. That's an incredibly large number. The entire U.S. economy is estimated to be $16.62 trillion, meaning OPEC's earnings are about 7.5% of the size of the entire American economy.

While the U.S. isn't solely responsible for pouring a trillion dollars into OPEC's coffers, it is on track to send another $400 billion to foreign nations again this year. About 39% of that will end up padding OPEC's bottom line this year. Overall, our oil imports total more than a billion dollars per day, which, instead of being reinvested to grow our economy, it's growing the economies of competing nations. Just think about what would happen if that money stayed right here at home.

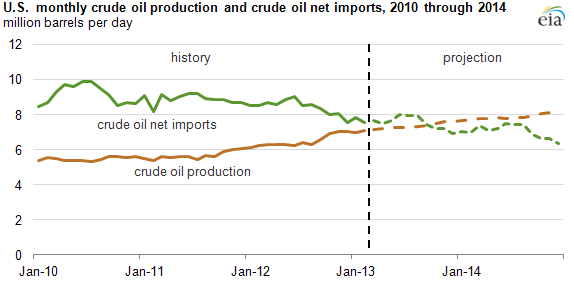

The good news is that we are making some progress. Crude oil production in the U.S. continues to climb, which is slowly reducing the amount of oil that's imported. That trend is projected to continue, which, if projections hold, would have the U.S. soon producing more oil than is imported for the first time since 1995. The following chart shows that we're right about even today:

Source: Energy Information Administration.

As a nation, we have a lot of companies to thank for reversing this long trend. Continental Resources (CLR +0.00%), which dubs itself as "America's Oil Champion," is among the leaders in pushing out oil imports. Over the past year the company has grown its oil equivalent production by 42%, which has vaulted it to becoming the top oil producer in the Bakken. Over the past three years, the company has grown its production by a compound annual rate of 38%. It has no plans to slow down, as this year the company and its partners will drill 944 new wells, which is up from the 847 drilled last year. Its plan is to triple its oil equivalent production by 2017.

Meanwhile, America's natural gas leader and No. 2 producer, Chesapeake Energy (CHK +0.00%), has been investing heavily to grow its oil production. Last quarter, the company reported a 44% year-over-year spike in its oil production. The company continues to deliver excellent operational results, as it has revised its oil production estimates higher in three of the past four quarters.

Another company that deserves credit for helping push America's oil production higher is Pioneer Natural Resources (PXD +0.00%). Already the third largest oil producer in Texas, Pioneer continues to see huge potential production growth opportunities in the future. In fact, the company believes its overall production will grow by a compound annual range of 13% to 18% through 2015. Overall, it sees total resource potential of about 9 billion barrels of oil equivalent, which is energy we won't have to purchase from other countries.

While last year was another banner year for OPEC, these oil and gas companies are spending billions to invest in projects focused on the effort to produce more energy here at home. The good part about that is it means more dollars will stay here at home as well. That's great for our economy, and great for investors.