It has taken a while, but EV Energy Partners (NASDAQ: EVEP) has finally found a buyer for some of its Utica acreage. The oil and gas MLP was able to sell 4,345 acres for a total of $56 million as part of a larger package with EnerVest, which is a quite impressive $12,900 per acre. The price is nearly 30% richer than some of Gulfport Energy (GPOR +0.00%) recent acreage purchases. So, while the sale represents just a small portion of what EV Energy is looking to sell, it does kick off the process on a positive note.

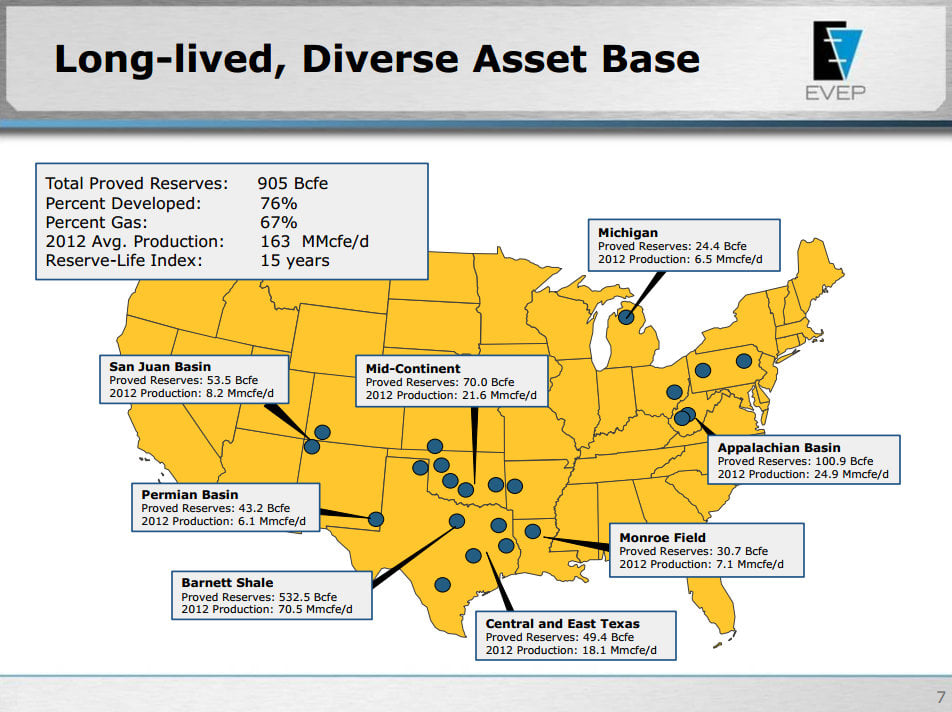

Source: EV Energy Partners

The acreage it's selling is located in Guernsey, Harrison, and Noble counties in Ohio. That's right in the heart of the southern section of the wet-gas portion of the play. These are some of the most active acres in the play, with producers such as Chesapeake Energy (CHK +0.00%), Rex Energy (NASDAQ: REXX), and Gulfport all recently drilling wells in the region.

Of those companies, Chesapeake has been the most active driller in the Utica. The company has drilled 321 wells there, with 106 currently producing, 93 waiting on pipelines, and another 122 in various stages of completion. Over the past quarter alone the company has grown its production by 48% with no slowdown in sight; it has 11 rigs operating in the region. While the company is looking to lighten up on its acreage position in the region, the Utica still remains one of its core assets -- it's devoting 10% of its drilling budget to the play.

Similarly, Gulfport is also devoting a lot of capital to the play. In fact, about $500 million of its $590 million capital plan this year will be devoted to the Utica. One of its most recently completed well pads, Boy Scout, is in Harrison County, and the two wells recently placed into production both are delivering over 1,000 barrels of oil equivalent per day, which is why Gulfport is so thrilled with its position in the Utica.

Rex Energy has also enjoyed success in the southern region where EV Energy is selling, as evidenced by the three wells placed into sales last quarter. These wells have performed even better than Gulfport's Boy Scout wells, with an average 30-day sales rate of more than 1,588 barrels of oil equivalent per day. Rex's three most recent southern wells have actually performed better than its last three wells brought into sales in its northern prospect, which might hint at why EV Energy was able to receive so much value for the acres it sold.

While the Utica has proved to be a tougher play than producers were initially expecting, it is producing solid results for those producers targeting the right spots. While EV Energy didn't disclose its buyer, it would appear that the company is paying a premium for one of the top spots in the play.