Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Goodyear Tire and Rubber (GT +0.00%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Goodyear's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

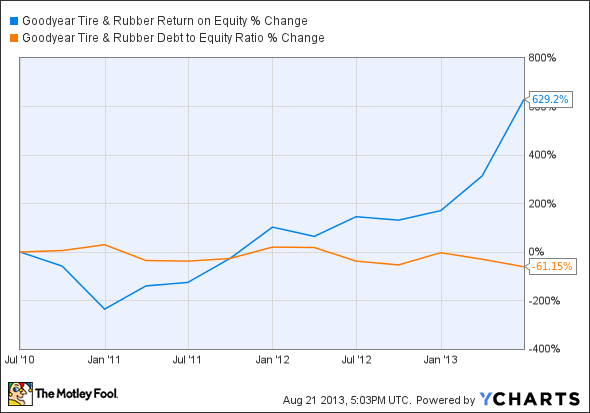

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Goodyear's key statistics:

GT Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

13.8% |

Fail |

|

Improving profit margin |

89.4% |

Pass |

|

Free cash flow growth > Net income growth |

(114%) vs. 115.6% |

Fail |

|

Improving EPS |

76.1% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

85.1% vs. 76.1% |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

GT Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

629.2% |

Pass |

|

Declining debt to equity |

(61.2%) |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Goodyear got off to a solid start, but it tripped on both revenue and cash flow analyses. Over the past three years, Goodyear's free cash flow has fallen substantially, even as the company has done an excellent job improving its profitability. That's isn't enough to write this stock off, as Goodyear still earned five out of seven passing grades, and it could achieve a perfect score with enough improvement on its free cash flow growth rate. Let's dig a little deeper to see what Goodyear is doing to boost its revenue and free cash flow over the next few quarters.

In its latest quarter, Goodyear's European profit spiked, but growth was strong across all of the company's geographic regions. Goodyear is looking to push up its international sales by tapping into Asian markets, which are expected to contribute 65% of global automobile sales by 2020. Increased demand for tires in the two-billion-plus-strong Indian and Chinese markets, combined with reduced rubber prices, should help Goodyear reap higher profits in the future.

On the other hand, my Foolish colleague Rich Duprey points out that Goodyear has a long history of controversies. In 2006, the United Steelworkers Union called a strike that cost Goodyear $367 million in just three months. Both parties have now agreed to a master contract, which will benefit about 8,000 employees serving across six manufacturing facilities in the United States. More recently, workers in a French tire factory have filed a suit against Goodyear for closing its facility due to non-profitability. It's unlikely that Goodyear will return to France now, but labor issues could pose more problems in the future -- at least until tires can be made entirely by robots.

Putting the pieces together

Today, Goodyear has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.