Organovo (ONVO +1.00%) is a little company that people think could do big things. Foremost among those "things" is the 3-D printing of human organs for transplants.

But the problem with such grandiose potential is that it can often distract investors from the more tangible opportunities lying in plain sight. As you'll see, Organovo could have much more practical streams of revenue sooner than printed organs ever come along.

A market in dire need of new efficiencies

In 2010, the pharmaceutical industry spent $50 billion on research and development of new treatments. At the same time, the FDA approved only 20 new drugs.

Sources: Organovo, FDA, Pharmaceutical Research Manufacturers of America.

Though much of the money invested is for the drugs of the future (well beyond 2010), these numbers represent just how expensive it is to bring a drug to market.

More representative figures do exist to put the spending in perspective: A new drug, on average, takes 12 years and $1.2 billion to bring to market. And that doesn't even take into consideration all of the drugs that never see the inside of a pharmacy.

Sometimes, drug companies believe they have a big hit on their hands because of successful tests in the lab with two-dimensional cells, or on animal subjects. It isn't until human trials begin -- and after hundreds of millions of dollars have been spent -- that unexpected toxicities arise.

These toxicities either set the drug back significantly or force companies to scrap their plans altogether. BioWorld Today estimates that "[f]orty percent of drug development costs go toward molecules that ultimately fail," often because of "unforeseen toxicities." With the industry spending $50 billion per year, that means $20 billion down the drain.

Primary application = killing drugs faster

Clearly, any company that can add reliable and cost-cutting efficiencies to the process could be richly rewarded. And it is here where Organovo's most practical revenue stream could materialize.

Organovo enters the scene by offering pharmaceutical companies three-dimensional tissues that mimic native human biology -- and aim to have a much higher predictive value for the success of drugs than prior methods.

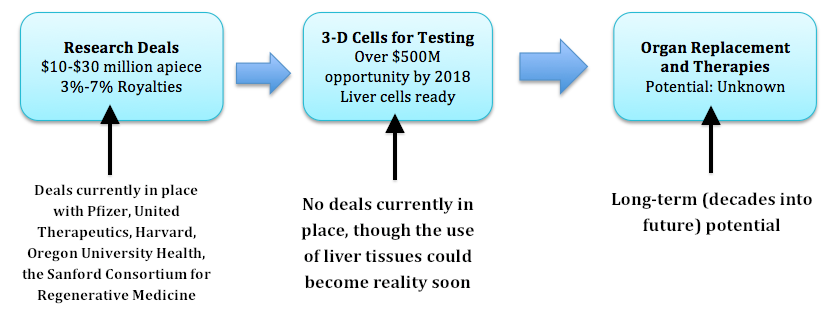

Already, the company has partnered with both Pfizer (PFE 0.35%) and United Therapeutics (UTHR 1.65%) to research and test out the 3-D tissues. The collaboration with Pfizer ended last year, and Organovo is waiting to hear back to see if Pfizer wants to continue collaborating. The United Therapeutics deal is still ongoing and was expanded upon in 2012.

More long term, market research firm Scientia Advisors sees a specific market opportunity of more than $500 million for Organovo by 2018. Currently, the company has functional liver tissues developed, but it hopes to expand to kidney and heart cells.

Organovo would earn its keep by manufacturing the cells and providing them to the drug companies. Along the way, it hopes to continue partnering with drug companies and academic institutions to expand the number of organ cells it offers. Specifically, Organovo is looking for collaboration deals worth between $10 million and $30 million, where the company could have a 3% to 7% royalty.

At the same time, the company sees the possibility of developing tissues for therapy. When that time comes, Organovo will expand its scope to include lung, bone, and blood vessels.

Overall, the revenue and development stream looks something like this.

Source: Organovo.

Don't do too much math

If we make an assumption of $300 million in revenue by 2018, with a conservative estimate of 10% profit margins, earnings would come in at $30 million. Assuming the number of shares outstanding stays the same (which it probably won't), and a P/E ratio of 30, the company could be worth $900 million by 2018. That gives investors a nice 20% rate of return from today's market cap of about $370 million.

But the reality is that these assumptions should be taken with a grain of salt. History has proved time and again that we humans stink at predicting the future. That's why investors in Organovo -- myself included -- need to be well aware of the risks associated with investing in the company.

At the end of the day, there are literally hundreds of "multiple futures" -- as Foolish co-founder David Gardner likes to call them -- that Organovo could take. Some of those possibilities include bankruptcy, and some include amazing profitability.