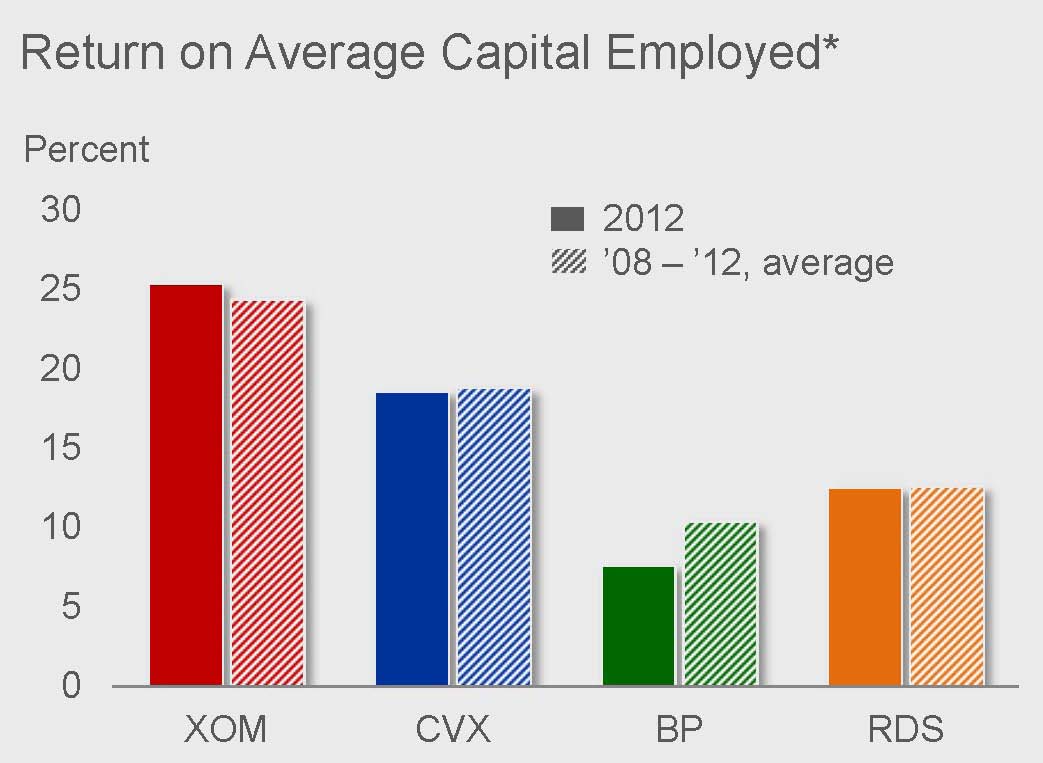

Among the major integrated oil and gas companies, ExxonMobil's (XOM +0.00%) return on capital employed is industry-leading. This lead, at least in part, is due to its in-depth understanding of energy markets. Because of this insight, it is useful to study their Outlook for Energy, a yearly publication with key findings concerning future energy demand and composition. The findings provide a good foundation for energy sector investors to evaluate development projects across the sector.

Source: ExxonMobil 2013 Annual Meeting

Growing demand

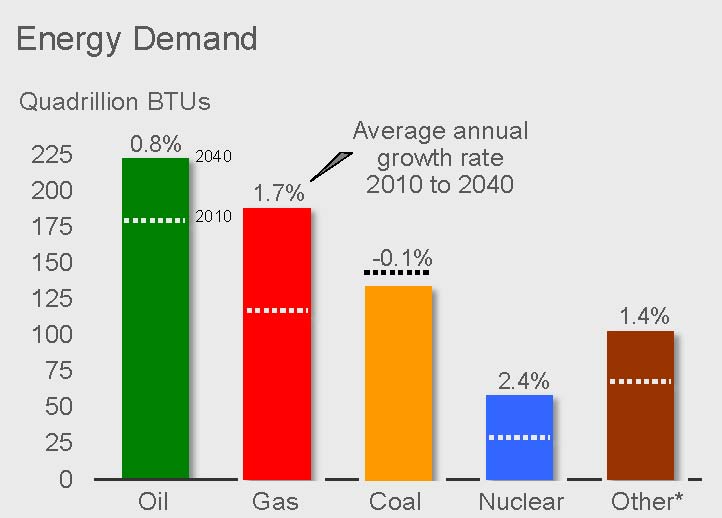

Overall Exxon projects global energy demand will grow 35 percent as the world's population expands from 7 billion people today to 9 billion people in 2040. Energy demand in developing nations (non OECD) will rise 65 percent from 2010 to 2040. Population growth in Africa and India coupled with world real GPD growth will drive global energy demand.

The report makes two interesting sub points. First, due to efficiency gains, energy demand in developed nations will remain flat even as their economic output increases 80% by 2040. Good examples driving these gains are hybrid vehicles and high-efficiency natural gas power plants. Second, population in China will peak around 2030 due to family size policies. And as its population ages, the working age population will shrink leading to decreased economic activity and energy demand.

Shift to natural gas and diesel

Drilling, completion, storage, and transmission advances are enabling the cost-effective development of unconventional resources in oil, natural gas, and renewable energy. Oil will remain the largest segment, while cleaner burning natural gas bypasses coal to become number two. Total demand for coal will peak, then begin to decline as natural gas usage for power generation increases.

Source: ExxonMobil 2013 Outlook for Energy

For example, advances in purification, liquefaction, and safety enable Chevron (CVX +0.00%) to further develop large natural gas reserves off the Australian coast. The gas will be brought onshore via pipelines and liquefied. The gas will then be transported to Japan, South Korea and other growing Asian markets aboard double-hulled, insulated ships.

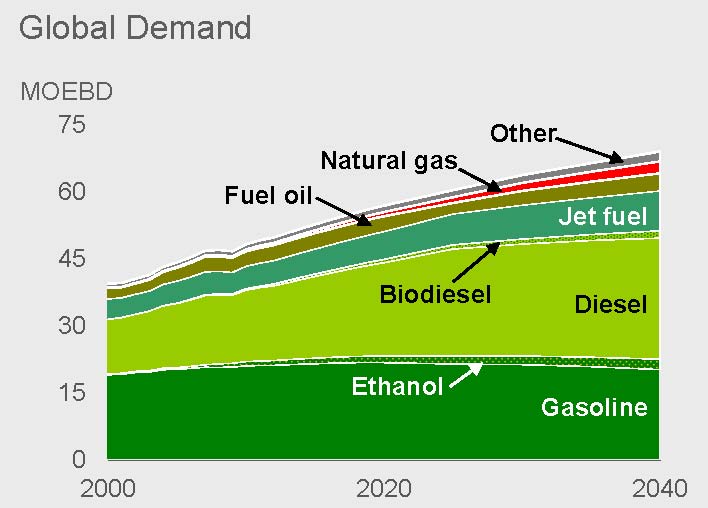

Exxon also believes transportation fuel demand will grow 40%, slightly faster than the energy average. Gasoline demand will remain steady as efficiency gains offset growing markets. However, as commerce increases, demand for diesel will rise and overtake gasoline.

Source: ExxonMobil 2013 Outlook for Energy

Summary

Demand for energy is growing with large shifts in market composition. The importance of insight into this demand composition is the key to the capital deployment that underpins margins and earnings. Best-of-breed Exxon has historically exploited its understanding of these markets to employ capital. While BP and Chevron also have large, innovative investments that fit the megatrends, Exxon remains the proven success story.