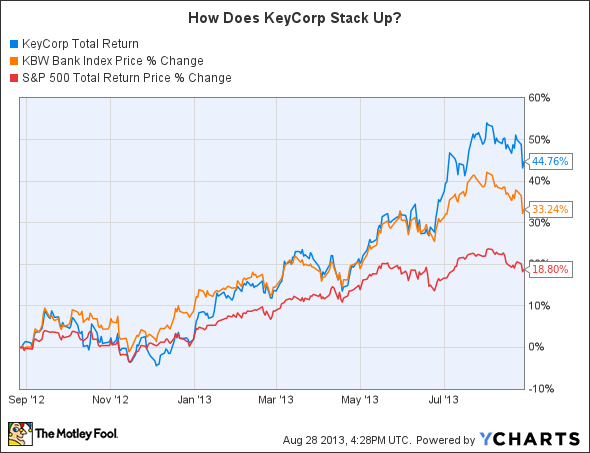

Over the past 12 months, KeyCorp (KEY 0.75%) has handily outperformed both its peers on the KBW Bank Index and the broader market's S&P 500. Their total return of 44.3% beats the former by roughly 11 percentage points and the latter by almost 25 percentage points. But while this performance is outstanding, it forces current and prospective investors to question whether the regional bank can continue to do so going forward.

According to the collective insight of banking analysts, the answer to this question may be yes. The median target price of the 25 analysts surveyed by Standard & Poor's Capital IQ is $13 a share, with a high estimate of $16 and a low of $9. As of the time of writing, Keycorp trades for $11.78 per share. Consequently, if the analysts are to be believed, which is admittedly a big "if," then there's an anticipated upside of 10%.

|

Metric |

KeyCorp |

KBW Bank Index |

|---|---|---|

|

Price to Tangible Book Value |

1.26 |

1.82 |

|

Price to Book Value |

1.12 |

1.25 |

|

Price to Earnings |

14.00 |

15.21 |

Source: Standard & Poor's Capital IQ.

In this case, KeyCorp's valuation lends credibility to the potential for future appreciation. At present, shares of the bank trade for 1.26 times tangible book value and 1.12 times book value. As you can see in the table above, those figures are 31% and 10% less, respectively, than the 24-member KBW Bank Index, of which KeyCorp is a member. In addition, its 14 price-to-earnings ratio is currently 8% less than the KBW and 22% less than the average stock on the S&P 500.

At the end of the day, this is a quick and rudimentary analysis that shouldn't be relied upon singularly when deciding whether or not to buy or sell shares of KeyCorp. What it shows us instead is that a deeper look at its shares may very well be in order given the potential for future gains.