Ford's Fusion, Titanium trim. Photo Credit: Ford Motor Company.

Ford's (F +1.45%) Fusion is on pace to do something no other vehicle besides the F-Series has done in nine years: sell more than 300,000 units in one year. Ford's flashy sedan also has the best chance to do something a Ford vehicle hasn't done since the Taurus in 1996: take the sales crown in the mid-size sedan segment. To help the Fusion accomplish this rare feat, Ford needs to fix one thing -- and it just has.

Gaining ground

Sales of the Fusion were up 13.4% through July. That increase made the sedan partly responsible for Toyota's (TM +3.47%) Camry becoming one of only two vehicles in the top-20 sales ranking to decline in year-over-year sales, down 0.6%. Toyota's Camry has taken the mid-size sales crown in 15 of the last 16 years, but the Japanese automaker now recognizes its increased competition.

"It is true that rival carmakers have come out with very competitive models in the segment, and that competition in the U.S. mid-size sedan segment is becoming fiercer," Nobuyori Kodaira, a Toyota executive vice president, according to Bloomberg. "What we need to do is to come out with even more competitive models."

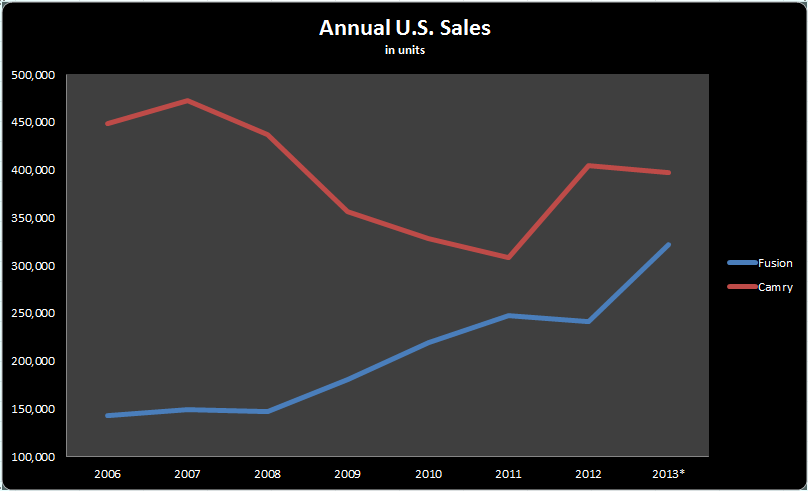

Graph by author. Information credit: Automotive News DataCenter. 2013* estimated through first 6 months of sales.

As you can see, the Fusion is clearly catching up with the Camry -- but recent supply constraints have held the Fusion back.

"Once our additional manufacturing capacity on Fusion comes on line, the battle for sales leadership in the midsize segment will tighten considerably," said Erich Merkle, Ford U.S. sales analyst, in a company press release.

Consider that the Fusion is selling in fewer than 20 days in key markets such as San Francisco, Los Angeles, and Miami -- far faster than the industry average of roughly 60 days, according to Ford.

Ford has to increase its production capacity before the Fusion can take its shot at topping the Camry and climb atop the sales ranks. And on Aug. 29, Ford announced that it's hiring 1,400 new jobs and investing $555 million in its Flat Rock Assembly Plant to increase Fusion production. The move is expected to boost production capacity by about 30%, or up to 350,000 units annually.

Money, money!

This increased capacity does more than just enable Ford to sell more Fusions; it will also increase profits.

Because Ford can't meet the high demand for Fusions, its dealerships aren't forced to negotiate on price to move models off the showroom floor. That helps the Fusion sell at a premium of $1,176 above the industry average. Moreover, because the Camry's demand has fallen, yet its supply remains high, the opposite pricing power takes effect – sending the Camry's price down 2%, to sell at a $2,378 discount to the Fusion, according to Bloomberg.

By the laws of supply and demand, we can expect the Fusion's price to drop slightly when its extra capacity comes online. But it won't necessarily drop much, and the eventual price will be closer to its equilibrium between sales and price. Ford might not charge as much for each Fusion, but it'll be able to sell more of them overall, maximizing the Fusion's total profits.

"You might see prices come down a few hundred dollars, but I don't think they face any significant risk of serious price degradation," Alec Gutierrez, an analyst with Kelley Blue Book, told Bloomberg. "They're going to hold their premium spot in the segment."

Bottom line

This is a great development for investors and Ford alike. Ford's F-Series has already been America's best-selling vehicle for the last 31 years. If the Fusion can use its extra capacity to take the mid-size sedan sales crown in a few years, it will represent a huge win for Ford. As it stands now, the extra production capacity will allow the Fusion to keep gaining market share and profit.

As the Fusion's resurgence demonstrates, Ford continues to make improvements across its lineup. It's also improving its balance sheet, and it remains a solid investment opportunity at today's price.