Oil and natural gas producer Vanguard Natural Resources (NASDAQ: VNR) likes to go against the grain. While most of its peers have been focused on acquiring or developing oil-rich assets, Vanguard has been shopping in the clearance isle and stocking up on natural gas. It's a move that could pay off handsomely in a couple of years as the supply and demand balance for natural gas begins to shift.

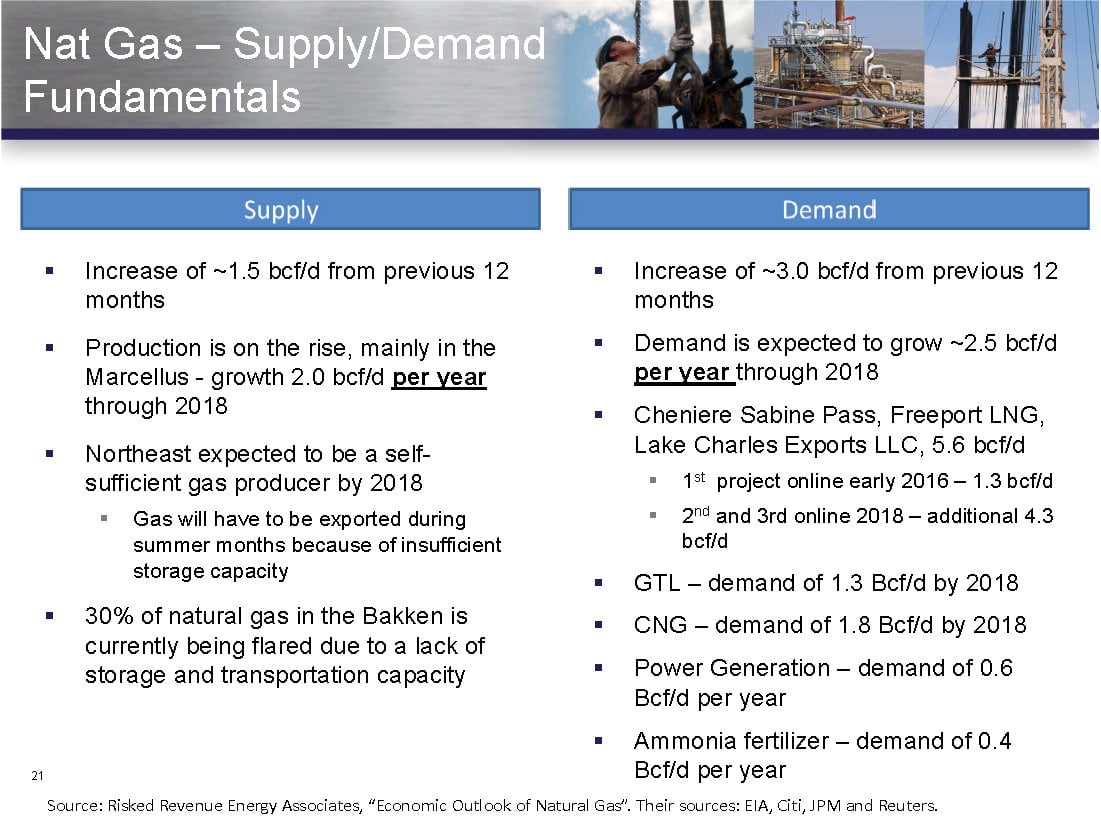

Vanguard's business model is pretty simple. It buys up oil and gas reserves and then locks in the margins of the future production by hedging it for the long term. In its most recent natural gas acquisitions, the company was able to pick up dirt cheap assets that will earn a fair profit on the production over the next few years. However, over the longer term, those assets could turn out to be a real gem as the supply and demand imbalance for natural gas begins to shift. The following slide breaks down those fundamentals:

Source: Vanguard Natural Resources Investor Presentation (link opens a PDF).

Clearly, the biggest demand driver will come from already approved natural gas export terminals such as Cheniere Energy's (LNG 1.18%) Sabine Pass. These projects will sop up a big portion of the increase in natural gas production over the next few years. As the slide shows, by 2018 we should be exporting about 5.6 billion cubic feet of natural gas per day, or Bcf/d. For some perspective, as of this past May, natural gas production in the contiguous 48 states was 73.37 Bcf/d, meaning these future approved exports would equate to less than 8% of current production.

Another major future demand driver will come from transportation, where gas-to-liquids and compressed natural gas, or CNG are expected to sop up another 3.1 Bcf/d of incremental demand. Driving this demand, at least on the CNG side, is Clean Energy Fuels (CLNE 2.29%), which is building America's Natural Gas Highway. What should be noted, though, is that Clean Energy has a lot more potential outside the CNG market. While CNG has the potential to displace 5.5 billion gallons of fuel per year in transit buses and garbage trucks, the bigger market is the LNG potential for the long-haul truck market, which is a 25 billion-gallon-a-year market. If Clean Energy can make inroads into that market, it could add significant demand for natural gas in the coming years that's not reflected on the next chart.

Source: Vanguard Natural Resources.

This potential imbalance is good news for natural gas producers, like the nation's No. 2 producer, Chesapeake Energy (CHK +0.00%), as well as other natural gas heavy producers like SandRidge Energy (NYSE: SD). While both companies are focused on growing oil and natural gas liquids production, as the supply and demand dynamics shift over time, it should lead to higher prices.

Chesapeake currently produces about 3.1 Bcf/d of natural gas, which is nowhere near as profitable as the oil and NGLs it produces. However, for some perspective, Chesapeake could earn 10% more money this year if gas stays above $5 for the rest of the year. It's a similar story for SandRidge. In its case, 55% of its Mississippian Lime production is natural gas, yet the company derives 80% of its revenue from the 45% of its production that's oil-focused. Bottom line: Higher natural gas prices means higher revenue and earnings for both companies.

All this is not to say that Americans should expect a natural gas price spike leading up to 2018. On the contrary, as the price rises, so should production. Several natural gas basins are currently not economical, but they would be if the price of natural gas rose to between $5 and $6 per Mcf. In fact, that price just might be the long-term happy-medium price that everyone can live with, much as $100 oil is today.

For investors and consumers alike, the future is clear: Demand and therefore the price for natural gas is likely to head higher over the longer term. That's quite positive for everyone involved, especially smart companies like Vanguard that are getting in early on the natural gas revolution.