The Dow Jones Industrial Average (^DJI +0.38%) is set to open lower this morning. Stock index futures as of 7:30 a.m. EDT point to a 23-point dip at the opening bell. Markets in Europe and Asia are mostly down, and traders continue to stress about the rising potential for a strike against Syria as they wait for key U.S. payroll reports due later in the week.

A good problem to have

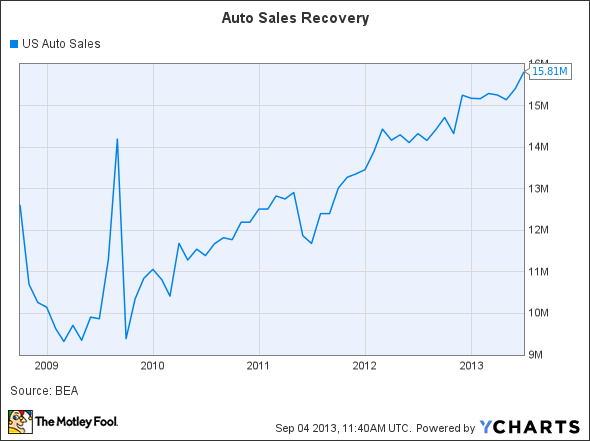

But carmakers will be in focus today when they release sales results for the month of August. Demand for new cars has been one of the clearest bright spots in consumer spending recently, charging to a yearly pace of about 16 million units.

US Auto Sales data by YCharts.

Last month, Ford (F +1.05%) reported its best July since 2006, with sales up 11% from the prior year, while General Motors (GM +1.45%) saw a 16% bounce. However, lack of supply could keep a lid on August's results. Dealers have seen shortages of their most popular models while factories haven't been able to produce enough units to keep up with demand. As a result, Ford's sales growth is expected to be a bit less than 10%, with just a 10.2% rise expected for GM. Still, if the market punishes Ford for a lower-than-expected number, I'd see it as a good opportunity to buy into a business with solid long-term growth potential.

Psst...wanna buy some stock?

Speaking of stock purchases, LinkedIn (LNKD +0.00%) could see active trading today after the company announced a new offering of $1 billion in common stock. While the Street isn't impressed -- shares are down 2.4% in premarket trading -- I think it's a smart move.

The dilution impact will be minor for existing shareholders: LinkedIn is boosting its share base by about 4%. And with the stock near all-time highs, it's hard to argue with the company's timing as it bulks up on cash for investing in its business.

Spare a dollar

Finally, Dollar General (DG +0.44%) reported solid earnings results this morning. Comparable sales bounced 5.1% higher, and earnings grew by 15%, continuing a long-running outperformance versus Wal-Mart. Dollar General's five-year sales growth rate is nearly 6%, as compared to Wal-Mart's 0.3%. And while it's valued at a premium to the retail giant, Dollar General looks like the better deal here. It expects to keep up that winning streak with full-year sales growth of between 4% to 5%. Shares are up 3.7% in premarket trading.