Vehicle sales have been solid this year giving investors in Ford (F 1.52%) and General Motors (GM 0.11%) reason to cheer as their stock prices have risen 81% and 68%, respectively, over the last year. Detroit's Big Three automakers turned in a better than expected August, but how do their numbers hold up against Japanese competitors?

General Motors – 275,847 units sold, up 15%

GM did well across the board – all of its brands turned in double-digit sales gains in August. Cadillac led the charge with a 38% increase, followed by Buick with a strong performance, up 37%. GMC and Chevrolet both turned in 14% and 10% increases, respectively. When you mash all those numbers together company-wide sales increased by 15% to 275,847 units sold – the most of any automaker in the U.S. market.

Pacing its overall gains was GM's most profitable segment, full-size pickups, with a 15% increase. That was driven largely by the Silverado, which improved sales by nearly 14% over last year. Beyond full-size pickups, GM had significant improvements in two of its passenger cars as retail deliveries for its Impala and Malibu were up 76% and 93%, respectively. That's a huge win for GM because it desperately needed to produce a hit with its passenger vehicles, and the redesigned Impala could be the winner the company was hoping for.

Ford – 221,270 units sold, up 12%

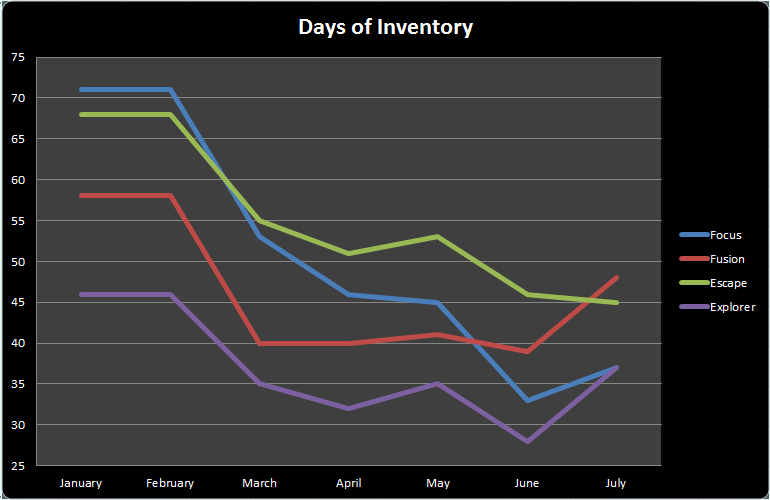

Ford had another consistent month posting its best retail sales since August 2006. Its retail sales increased 20% and total sales were up 12%. The biggest August highlight for the company was that sales of its F-Series topped 70,000 units for the second time this year – something it hasn't done twice in a year since 2006. The Fusion and Lincoln MKZ also set best-ever sales for the month of August. While an overall increase of 12% is nothing to sneeze at, Ford likely could have seen higher gains if supply wasn't limited on key models.

Graph by author. Information from Automotive News DataCenter.

It's been known for months that inventory of the Fusion was very limited and plants were running over capacity trying to keep up with demand. Because of the tight inventory dealers aren't negotiating on prices, causing the Fusion to sell at a $1,176 premium to the industry average and a $2,378 premium to the market-leading Toyota (TM 0.39%) Camry. While that's a good problem to have, it's great news for investors that Ford hired 1,400 workers to its Flat Rock assembly plant to bring additional production of the Fusion into the U.S.

Chrysler – 165,552 units sold, up 12%

Not to be outdone, Chrysler had its best August in six years as it turned in a sales increase of 12%. That was largely driven by sales of its full-size Ram and Grand Jeep Cherokee, which were up 30% and 39%, respectively. Similar to GM, all of Chrysler's five brands reported sales increases and the company recorded its 41st consecutive month of year-over-year sales gains. To top it all off, Chrysler had six models that set sales records in August.

Keep in mind

While all of Detroit's automakers did well, they still trailed behind Japanese rivals in terms of sales gains. Honda (HMC 0.84%) led the pack with sales gains of 27%, to 166,432 units sold. Toyota posted an impressive 23% gain when you consider that it was working from a higher base sales number. Toyota's sales improved from 188,520 last year to 231,537 which was just enough to edge out Ford for the No. 2 sales spot in the U.S. market. Another thing to keep in mind is that Labor Day sales were recorded in August this year, which could have inflated the sales gains slightly. Toyota and Honda topped Detroit's Big Three in August sales gains but Ford and GM are much more competitive than they have been in a long time and could start reversing that trend sooner than you might think.